by Matt Andrulot, Managing Director of RIA+

Key Takeaways:

- What are private markets and private equity investments?

- What are the different types of private investments?

- How do private markets differ from the public markets?

- What is due diligence, and why is it important in private markets?

- How does investing in private markets add to a well-diversified asset allocation?

Private investments, often referred to as alternative investments, have become increasingly significant components of today’s modern portfolios. These private investments offer a level of insulation from daily market volatility and have witnessed substantial growth over the past decade. Explore the evolution of private markets and private investing with us. Understand the various alternative asset classes, their roles in a diversified portfolio, and the importance of due diligence when selecting these investments.

LISTEN NOW: Alternate View Podcast

What Are Private Markets?

Private markets encompass a variety of alternative investments not listed on publicly traded exchanges. These include private equity investments, private credit, and private real assets. And they offer unique opportunities for qualified investors. The absence of regulatory burdens and daily volatility swings makes private investments attractive for those seeking long-term growth and diversification. However, private markets differ fundamentally from public markets in their operational, structural, and regulatory frameworks. Unlike public markets, where companies must regularly disclose financial information, private markets operate with far less transparency. This allows for more flexible investment strategies but also increases the risk profile for investors.

The Evolution of Private Markets

A Shrinking Public Market

Over the past few decades, the number of publicly listed companies in the U.S. has halved. In the late 1990s, there were over 8,000 listed companies; by 2020, this number had dropped to less than 4,000. This significant reduction highlights a growing trend: successful companies increasingly choose to stay private longer, avoiding the public market’s rigorous regulatory requirements and the volatility of public trading.

The Surge of Private Companies

As of 2022, more than 95,000 private companies globally had annual revenues exceeding $100 million, compared to just 10,000 public companies. This reflects a broader shift in capital markets where private equity investments and debt have become dominant forms of financing. This is particularly true for companies in the growth and maturity phases of their cycles. The assets under management (AUM) in private markets surged from $600 billion in 2000 to $9.7 trillion in 2022. This is primarily driven by the lower regulatory burden in private markets and the appeal of avoiding daily price fluctuations seen in public markets.

Alternative Private Investments Asset Classes

Hedge Funds

Hedge funds are diverse investment vehicles that employ a wide range of strategies across various asset classes. Unlike traditional mutual funds, which typically follow a buy-and-hold strategy, hedge funds actively trade in the markets, aiming to generate returns regardless of market direction.

- Equity Long/Short is one of the most common hedge fund strategies. It involves taking long positions in undervalued stocks and short positions in overvalued ones. This strategy aims to capitalize on stock mispricings while hedging against market risk. During the 2008 financial crisis, for example, some long/short equity funds generated positive returns. They did this by shorting financial stocks while maintaining long positions in defensive sectors like utilities and consumer staples.

- Credit Long/Short: This strategy involves capitalizing on inefficiencies within credit markets. They do this by taking long positions in undervalued bonds and short positions in overvalued ones. Hedge fund managers may invest in investment-grade bonds or distressed debt, using derivatives. This is to hedge against interest rate or credit risk. An example of this strategy’s success can be seen during the European debt crisis. Certain funds profited from shorting sovereign bonds of troubled countries while going long on more stable corporate debt.

- Equity Market Neutral: Aimed at eliminating market risk, this strategy balances long and short positions in equities, striving to generate returns that are independent of market movements. The approach is typically employed by hedge funds focused on arbitrage opportunities, where mispricings between related securities can be exploited.

Private Equity Investments

When investing in non-public companies, often focusing on businesses with strong market positions and growth potential, it’s called private equity. Private equity funds gather capital from investors who then become limited partners (LPs) in the fund, while a general partner (GP) manages the investments. Key strategies within private equity include:

- Leveraged Buyouts (LBOs): Leveraged buyouts involve acquiring a controlling interest in a company using significant amounts of borrowed money, with the company’s assets and cash flows typically used as collateral. LBOs are common in mature industries where companies have predictable cash flows, such as consumer goods or manufacturing. A classic example is the buyout of RJR Nabisco in the 1980s, one of the largest LBOs in history.

