Retirement might be the last thing on your teenager’s mind but helping them open a Custodial Roth IRA account early can be a powerful and tax-efficient way to set them up for long-term financial success and wealth building. In fact, it’s one of the few planning opportunities where time and compounding truly do the heavy lifting. Plus, it creates a meaningful avenue for parents and/or grandparents to support a child’s financial future through thoughtful matching and gifting.

In this guide, we cover:

- What is a custodial Roth IRA?

- Custodial Roth IRA for minors—who is eligible?

- What are the benefits and potential drawbacks?

- Example of how compounding helps small contributions grow.

- How do I open a custodial Roth IRA with my teen?

Roth IRA vs. Traditional IRA: What’s the Difference?

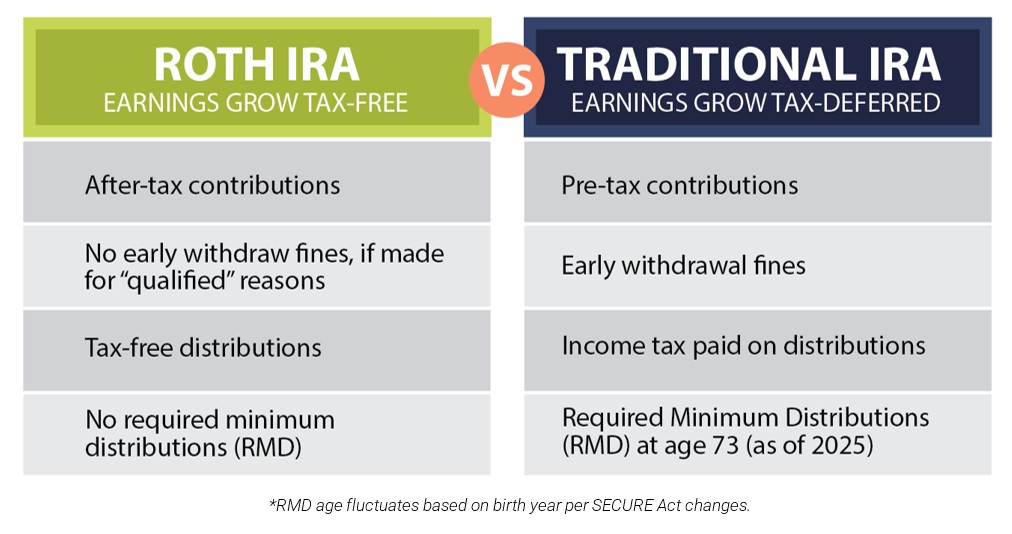

An Individual Retirement Account (IRA) is a tax-advantaged investment vehicle designed to help individuals save for retirement. But not all IRAs are created equal. There are two primary types: Traditional and Roth.

Both offer advantages, but the best choice depends on the contributor’s age, time horizon, and current tax situation.

-

Traditional IRA

Contributions may be tax-deductible in the year they are made, providing immediate tax benefits. However, withdrawals in retirement are taxed as ordinary income—including both contributions and investment earnings.

-

Roth IRA

Contributions are made with after-tax dollars and offer no current-year tax deduction. The trade-off? All qualified withdrawals in retirement, including earnings, are tax-free. This makes Roth IRAs particularly attractive for younger savers, whose contributions can benefit from decades of compounding growth.

What is a Custodial Roth IRA account?

A Custodial Roth IRA is simply a Roth IRA, but the account is opened and managed by an adult—usually a parent or guardian—on behalf of a minor until the minor becomes a legal adult at the age of majority in their state. All contributions must be based on the minor’s own earned income.

Why are Custodial Roth IRAs the Better Choice for Young Investors?

Since teens typically have lower taxable income, which means they’re in the lowest tax brackets they’ll ever experience, the Roth IRA’s after-tax contributions (instead of the Traditional IRA pre-tax contributions) make sense: pay taxes now (when rates are low), let the money grow for decades, and withdraw it tax-free later.

This approach is especially compelling for young investors because:

- Time is on their side: The earlier contributions are made, the more years compounding has to multiply their savings.

- Income is expected to rise: As your teen’s career progresses, their income—and tax rate—will likely increase, making tax-free withdrawals in the future even more valuable.

- Maximum growth potential: By starting early with a Roth IRA, young investors can generally build wealth over time, free from future tax burdens.

