Understanding The Fed Dynamic

The Federal Reserve is one of the largest central banks in the world, joined closely by the People’s Bank of China and Bank of Japan.1 It holds nearly $7 trillion in assets which equates to ~30% of U.S. GDP. These central banks hold immense power over the global banking system, their economies and global stock and bond markets.

As a result, when members of their banks speak, the public listens and markets tend to react. The U.S. central bank is about to undergo some of its regularly scheduled rotation of voting members. But also a new Federal Reserve Chairman will be appointed in 2026. Therefore, there has been a lot of speculation and noise around what to expect from the Fed next year from an interest rate perspective.

In this quarterly white paper, we want to educate investors about the Federal Reserve, its structure and what we expect to see from the Fed in 2026. We will also offer our view on what the new composition of voting members and potential Fed Chairman may mean for the equity and bond markets.

What is the Federal Reserve System?

The Federal Reserve system is the central bank in the United States. Its core responsibilities are setting interest rate policy, supervising banks, and maintaining a fully functional and stable payment system. It’s also responsible for supporting protections for the U.S. consumer. The bank acts independent of any political party. However, Congress and several of its members are nominated by the President of the United States oversee the Federal Reserve.

The Federal Reserve and the Federal Open Market Committee

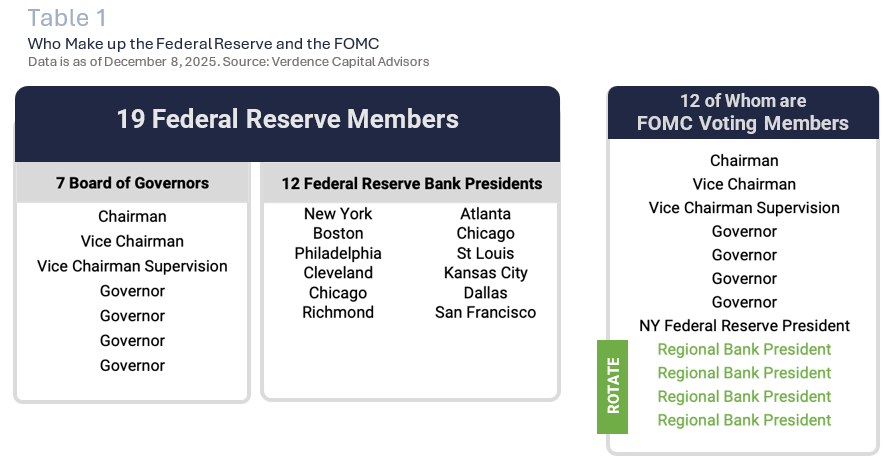

The Federal Open Market Committee (FOMC) is a committee made up of members of the Federal Reserve system. Seven Fed Governors and 12 regional Federal Reserve Bank Presidents make up the committee. The committee meets eight times per year to set monetary policy. The President appoints the seven Fed Governors who are confirmed by the Senate and are meant to be diversified geographically.

These Governors serve “staggered” 14-year terms, with one expiring every two years.2 There are 12 members that vote at the regularly scheduled FOMC meetings. The seven Fed Governors and the President of the New York Federal Reserve are permanent voting members. The other four voting members rotate annually among the 12 Federal Reserve Bank Presidents. All 19 members attend the eight FOMC meetings each year to contribute to the discussion around interest rate policy (Table 1). This is regardless of their voting status.

The FOMC and its Dual Mandate

Now that we understand the composition and voting structure, it is important to understand the function of the committee from an interest rate perspective. The FOMC serves a dual mandate (i.e., price stability and maximum employment). Price stability refers to keeping inflation controlled at a specific target (e.g., 2.0%).

Maximum employment means assuring there are enough available labor opportunities in the economy for those that want a job. To achieve this dual mandate, the FOMC is responsible for setting interest rate policy. (i.e., Federal Funds target rate). The Federal Reserve Bank of New York carries out regular operations (e.g., reverse repos) to maintain that target rate.

Understanding the Composition of the FOMC and Why it Changes

The 19 members of the FOMC committee have in depth knowledge of areas such as economics, public policy, law and finance (to name a few). They have extensive education with many achieving a PhD in their respective field of expertise.