- Growth Equity: Growth equity investments target companies that are more mature than typical venture capital targets but still require capital to expand operations, enter new markets, or finance significant acquisitions. These companies may not yet generate substantial profits but have demonstrated significant growth potential. Notable examples include private equity investments in companies like Uber during its rapid expansion phase.

- Mezzanine Financing: Mezzanine financing is a hybrid of debt and equity financing, often used by companies seeking capital to expand or complete a buyout. It typically carries higher risk and, therefore, seeks to achieve higher returns. The financing is subordinated to senior debt but senior to equity, making it an attractive option for investors looking for a middle ground between the low returns of senior debt and the high risks of equity.

Private Credit

Direct lending, also known as private credit, involves non-bank lending to companies. These investments are typically made to smaller companies with limited access to public funding markets, generally offering attractive yields. The private credit market has grown significantly. This is particularly due to traditional banks reducing their lending to small and medium-sized enterprises (SMEs) due to stricter regulatory requirements.

- Direct Lending: Direct lending involves providing loans directly to lower or middle-market companies, often as senior secured loans. These loans are typically used for acquisitions, recapitalizations, or growth capital, with returns generated from interest payments and fees. For example, during the 2020 economic downturn, direct lending funds provided crucial liquidity to companies that were otherwise unable to secure financing from traditional banks.

- Distressed Debt: Distressed debt funds invest in the debt of companies in financial distress. They’re based on typically purchasing the debt at a significant discount. The strategy is to profit from the recovery of the company, either through restructuring or liquidation. These investments can be highly speculative, relying on the fund manager’s expertise in bankruptcy law and corporate restructuring.

Private Real Estate

Private real estate investments cover a range of strategies and property types, from income-generating properties to speculative assets. The appeal of private real estate lies in its potential for steady cash flow and appreciation, coupled with its historically low correlation with public markets.

- Core & Core Plus: Core real estate investments focus on high-quality, income-generating properties with low-risk profiles. These properties are typically located in prime locations and are fully leased to stable tenants. Core Plus investments are similar but may involve properties that require some improvements or active management to enhance value.

- Value-Add: Value-add real estate investments target properties that require significant improvements, such as renovations or better management, to unlock their full value. These investments are riskier than core investments but offer higher potential returns. For instance, a value-add strategy might involve purchasing an underperforming office building, renovating it, and leasing it to higher-quality tenants at higher rates.

Venture Capital

A form of private equity focusing on early-stage companies with high potential growth is venture capital. Venture capitalists provide funding in exchange for equity, often taking an active role in the management and strategic direction of the company.

- Seed Funding: Seed funding is the initial capital provided to startups to develop their products and validate their business models. This stage involves significant risk, as many startups fail to achieve commercial success. However, those who succeed can generate outsized returns, as seen with companies like Airbnb and Instagram, which were initially funded by venture capital.

- Late-Stage Funding: Late-stage venture capital involves investing in more mature companies that have demonstrated strong growth and are nearing an initial public offering (IPO) or acquisition. These investments carry less risk than seed funding but also offer lower potential returns.

Real Assets

Real asset funds access a variety of investments that have tangible value, such as real estate, infrastructure, and natural resources. These investments are expected to keep pace with inflation and are often used as a long-term hedge against it.

- Real Estate Funds: These private funds invest in a pool of real estate offerings or into a direct real estate structure. Investments vary across office space, apartment buildings, warehouses, and shopping malls. As with most private investments, these represent long-term investments with capital locked up for different periods depending on the project. Private real estate draws investors for its steady cash flow and historically negative correlation to publicly traded real estate investment trusts.