Read More: How a Well-Being Trust Expands Beyond Traditional Trust Planning

Do Custodial Roth IRAs have any drawbacks?

While the benefits sure do make the argument of why it’s a great investment tool for teens, there are a few drawbacks to consider.

Yes, contributions can be withdrawn at any time. However, earnings are generally subject to taxes and penalties if taken out before age 59½, except in specific circumstances (e.g., qualified first-time home purchase, education expenses, or certain hardships).And when your child reaches the age of majority (typically 18 or 21, depending on the minor’s state of residence), they gain full legal control over the account—including the ability to withdraw funds or change investment strategies—regardless of your original intentions for the money.

Plus, not all young adults are prepared to handle a windfall at age 18 or 21. So there’s a risk they may not use the account in alignment with your family’s long-term intentions, underscoring the importance of financial education and ongoing mentorship. A custodial Roth IRA can be a powerful tool for building intergenerational wealth and teaching responsible investing—but it’s important to weigh these factors and coordinate with your overall wealth and family governance strategy.

Roth IRA Eligibility for Minors: What Parents Need to Know

To contribute to a Roth IRA custodial account, your teen must have earned income, typically from a part-time job reported on a W-2 or 1099 and fall under the income limits which are high enough that most teens will qualify. The maximum contribution limit in 2025 is $7,000 or the total amount of earned income; whichever is less.

This presents a unique opportunity:

- A teenager or minor can make their own Custodial Roth IRA contributions

- OR – parents and/or grandparents can contribute on the teen’s behalf as a financial match— provided the teen has earned income—or as a gift.

This incentive—“we’ll match every dollar you save”—can help instill valuable saving habits early on, while staying within IRS gifting and contribution guidelines.

Custodial Roth IRA Example: The Long-Term Value of Early Contributions

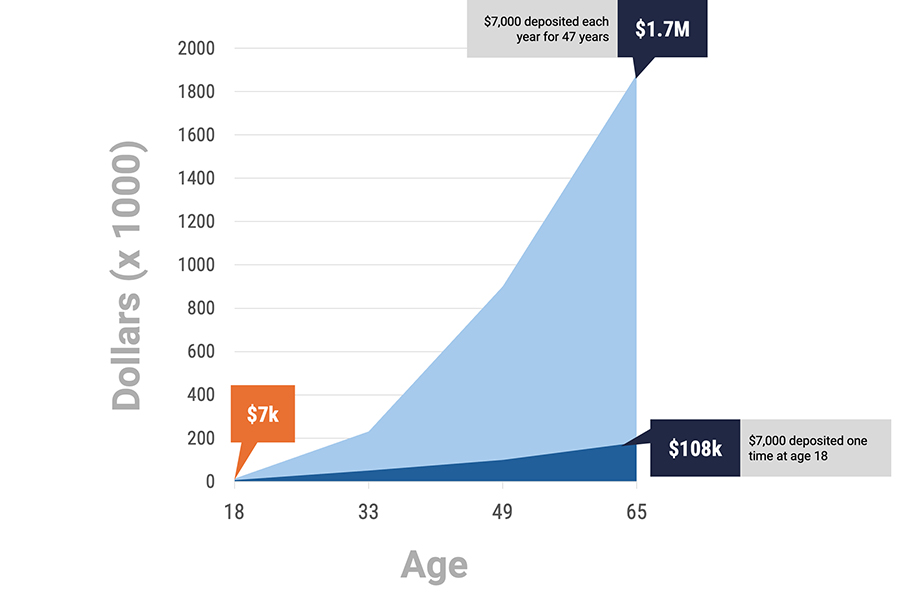

Even modest contributions into a Roth IRA custodial account made during teenage years can compound into six- or seven-figure tax-free balances by retirement.

Consider the case of Grayson, a 16-year-old with a part-time job, earning a modest income. If he earns less than the income limit for custodial Roth contributions ($161,000 for single filers in 2025), he can contribute up to $7,000 or his total earned income—whichever is less. Assuming a 6% rate of return, this one-time contribution could grow to $108,000 by age 65.

Now imagine Grayson contributes $7,000 to a custodial Roth IRA annually. By retirement, he could accumulate approximately $1.7 million, entirely tax-free1. This highlights the powerful advantage of time and tax-free growth in a custodial Roth IRA for minors.

A one-time contribution:

6% rate of return: ~$108k*

Contributes $7k a year:

6% rate of return: ~$1.7M*

1Assuming an average of 6% interest earned per year.

