Key Takeaways:

- Earnings season set to begin tomorrow (Tuesday).

- S&P 500 is expected to report its tenth consecutive quarter of year-over-year earnings growth.

- Increased M&A activity expected to be a tailwind for the financial sector.

- Technology continues to lead earnings growth, but can hyperscalers deliver?

- Energy is the only sector expected to report a year-over-year decline in revenue.

4Q25 Earnings Season Kicks Off

S&P 500 companies will begin reporting 4Q25 earnings tomorrow (Tuesday) with major banks taking center stage. According to FactSet, the S&P 500 is expected to report that S&P 500 earnings grew ~8% (YoY).1 If this comes to fruition, it would mark the tenth consecutive quarter of year over year earnings growth. Over the past twenty years (80 quarters), analysts have typically reduced quarterly earnings growth estimates by ~4% throughout the quarter. However, during 4Q25 analysts increased earnings estimates by 0.5%, marking the second straight quarter in which estimates were revised higher during the quarter. In this weekly insights, we provide a preview of what investors may see this earnings season.

Financials kick off earnings season:

Major companies in the financials sector, including JPMorgan, Bank of America, and Wells Fargo (among others) will report quarterly results beginning tomorrow. The broad sector has recorded the second-largest percentage increase in the estimate for earnings since the start of the quarter. The sector is expected to report earnings growth of ~6% YoY (vs. 4% on September 30th). Financial companies will likely benefit from pro-growth policy initiatives in President Trump’s One Big Beautiful Bill, as well as increased M&A activity amid easing monetary policy.

Tech still the dominating contributor to earnings growth:

The information technology sector is expected to report the highest year-over-year earnings growth of all eleven sectors (+26% YoY), with all six industries expected to report growth as well. We are monitoring comments on capex spending plans from hyperscalers and other mega-cap tech names as the AI infrastructure buildout continues.2 Nvidia is expected to be the largest contributor to earnings for the sector. If the company were excluded from the sector, the growth rate would be 18% (YoY).

Consumer discretionary to lag:

The consumer discretionary sector is expected to report the largest year-over-year earnings decrease of all 11 sectors (-3.5% YoY). Five of the nine industries in the sector are expected to report earnings declines, with three of the five expected to report a drop of more than 10%. Household durables and automobiles (-35% each) are expected to report the largest decrease as consumer spending on discretionary items slowed.

Energy will still be a weak spot:

The energy sector is the only sector that is expected to report a year-over-year decline in revenue (-2.2% YoY, EPS estimate is -1.9% YoY). Lower year-over-year crude oil prices are to blame for this amid increasing geopolitical tensions.

The Bottom Line:

Earnings growth for 2025 has defied expectations and analysts are expecting the strength to continue in 2026. According to FactSet, S&P 500 earnings are expected to grow ~15% in 2026, which would mark the third straight year of double-digit earnings growth. However, it is highly dependent on info tech earnings so if they do not deliver it threatens the full index earnings growth. In fact, 2026 earnings estimates for the info tech sector rose 9.5% during 4Q25, more than double the aggregate S&P 500 increase (2.5%).

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Manufacturing sector still in contraction territory.

- Job openings fall to one-year low in the U.S.

