Key Takeaways:

- The devastating Russia/Ukraine war may soon be coming to an end.

- The war has been detrimental to the region and also extremely costly.

- The world has felt the impact, specifically from trade volatility.

- President Trump has been negotiating a peace deal for the countries.

- A long-term agreement may take more time to broker.

Updates on the Russia/Ukraine War

While Russia and Ukraine have been in a conflict for more than a decade, the full fledged Russian invasion of Ukraine began just over three years ago (February 24, 2022). It is believed that more than one million are now dead or injured over the last three years.1 Russia occupies ~20% of Ukraine and the war has impacted both country’s economic growth, inflation and their ability to trade. Recently, President Trump has been trying to negotiate a peace deal between the two nations to bring an end to the costly war. The situation remains very fluid and the complexity will likely prolong any extended resolution. In this weekly, we look back over the past three years and what the war has done to the global economy, and also provide an overview of the negotiation progress as it stands today.

- Costs of the war: The economic impact of the war is one that will likely continue to be felt globally for quite some time. Economic growth (i.e., GDP) in Ukraine is likely to slow to 3.2% in 2024, from a +5.3% reading in 2023, as damage from Russia’s invasion and electricity disruptions continue to rattle the country.2 Pre-invasion, Ukraine had a total GDP of ~$200 billion. By the end of this year, it is estimated the total economic cost of the war (to Ukraine) will be ~$120 billion in cumulative loss in GDP and ~$1 trillion in damage to infrastructure.3

- World economic impact: Low- and middle-income countries have been impacted due to rising food prices. These countries typically have a higher demand for wheat, which are key exports out of the Russia/Ukraine region. Wheat prices have fallen drastically since their 2022 peak (~54%), which has been beneficial for countries that rely on the crop. Any continued fighting could put increased strain on export capabilities.

- US impact: Financial aid has been provided by many Western countries, including the U.S., trying to support the Ukrainian military. The U.S. has committed ~$128 billion to Ukrainian efforts, or roughly 0.55% of GDP.4 President Trump has wanted to stall some of this aid, as he feels European nations specifically have not provided an equal amount of support.

- Bargaining a peace deal: President Trump has been negotiating a ceasefire proposal to end the war in Ukraine. A contentious meeting between Ukrainian President Zelenskyy and President Trump on February 28th, 2025, put negotiations at a standstill. Ukraine ultimately came back to the table after the United States stopped sharing military intelligence and military aid. The more difficult part of the peace deal has proven to be getting Russia to the table. Russia has already issued several red lines to the proposal, suggesting any long-term resolution may take longer to negotiate.

The Bottom Line:

A long-term agreement to peace in the region will likely take time, effort, and cooperation from all sides. This includes the United States and other European countries. From an investment perspective, investors still require a larger premium for taking on the added risk of investing in the region or assets tied to the region, including wheat.

Your Economic and Market Detailed Recaps

- Small business owners growing more uncertain.

- CPI inflation increases less than expected; still elevated.

- Consumer sentiment plummets on increased uncertainty.

- Global equities fall as U.S. recession fears surge.

- Treasury yields whipsawed by economic data.

- Commodities higher led by safe-haven Gold.

Weekly Economic Recap — Consumer Sentiment Plummets on Increased

Uncertainty

Small business optimism fell to a four-month low in February (100.7). The uncertainty index surged as owners cited the need for more clarity on tariffs. Owners indicated they raised prices by the most since April 2021.

Job openings increased in January to 7.74 million (from 7.51 million). The increase in job openings was led by the retail and finance industries. Layoffs fell to a seven-month low (1.64 million) while the quits rate increased to its highest level since August 2024 (2.1%).

Inflation as tracked by the Consumer Price Index increased less than expected in February on an annualized basis (2.8% vs. 2.9%). Shelter costs accounted for nearly half of the monthly increase at the headline level, but the annualized increase (4.2%) was the smallest since December 2021. Food prices increased at the fastest pace since January 2024 (2.4%) led by a continued surge in egg prices. CPI core, which excludes volatile food and energy prices, increased at the slowest annualized pace (3.1%) since April 2021.

Producer prices were lower on an annualized basis in February from the prior month (3.2% vs. 3.7%). A drop in services prices, led by a decrease in margins for machinery and vehicle wholesaling, offsett an increase in goods prices. Food prices accounted for nearly 70% of the headline advance on a monthly basis. Core prices decreased for the first time since July.

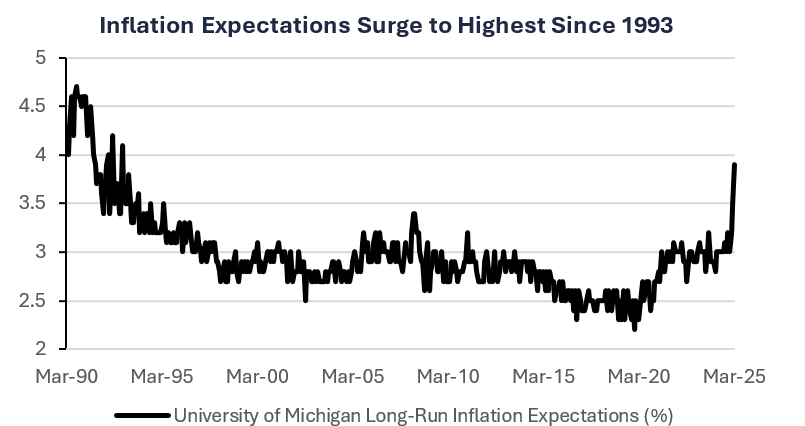

Consumer sentiment as tracked by the University of Michigan fell for the third consecutive month. Expectations for future conditions deteriorated as consumers cited a high level of uncertainty around policy and economic factors. Long-run inflation expectations increased to 3.9% from 3.5%, marking the largest monthly increase since 1993.

Weekly Market Recap — Global Equities Lower on U.S. Recession Fears and Trade Uncertainty

Equities: The MSCI AC World Index was lower for the fourth straight week. Recession fears surged in the U.S. last week, causing all major averages to end the week lower and are now lower for the year. Uncertainty around trade policy also contributed to negative U.S. equity returns. German equities led gains in Europe on increased defense spending initiatives, while shares in China rallied on hopes of stimulus plans increasing consumption.

Fixed Income: The Bloomberg Aggregate Index was lower for the second straight week. Treasury yields were flat to slighly higher across the curve last week, whipsawed by lighter-than-expected inflation data and inflation expectations increasing to their highest since 1993. Floating rate instruments were slightly higher while other areas underperformed.

Commodities/FX: The Bloomberg Commodity Index was higher for the second straight week. Crude oil prices were slighly higher as investors grew pessimistic about an end to the Russia/Ukraine war. Gold prices ended the week above the $3,000/oz. level for the first time ever as investors flocked to the safe-haven amid trade policy uncertainty.