*Values shown are based on compounding returns year-over-year and do not factor in inflation or management fees.

This highlights the powerful advantage of time and tax-free growth in a custodial Roth IRA for minors.

Figures assume an annual average return of 6% with income reinvested.

How do I open a Roth IRA custodial account with my teen?

Opening a custodial Roth with your teen is a straightforward process that can make a lasting impact on their financial future. Here’s how to get started:

- Confirm Eligibility:

First, make sure your teen has earned income from a job or self-employment. This is required for any contributions to a Roth IRA, even for minors. - Select the Right Financial Partner:

While many banks, firms, and online investment platforms offer custodial Roth IRAs, partnering with a firm experienced in guiding young investors can help navigate account setup, tailor investment strategies to your child’s and family’s legacy goals, and ensure all contributions are coordinated with your overall wealth plan. They can provide your teen with personalized advice and hands-on financial education from day one. - Gather Necessary Information:

You’ll need personal details for both you (the custodian) and your teen, including Social Security numbers, proof of earned income, and contact information. - Complete the Application:

Open the account in your teen’s name, listing yourself as the custodian. This process is usually quick and easy. - Fund the Account:

Deposit contributions based on your teen’s earned income for the year—up to the current annual limit ($7,000 for 2025, or your teen’s total earned income, whichever is less). Anyone can contribute, but the total can’t exceed the teen’s earnings. - Select Investments:

Work together with a professional advisor and your teen to choose investments that align with a long-term growth strategy, such as index funds or diversified ETFs. This is also a great opportunity for the teen to learn investing basics. - Monitor and Encourage:

Help your teen track their progress and celebrate milestones. Consider offering to match contributions or reward their savings efforts to encourage consistency.

More Than Just Money: Building Strong Financial Habits Early

Helping your teen open a Roth IRA custodial account is more than just a smart financial move. It’s a way to instill long-term discipline, teach foundational money concepts, and spark an early understanding of investing and delayed gratification.

They may not fully grasp the benefits today, but over time, they’re gaining the tools—and the mindset—for lifelong financial success.

Whether you’re looking to jump-start your teen’s savings or gift them a head start toward retirement, we’re here to help. Let’s talk about how you can make a lasting impact on your child’s financial future. Book a consultation today.

1Assuming an average of 6-7% interest earned per year.

Verdence: Your Partner in Financial Planning

At Verdence, we specialize in helping high-net-worth families and individuals navigate these complexities with confidence. Our team focuses on personalized strategies that align with your goals in addition to keeping you informed about changes in financial regulations and opportunities.

What Sets Verdence Apart

- Unbiased Advice: As fiduciaries, we act in your best interest with complete transparency.

- Comprehensive Planning: From investing strategies to tax optimization, our approach seeks to integrate every aspect of your financial life.

- Family-Centered Service: We help you balance wealth preservation with the values and family legacy planning you want to pass down.

Take the Next Step Today

Contact Verdence to schedule a financial review and learn how we can help you focus on wealth while reducing stress. Together, we’ll create a clear, actionable plan for your financial future.

Author:

Sarah Mouser, CFP®, CDFA®, CTS™, CES™, CCFS®, ELA™ | Managing Director, Financial Planning

FAQs :

What is a custodial Roth IRA for minors?

A custodial Roth IRA is a retirement account an adult opens and manages for a minor, using the child’s earned income. The minor takes control when they reach adulthood.

What are the custodial Roth IRA rules?

- The minor must have earned income.

- The adult manages the account until the child reaches legal age.

- Annual contributions can’t exceed the minor’s earned income or $7,000 for 2025.

How can I open a custodial Roth IRA for my teen?

Choose a bank, broker, or wealth advisor, provide both your and your teen’s information, and fund the account with your teen’s earned income.

What are the 2025 custodial Roth IRA limits?

The maximum contribution is $7,000 or your teen’s total earned income—whichever is less.

Where can I open a custodial Roth IRA?

Most major banks, brokerages, and wealth management firms offer custodial Roth IRAs.

Important Disclosure:

Verdence Capital Advisors LLC is providing this information as a guide. Verdence Capital Advisors LLC is not engaged in the practice of law and is not providing legal advice by the provision of this information. It is recommended that clients seek the opinion of their attorney regarding the specific legal and tax issues addressed herein.