Key Takeaways:

- Fed delivers on the 50-bps rate cut.

- Should offer limited relief to credit card holders in the near term.

- Bringing life back to the housing market but watch Treasury yields.

- Interest costs on federal debt still a problem for the deficit.

- Not as optimistic Fed can deliver on markets expectations.

The Fed Cut Rates… So Now What?

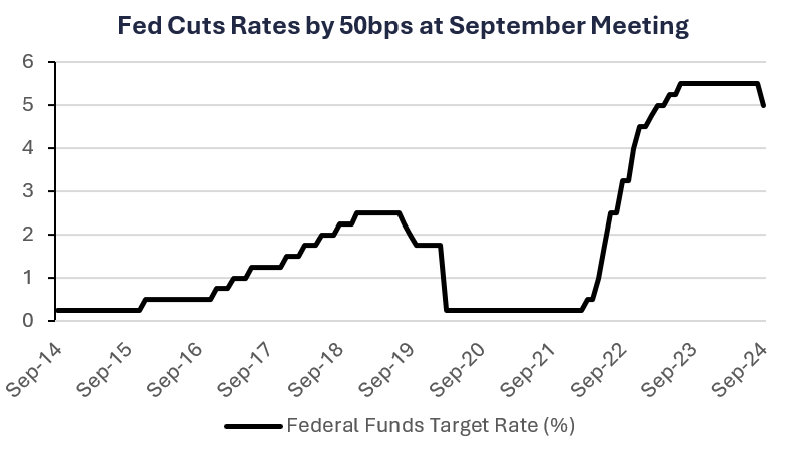

Last week, the Federal Reserve cut interest rates by 50bps to a range of 4.75% – 5.00%. This was the first interest rate cut since the onset of the Covid pandemic, and the first time the Fed has cut by 50bps since 2008. After the interest rate cut, some may be wondering what this means and how the cuts will filter through the economy. In this weekly, we aim to provide an overview of how the interest rate cuts may impact the economy and consumers.

- Credit card rates may move modestly lower: Credit card debt continues to surge and sits at a record high (at $1.4 trillion) as consumers have struggled to keep up with the years of high inflation. According to TransUnion, the average credit card balance is over $6K and the average credit card rate is over 20%. While consumers will welcome any relief in the high level of interest on credit cards, it is important to note that variable-rate credit cards are priced off the prime rate. While that rate came down last week with the Fed funds rate, at 8%, that is still a high level of interest. Therefore, consumers should not expect a massive change in their credit card rates.

- Bringing optimism to the depressed housing market: Last week we saw the first increase in homebuilder sentiment in six months as the market had already priced in the Fed’s move. The mortgage rate has been declining even before the Fed cut rates as Treasury yields have fallen. According to the Mortgage Bankers Association, the mortgage rate has fallen from its high reached in October of last year (7.9%) to 6.15%. To understand the impact that can have on mortgage payments let’s consider a $415K mortgage. At 7.9% that monthly mortgage payment (interest and principal only) would have been ~$3,020 a month. At 6.15%, that mortgage payment has fallen to ~$2,530, a difference of almost $500 a month. We are hopeful this can help the ailing housing market. However, we also need to monitor Treasury yields because mortgage rates are based off longer term Treasury yields and not the Fed Funds rate. After the Fed’s rate cut, long term Treasury yields rose as the yield curve is normalizing and bond investors remain concerned about inflation.

- Interest costs on federal debt: The U.S. government has spent more than $1 trillion this year on net interest payments, greater than the $892 billion projected by the Congressional Budget Office in June.1 According to CBO’s most recent long-term projections, interest payments are expected to total ~$78 trillion over the next 30 years.2 These projections already factor in the expectation for lower rates. Therefore, for the deficit to improve we need a combination of low rates and controlled spending.

The Bottom Line:The cut in the Fed funds rate has been celebrated by equity markets. However, we remain skeptical that the Fed can cut rates as low as the futures market is expecting and even the Fed’s projections. With over 150 bps of rate cuts priced in over the next year, this is highly dependant on the outlook for inflation. We realize inflation is moving in the right direction but the Fed is walking a fine line with the money supply still near a record high and pockets of inflation growing much more than real earnings.

Your Economic and Market Detailed Recaps

Key Takeaways:

- Homebuilder confidence increases.

- Fed cuts rates by 50bps, remains data dependent.

- Leading Indicators Index falls again.

- Global equities rally after Fed rate cut.

- Bond yields move higher despite Fed rate cut.

- Commodities higher driven by energy prices.

Weekly Economic Recap — Fed Cuts Rates by 50bps, but Remains Data Dependent

Retail sales unexpectedly increased in August and the July increase was revised slightly higher (to 1.1% vs. 1.0%). The increase was driven by online purchases which offset a pullback in autos spending. The core group, which excludes volatile components and are related to the consumer spending component of GDP, increased for the fourth straight month.

Confidence among home builders increased in September for the first time in six months according to the NAHB Housing Market Index. The outlook index increased 4 points, the most since January. Additionally, measures of prospective-buyer traffic and present sales rose off their 2024 lows.

The Federal Reserve cut interest rates by 50bps (4.75% – 5.00%) in an 11-1 vote at their meeting last week. It is the first cut of that size since 2008. The central bank also released updated projections, which indicated members see the equivalent of ~50bps more of cuts by the end of the year. The statement stated, “the Committee has gained greater confidence that inflation is moving toward 2%.” During his press conference, Fed Chairman Powell stated, “I do not think anyone should look at this and say, ‘this is the new pace,” reaffirming the Committee will remain data dependent.

Completions of housing in the US increased in August. Completions of multifamily housing units increased by 759k in August, the most since July 1974. Regionally, this increase was concentrated in the South.

The Leading Economic Indicators Index declined for the 30th month out of the past 32 in August. Weakness in new orders, which recorded its lowest value since 2023, and a negative interest rate spread were the largest contributors to the fall in the index.

Weekly Market Recap — Global Equities Rally After Fed Cuts Rates by 50bps

Equities: The MSCI AC World Index was higher for the fourth consecutive week as equity markets rallied after the Federal Reserve cut interest rates by 50bps. All major averages in the U.S. were higher for the week. Small-caps, which tend to be more sensitive to changes in interest rates, outperformed after the Fed cut rates. The S&P 500 and Nasdaq Composite were both higher for the second straight week.

Fixed Income: The Bloomberg Barclays Aggregate Index was lower for the first time in three weeks. U.S. Treasury yields finished the week slightly higher despite the Fed cutting interest rates. High yield corporate bonds and EM debt (USD) were the best performing areas of fixed income while Treasuries suffered.

Commodities/FX: The Bloomberg Commodity Index was higher for the second straight week. Crude oil was higher for the second straight week as supply in the U.S fell as major refineries in the Gulf of Mexico remain offline after Hurricane Francine. Gold prices finished the week above the $2,600/oz. level on rising tensions in the Middle East.