While 19 members attend the regularly scheduled FOMC meetings on interest rate policy, not all members vote. Understanding why voting members rotate annually is key to understanding how policy decisions evolve. Changing the composition of the FOMC is an integral part of the success of central banks to achieve their mandate. In fact, many major global central banks are structured with rotating members and/or voting members (e.g., ECB, BOE and BoJ).

The importance stems from the framework that central banks should be independent. An independent central bank reduces the chance of political persuasion. Political persuasion has historically proven to be damaging to economic growth and inflation.

For example, in the 1970s the Federal Reserve was influenced by then President Richard Nixon. He wanted to keep rates low and stimulate credit. This in turn ended up fueling decades of inflation and caused high unemployment. A changing composition also promotes debate about interest rate policy with fresh perspectives regularly introduced. In addition, setting clear guidelines on what the changes within the committee will be enhances transparency and the credibility of the central bank.

How can the Composition of the FOMC Impact Markets?

Central bank officials are typically characterized as being a “hawk” or a “dove.” A central bank member that is considered a “hawk” is typically more concerned about controlling inflation. They may tilt towards voting for higher interest rates.

A dovish member is typically more concerned with stimulating growth and keeping unemployment low. This is so they may lean towards lower interest rates. As the composition changes each year, it can have an impact on the expectation for interest rates and economic growth. This depends on which member becomes a voting member. Ultimately, it may alter the outlook for specific asset classes.

What Changes are Expected in 2026?

The upcoming year is no different and we will be introduced to a new set of voting members on the FOMC. However, the recent news headlines have been focused on the changes to the Federal Reserve Chairman seat in 2026. The Federal Reserve Chairman is always a Federal Reserve Governor, but a chairman does not need to be a Governor before being appointed to the position. They automatically become a Governor for the 14-year term when they are appointed to the head position as chairman.

For example, Ben Bernanke, Alan Greenspan and Paul Volker were appointed the Chairman and as a Fed Governor simultaneously. The Federal Reserve Chairman is decided every four years, and a Fed Chairman can be reappointed by the President multiple times within his term as Governor (a Governor can serve two 14-year terms). Alan Greenspan was the longest serving Federal Reserve Chairman, serving as Fed Chair from August 1987 to January 2006. He was reappointed by several Republican Presidents and a Democratic President.

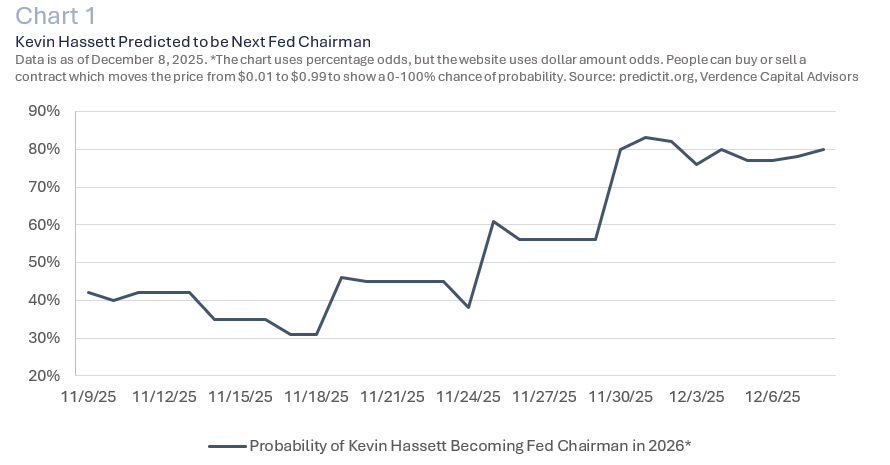

The current Federal Reserve Chairman, Jerome Powell was sworn into office in May 2012 as a Governor and was appointed Fed Chairman by President Trump, taking the chairman seat in February 2018. It has become clear that President Trump will not reappoint Powell in May 2026 when his position expires. According to the betting odd website, Predictit.org, there is ~80% chance that Kevin Hasset will be appointed the next Federal Reserve Chairman. (Chart 1).