- Infrastructure Funds: These funds pool private capital to finance and develop public infrastructure projects, often in collaboration with government entities. Infrastructure is a global necessity, with an estimated $3.6 trillion needed annually. Given the limitation of government budgets, public-private partnerships are essential. These funds may offer both capital appreciation and steady income.

- Natural Resource Funds: These funds invest in companies focused on the extraction, drilling, production, and refining of commodities, chemicals, and timber. These investments are closely tied to overall economic conditions, carrying inherent risks and potentially experiencing more volatility than other private investments.

The Role of Alternative Investments in a Portfolio

Portfolio Diversification

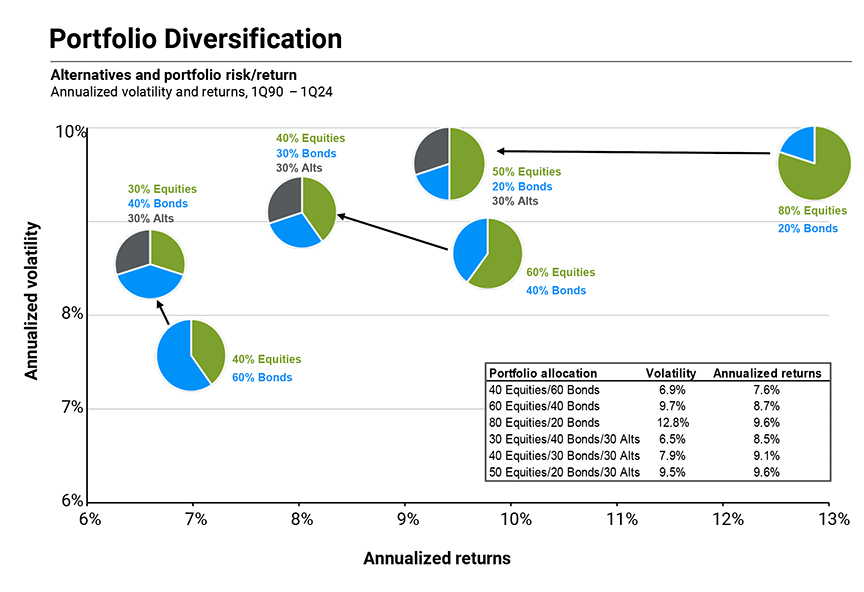

Alternative investments typically have low correlations to traditional asset classes, making them valuable for portfolio diversification. They can act as both return enhancers and diversifiers, reducing overall risk exposure and potentially hedging against inflation. For example, during periods of market volatility, assets like private real estate or infrastructure may provide stable income streams, offsetting losses in more volatile public equities.

In addition to reducing risk, alternative investments can enhance returns. For instance, private equity investments and venture capital have historically outperformed public markets over the long term, particularly during economic expansions. By including a mix of alternative assets, investors can achieve a more balanced and resilient portfolio.

Determining Allocation

The appropriate allocation to alternatives depends on the investor’s risk tolerance, investment horizon, and objectives. While alternatives are attractive to sophisticated and high-net-worth investors, they may not suit everyone due to their unique risk-return profiles and complexity. For example, younger investors with a longer time horizon may allocate more to high-risk, high-reward venture capital, while retirees might prefer the steady income from private real estate or direct lending.

Once a suitable allocation to alternatives is determined, diversifying within these asset classes is crucial. A well-diversified alternative investment portfolio can result in less volatility and a greater likelihood of achieving successful outcomes.

Source: JP Morgan Guide to Alternatives U.S. 3Q 2024-: Bloomberg, Burgiss, HFRI, NCREIF, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Alts include hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Equities are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index. Volatility calculated as the annualized standard deviation of quarterly returns. One cannot invest directly in an index or benchmark, and they do not reflect the deduction of various fees that would diminish results. Data are based on availability as of August 31, 2024.