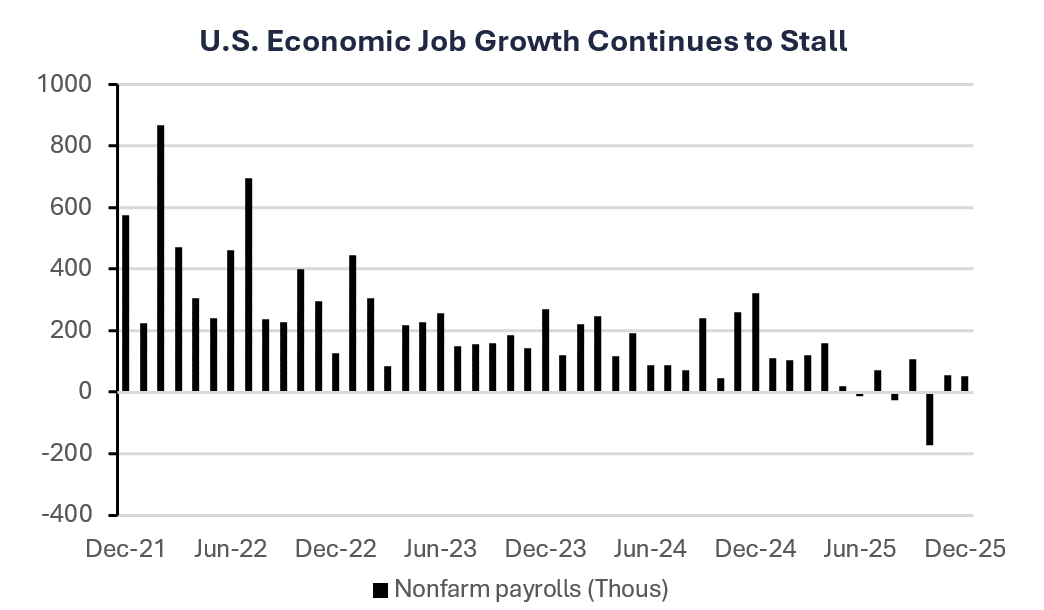

- U.S. annual job growth falls to lowest since 2020.

- Global equities higher despite geopolitical tensions.

- Bond yields whipsawed by economic data.

- Geopolitical tensions drive commodities higher.

Weekly Economic Recap — Labor Market Weakness Prevails

Manufacturing activity in the U.S. remained in contraction territory (a reading below 50) for the tenth straight month according to the ISM Manufacturing gauge. Producers have been drawing down their raw material inventories at the fastest pace since October 2024, highlighting firms’ reliance on existing stockpiles to satisfy demand. New orders contracted for the fourth straight month while employer headcount shrank for the eleventh straight month.

Service sector activity in the U.S. expanded in December at the fastest pace since October 2024 (54.4) according to the ISM Service gauge. New orders increased by the most since Septemebr 2024, while a measure of business activity increased to a one-year high. Inventory sentiment decreased for a third month.

Job openings in the U.S., as tracked by the JOLTS report, fell to a more than one-year low in November to 7.15 million. The total number of hires decreased to the lowest level since mid-2024 while total layoffs declined to a six-month low. The number of vacancies per unemployed worker, a ratio closely monitored by Fed officials, fell to 0.9 to 1, the lowest level since March 2021, and down from its 2022 peak of 2 to 1.

The U.S. economy added fewer jobs than expected in December (50K vs. 55K est.). The unemployment rate decreased marginally to 4.4% (from 4.5%). For the year, the economy added only ~1.44 million jobs, the weakest annual job growth since 2020.

Consumer sentiment as tracked by the University of Michigan increased for the second straight month. Sentiment broadly improved surrounding the current economic environment, but concerns remain around the state of the labor market.

Weekly Market Recap — Global Equities Higher Despite Increasing Geopolitical Tensions

Equities:

The MSCI AC World Index was higher for the second time in three weeks as investors looked past growing geopolitical tensions, specifically coming from U.S. tensions with Venezuela and Iran. All major averages in the U.S. posted gains in the first full trading week of the new year. Small-caps, as tracked by the Russell 2000 Index hit a record high and led U.S. gains. Value outperformed growth at the large cap level.

Fixed Income:

The Bloomberg Aggregate Index was higher despite yields being whipsawed by economic data. Short-dated bonds (2YR) were relatively flat, while long-dated bonds (10YR) rose. All sectors of fixed income finished the week higher with municipal bonds leading.

Commodities/FX:

The Bloomberg Commodity Index was higher for the second time in three weeks. Precious metals led performance as investors sought out safe-haven assets. Crude oil prices were higher by the most since October amid uncertainty around Venezuela and Iran’s supply, driven by mounting geopolitical tensions with the U.S.