Key Takeaways:

- Inflation easing but stubborn price pressures remain.

- Consumers increasing expectations for missing minimum debt payments.

- Credit card balances sit at record high as delinquency rates climb.

- Consumers delay home projects as prices

- Customers focusing on essentials.

Theme of the Week — Consumer Resiliency is Running Thin

Last week, investors were flooded with economic and earnings data that provided further clues on the strength of the consumer. While headline inflation, as tracked by the Consumer Price Index, grew at its slowest annual pace since March 2021, investors may have missed some of the more concerning components of the index that remain subborn. In addition to the inflation report and retail sales report, two consumer bellweathers, Home Depot and Walmart, reported 2Q24 earnings last week which gave further insight into the outlook for the consumer. This week, we provide a deeper look at the state of the consumer through the lens of the most recent data.

- Inflation is better but still stubborn: There are still sticky inflation pressures challenging consumers that were largely overlooked by the headline CPI number. For instance, shelter jumped 0.4% (MoM) after slowing in June and housing related costs accounted for nearly 90% of the overall headline increase. In addition, services in the CPI report are growing 4.9% (YoY), well above the growth in earnings (3.6% YoY).

- Were retail sales as good as they showed? Headline retail sales surprisingly jumped (+1.0% MoM) at the fastest pace in 18 months in July. Most of the increase was led by a large jump in sales at auto dealers. However, this may only be a rebound after the steep decline seen in June due to a software outage at dealers from a cyber-attack. When excluding autos, sales rose a modest 0.4%.

- New York Fed Survey flashes warning signs: Last week, the New York Federal Reserve Survey showed mixed signals for consumers. First, in a positive sign for the economy, the three-year inflation outlook fell to the lowest since at least 2013 (to 2.3%). However, in the near term, those consumers expecting to miss a minimum debt payment rose to the highest since April 2020.

- Credit usage can’t withstand current levels: TransUnion cites the average credit card balance is ~$6,300, an increase of 4.8% YoY. Delinquency rates are also higher. Over the last year, roughly 9.1% of balances transitioned into delinquency.

- Home Depot emphasizes challenged consumer: Home Depot reported below consensus 2Q24 earnings. Revenues fell as “consumers are deferring home improvement projects given higher rates,” says CFO Richard McPhail.

- Walmart is concerned about 2H: While Walmart posted better than expected 2Q24 earnings, the retailer projects a weaker 2H24. The company noted, “customers remain choiceful, value-seeking and focusing on essentials.”

The Bottom Line

There is a lot of focus on the resiliency of the U.S. consumer. Despite July’s retail sales report, we are cautious about the consumer. Credit card debt is at a record high, the average credit card rate is over 20% and in another recent NY Fed survey, Americans that are growing worried about losing their job is at the highest level since 2014. With the labor market weakening and select areas of inflation remaining sticky, this threatens the optimism that the consumer can continue to support growth.

Footnotes: Data is as of August 16, 2024.

Source: Bloomberg Finance LP, Verdence Capital Advisors.

Your Economic and Market Detailed Recaps

Key Takeaways:

- Small business optimism surprisingly jumps.

- Headline inflation moving towards Fed’s target.

- Retail sales climb driven by a surge in auto sales.

- Global equities jump on better inflation data.

- Bond yields fall as rate cuts in September priced in.

- Commodities rally but oil retreats.

Weekly Economic Recap — Inflation Eases Further

NFIB small business optimism increased to the highest level since February 2022 in July. Those companies anticipating the economy to worsen fell to the lowest level since November 2020. Businesses citing plans to raise prices fell the most since April 2020, matching this year’s low.

Producer prices rose modestly in July. While food and energy prices rose, service prices declined. This was the first time service prices declined this year and they fell at the fastest month over month pace since December 2020. At the core level (excluding food, energy and trade) prices rose slightly more than expected (0.3% vs. 0.2% est.).

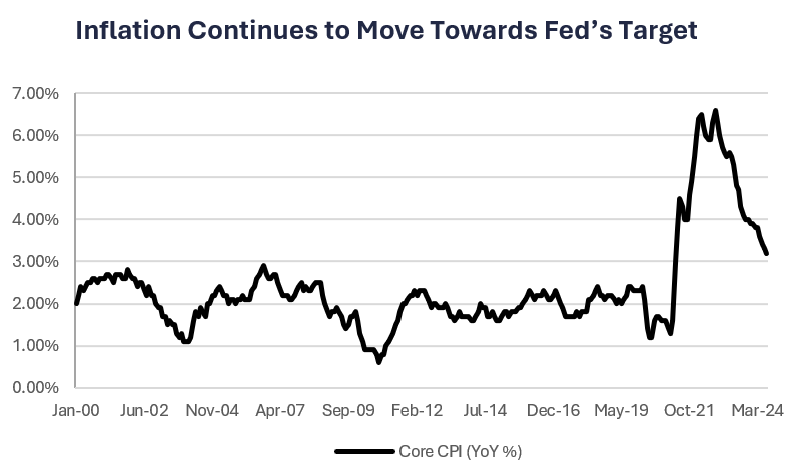

Headline inflation, as tracked by the Consumer Price Index, increased slightly less than the consensus estimate on an annualized basis (2.9% vs. 3.0% est.) and at the slowest pace since March 2021. Shelter costs accounted for 90% of the headline index increase. Core CPI, which exludes volatile food and enery prices, increased at the slowest pace since April 2021 (3.2% YoY).

Consumer spending remained resilient in July as retail sales increased by the most since January 2023. The increase was led by sales of motor vehicles, which accounted for half of the increase. If they were excluded, sales were primarily led by non-discretionary items (e.g., food and beverages). At the core level, which excludes volatile items, including auto sales and gas, prices increased at the slowest pace since April 2024.

Consumer sentiment, as tracked by the University of Michigan Index, increased for the first time in five months. The increase was led by better confidence on future expectations as confidence on current economic conditions declined for the fifth consecutive month.

Weekly Market Recap — Global Equities Rally on Fed Rate Cut Optimism

Equities: The MSCI AC World Index posted its best one week rally since November 2023 as investors priced in rate cuts in September as inflation continues to wane. Developed international equities led the gains (i.e. MSCI EAFE), primarily Japanese equities as the Yen rallied. Within the U.S., technology and growth resumed their leadership as interest rates fell. The S&P 500 outperformed both small and midcap stocks and remains ~2% from its record high reached in July this year.

Fixed Income: The Bloomberg Barclays Aggregate Index rallied for the third time in the past four weeks. Slowing inflation and rate cuts priced in for the September meeting helped push yields lower. Emerging market and investment grade bonds led the gains. In addition, longer term Treasuries outperformed short term Treasuries (10YR vs. 2YR).

Commodities/FX: The Bloomberg Commodity Index rallied for the second consecutive week. However, crude oil slipped for the fifth week out of the past six as fears of Chinese demand were challenged by a weaker economic outlook. Gold prices posted their best one week rally in 19 weeks on hopes for Fed rate cuts.