Private Markets vs. Public Markets

Barrier to Entry: Accredited Investors Only

Unlike public markets, which are open to nearly all investors regardless of financial sophistication, private markets are typically accessible only to accredited investors. The U.S. Securities and Exchange Commission (SEC) defines an accredited investor as someone who meets specific income or net worth criteria, including a net worth greater than $1 million or an annual income exceeding $200,000. This barrier ensures that only those with the financial capability and sophistication to understand complex securities can invest in private markets.

Reduced Regulatory Burden

Private companies are not constrained by the regulatory hurdles and scrutiny faced by public companies. Public companies must make regular regulatory filings, registrations, annual reports, and highly reviewed earnings reports, all of which entail significant administrative expenses. In contrast, private investments are typically sold to a smaller pool of accredited investors and are not required to adhere to the same regulatory environment, resulting in lower administrative costs.

Shielded from Day-to-Day Price Fluctuations

Public stock markets experience daily changes in share prices, often exacerbated by computer-driven algorithmic trading. In contrast, private companies are not traded on public exchanges, so investors do not see daily fluctuations in their investment values. This means private investors avoid the stress associated with frequent dramatic shifts in their investment statements.

Fee Differences

Alternative investments typically charge notably higher fees, particularly in the form of management fees and performance-based “carried interest,” while public security portfolios generally have lower management fees with a more standardized structure.

Liquidity Differences

Public markets offer daily liquidity for investors who need to sell or want to buy, whereas private investors often forgo this liquidity. In exchange for locking up their money for prolonged periods, private investors may achieve better risk-adjusted returns over time. This trade-off is a key consideration for investors when balancing the potential for higher returns with the need for liquidity.

Performance

Historically, long term returns of private market equity have outperformed the public market equity (represented by the S&P 500). In exchange for these compelling returns private equity investors give up the level of liquidity and transparency inherent to public markets but also gain diversification and a reduction in volatility.

Source: https://fsinvestments.com/fs-insights/chart-of-the-week-2024-6-14-private-equity-outperformance/

Pitchbook, as of December 31, 2023, latest data available.

The Importance of Due Diligence in Private Equity Investments

What Is Due Diligence?

Due diligence is a comprehensive review of a private investment opportunity. It involves examining the investment’s financial health, market potential, and associated risks before committing funds. This process is crucial in private investments because they lack the transparency and published reporting found in public markets. Without readily available public information, investors must carefully assess the investment’s value and potential downside.

Why Is Due Diligence Important?

The due diligence process in private markets is more complex than in public markets. The efficient market hypothesis, which states that a publicly traded company’s stock price reflects all available public information, does not apply to private markets. In private markets, information is less readily available, and investors must conduct their own research to determine the value of a private investment.

Investors must undertake a deeper level of due diligence and market analysis to accurately assess the value of a private investment and the price a buyer may be willing to pay in the future. For example, the importance of due diligence is evident in the dispersion between returns in the public market and the private market. Private investments can vary significantly in their outcomes, making thorough due diligence essential to mitigate risks and enhance the potential for strong returns.

How Private Investments Can Enhance a Diversified Portfolio

Reducing Portfolio Volatility

Public stock markets are naturally volatile, with frequent ups and downs. Traditionally, investors have balanced this volatility by mixing stocks and bonds, often in a 60/40 ratio. However, this approach may be less effective now due to the Federal Reserve’s increased influence on bond markets. They can distort bond prices and make them less reflective of true market conditions. Additionally, low interest rates set by the Fed can encourage excessive risk-taking and potentially inflate stock prices beyond what company performance would justify.

Given these challenges, investors may want to explore new ways to spread risk in their portfolios. Private market investments offer a potential solution, providing attractive long-term returns, better portfolio diversification, and lower day-to-day volatility. By including private investments, investors might achieve a more stable and well-rounded portfolio.

