Key Takeaways:

- Powell suggests Fed may pause rate cutting cycle.

- It was the most divisive decision since 2019 as three voting members dissented.

- U.S. equity returns are strong during the duration of a Fed pause.

- Too early to tell what the Fed might do following their pause, and history is not a guide.

- No set course for monetary policy.

Powell’s Fed Likely Just Cut Rates for the Last Time

Last week, the Federal Reserve cut interest rates by 25bps to a range of 3.5% – 3.75% in a 9-3 vote. This was the first time since 2019 in which there were three dissenters at a Fed meeting. However, the Fed is even more divided than headlines would suggest.

Across all Fed officials, voting and non-voting members, there were a total of seven dissents. There were three “hard dissents” from voting members, including Fed Governor Miran (favoring a 50bps cut), and Chicago and Kansas City Fed President’s Goolsbee and Schmid (both favored no change). There were four “soft dissents” from non-voting members. With Chairman Powell suggesting the committee is “well-positioned” to assess the economy, this may be the last Fed cut overseen by Powell. In this weekly, we examine why the divisions at the Fed have grown so quickly, and analyze how markets historically behave under a Fed pause regime.

Why are the divisions so deep?

The Federal Reserve’s dual mandate of stable prices and maximum employment are both under pressure. Inflation is still above the Fed’s 2% target, with PCE Core increasing 2.8% YoY. This is concerning for hawkish Fed officials, who are more concerned with inflation. In contrast, dovish Fed officials are focusing on cracks in the labor market, as they typically favor lower rates to stimulate the economy, and therefore employment.

Historical market reaction to Fed pause:

We analyzed ten historical pause periods since 1981 and determined the Fed stays on hold for an average of 10 months.1 The S&P 500 returns an average 9.5% during the duration of a pause, while 10YR bond yields gain ~10bps. The U.S. Dollar generally strengthens by an average 2.7%. Gold prices, often viewed as a safe-haven in times of economic or geopolitical uncertainty, are lower by ~1.5% throughout the duration of a Fed pause.

Too early to tell Fed’s next direction:

History has been inconsistent when gauging the next interest rate move following a pause period. In fact, in the 10 periods analyzed, immediately following a pause period, there were five instances of a hike and five instances of a cut. Fed officials have penciled in a single rate cut in 2026 and 2027, but have reiterated there is “no set path for policy.”

The Bottom Line:

We agree with Chairman Powell’s remarks in his post-meeting press conference that suggested the committee is well-positioned to assess incoming data. We understand the rate cut last week was to address recent weakness in the labor market but we are also concerned that inflation is being ignored. With the economy expected to get a boost from the One Big Beautiful Bill and ongoing capex spending, there is a strong chance that the Fed is on hold for 1H26. This will give them time to assess whether inflation can continue its downward trajectory or if it remains stuck near current levels (PCE Core 2.8% YoY).

In addition, with the Fed’s more optimistic view on the economy in 2026, it warrants a wait and see approach to confirm that inflation is moving to its 2.0% target. We expect the division among the committee to continue and markets to be volatile as equity valuations may be overly optimistic on the Feds rate path.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Small business owner sentiment improves.

- Job openings in the U.S. climb to a five-month high.

- Fed cuts rates by 25bps; signals potential pause.

- Global equities finished mix despite Fed rate cut.

- Bond yields diverge as potential Fed pause on the horizon.

- Commodities fall on energy weakness.

Weekly Economic Recap — Fed Cuts Rates but Signals a Pause Might be on the Horizon

According to the National Federation of Independent Businesses (NFIB), small business sentiment rose in November to a three month high. A net 15% of owners anticipate higher sales volume in the next three months, the largest share this year. Hiring intentions increased as a result of the higher sales outlook, with a net 19% of small companies planning to create new jobs in the next three months, the largest share this year.

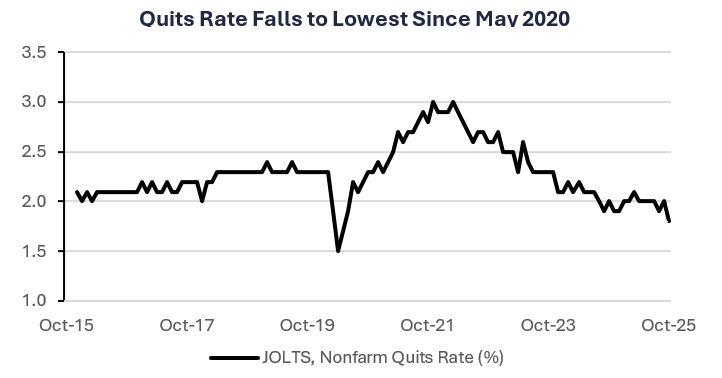

Job openings in the U.S. increased to a five-month high in October (7.67 million) and layoffs climbed to their highest level since 2023 (1.85 million), according to the JOLTS report. The quits rate, which measures those leaving their jobs voluntarily, fell to the lowest since May 2020, suggesting decreasing confidence in their ability to find a new position elsewhere.

The Federal Reserve cut interest rates for the third time this year (to 3.50% – 3.75%) at their December meeting in a 9-3 vote. It was the first time since 2019 in which there were three dissenters. In the post-meeting press conference, Powell signaled, [the committee] is well-positioned to wait to see how the economy evolves,” when asked about the potential path for rates. The Fed’s Dot Plot signaled only one cut in 2026 and 2027 before the Fed funds rate hits a long-run target of 3%.

The Employment Cost Index, which measures changes in wages and benefits, increased 3.5% YoY in September, the slowest gain in four years. Private compensation grew at the slowest pace since a decline in early 2023.

Weekly Market Recap — Global Equities Finish Mixed as Tech Valuations Back in Focus

Equities:

The MSCI AC World Index was lower for the first time in three weeks as fears over AI valuations crept back into the markets. Small-caps, as tracked by the Russell 2000, outperformed their large-cap peers in the U.S. after the Fed cut interest rates. Large-cap growth fell after Oracle (an AI beneficiary) reported underwhelming quarterly results; missing revenue forecasts and far exceeding capital expenditure plans.

Fixed Income:

The Bloomberg Aggregate Index declined for the second consecutive week as long term yields were driven higher after the Fed suggested last week’s rate cut may be the last for some time. Short-term yields (2YR) were lower after the Fed cut rates, while longer-term yield (10YR) were higher after the announcement. High yield bonds and floating rate instruments were the only areas of fixed income to finish higher.

Commodities/FX:

The Bloomberg Commodity Index was lower for the first time in three weeks and by the most in four months. Natural gas prices fell by the most since December 2022 as weather forecasts for the holiday season showed warmer temperatures. Crude oil was lower as oversupply concerns emerged on prospects for a Russia/Ukraine peace deal.