Improving Diversification

The inclusion of private investments in a portfolio can enhance diversification by offering exposure to alternative assets that are less correlated with public markets. This can help reduce overall portfolio volatility and potentially improve long-term returns. For example, during market downturns, private real estate or infrastructure investments may provide stable income streams, offsetting losses in more volatile public equities.

Conclusion

Taking advantage of private markets through less liquid investments can provide long-term investors with the ability to generate excess returns over time. Private markets also offer the benefit of eliminating the stress of daily price movements. Those movements that affect public securities, even when such movements have no fundamental impact on the actual value of the business. This makes private markets particularly attractive in environments where finding value in public equity investments and bond markets requires taking on more risk.

History suggests that private investments can outperform public investments at the turn of an economic cycle. While every client’s financial situation and investment goals may vary, the ability of a wide array of investors to access the private markets through different structures is growing. Investors are increasingly recognizing the potential of private markets. They see the offering of good risk-adjusted returns, enhanced income opportunities, and attractive diversification benefits.

Co-Authors:

Megan Horneman, Chief Investment Officer

Matthew Andrulot, Managing Director of RIA+

Frequently Asked Questions (FAQs):

What are private investments? How do private investments differ from public investments?

Private investments, also called alternative investments, involve assets or companies not traded on public exchanges. Unlike stocks or bonds available to anyone, private investments are typically restricted to accredited investors. They differ from public investments in three key ways:

Accessibility: Not available to the general public.

Liquidity: Generally harder to buy and sell quickly.

Higher fees and expenses: Involve higher minimum investments

Risk-return profile: Often offers potential for higher returns but with increased risk.

Private investments usually fall into three main categories: private equity, private credit, and real assets.

How do private markets compare to public markets in terms of risk and return?

Private markets generally offer the potential for higher returns but come with increased risks. This is due to lower liquidity, less transparency, and reduced regulatory oversight. They also tend to be less volatile than public markets, as they are not subject to daily price swings.

What are the main types of private equity investment funds?

The main types of private equity investment funds include buyout funds, venture capital funds, and growth funds. Each targets different stages of a company’s lifecycle, from early-stage startups to mature companies needing restructuring or expansion.

What is due diligence in private investments, and why is it important?

Due diligence is a comprehensive review of a private investment opportunity. It involves examining the investment’s financial health, market potential, and associated risks before committing funds. This process is crucial because private investments lack the transparency of public markets. So, it’s essential to assess value and risks carefully.

How can private investments enhance a diversified portfolio?

Private investments can provide diversification benefits by offering exposure to alternative assets that are less correlated with public markets. This can help reduce overall portfolio volatility and potentially improve long-term returns.

What are the barriers to entry for investing in private markets?

Investing in private markets typically requires being an accredited investor, which means meeting specific income or net worth criteria. Additionally, private investments often involve higher minimum investments and longer illiquid lock-up periods, limiting accessibility for many investors.

Why have private markets grown significantly in recent years?

Private markets have grown in recent years due to factors like the absence of stringent regulations. It’s also due to increased liquidity from nontraditional monetary policies and the strong performance of private equity-backed IPOs. Investors are also attracted to the stability and potential for higher returns that private investments offer compared to public markets.

Disclosures:

The information contained in this paper is provided for education purposes and has been obtained from sources we believe to be reliable but cannot be guaranteed. Due to various factors, including changing global tax laws, the content is subject to change without notice. You should not assume that any discussion or information contained in this paper serves as the receipt of, or as a substitute for, personalized advice from Verdence Capital Advisors. To the extent that a reader has any questions regarding the applicability of this content to his/her situation or any specific issue discussed, he/she is encouraged to consult with the professional advisor of his/her choosing. Verdence Capital Advisors is neither a law firm, certified public accounting firm or qualified tax authority, and no portion of this content should be construed as legal, accounting, or personalized tax advice. A copy of Verdence Capital Advisor’s current written disclosure statement discussing our advisory services and fees is available for review upon request.