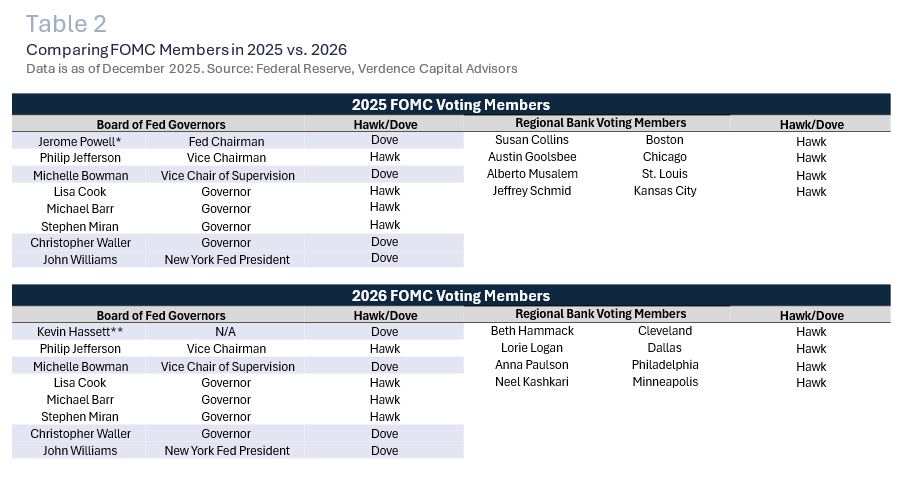

Kevin Hassett is the Director of the National Economic Council under President Trump. Other names that have been considered include Kevin Warsh (served as a Fed Governor 2006-2011), Scott Bessent (founder and CIO of Key Square Group) and Christopher Waller (Federal Reserve Governor since 2020).3 In 2026, we will see the Federal Reserve Bank Presidents of Boston, Chicago, St. Louis and Kansas City rotate out of being voting members and replaced with the Federal Reserve Bank Presidents from Cleveland, Philadelphia, Dallas and Minneapolis.4

Will Monetary Policy be Influenced by the New Composition of the FOMC?

Now that we know who will be voting on monetary policy next year, we can examine each member’s past rhetoric (and voting when available) and classify them as a “hawk” or a “dove.” We can then compare the 2026 voting members to the current composition of the FOMC voting team to see if monetary policy may tilt more “dovish,” “hawkish,” or resemble what we have seen from the Powell-led Fed.

The White House is not expected to announce the nominee for a new Fed Chairman until early in 2026. However, using current betting odds, we assume, in this analysis, that Kevin Hassett becomes the new Fed Chairman. This is also due to President Trump’s support for lower interest rates and Kevin Hassett’s public comments expressing there is “plenty of room” for rate cuts. We also assume Jerome Powell resigns from his positions at the Federal Reserve (Chairman and Governor).

“Hawks” and “Doves”

In Table 2, we looked at the current composition of the FOMC voting members and compared it to what the FOMC with its new voting members will look like next year. We classified each Fed official as a “hawk” or a “dove.”

While sources and historical voting stances may classify some of these members as “centrists,” we pulled as much recent commentary we could about where they think the biggest risk lies, inflation or the labor market. If they are more concerned with inflation, we classified them as a “hawk,” and if they have been more concerned about the labor market, we classified them as a “dove.” It is important to note, we choose to classify each official as one or the either, we did not classify any of them as a centrist.

While the Fed Chairman should be a centrist to gather all the intelligence and help the committee come to a consensus, we pulled Jerome Powell’s voting stance prior to serving as Chairman to classify his stance. As you can see, the FOMC is divided and despite interest rate cuts, the committee is tilted towards having more “hawks” in 2025 than “doves.” This is not expected to change in 2026, as there are the same number of “hawks” and same number of “doves” on the committee.

Therefore, if the administration wants rates to stay low, they will need to appoint a chairman who believes that the economy needs to be stimulated (with lower rates). And a chairman that also believes that inflation will reach their target despite additional stimulative measures.

Why Is Kevin Hassett Perceived as the Front Runner?

He has publicly stated that he would be “cutting rates right now”. He has also criticized the current Fed Chairman as being “late to the game in cutting rates.”5 Even with Kevin Hassett as Chairman, there is not expected to be a change in composition of “hawks” or “doves” on the committee.

The President’s hope is that Hassett will push the committee towards his own dovish view more than Powell did as he acted as a centrist in his term as Fed Chairman. There is also a concern that Kevin Hassett will be politically motivated given the close nature of his relationship with President Trump, a point that Kevin Hassett has argued against and we do not foresee.

A Fed Chairman is also concerned about their own legacy and history has proven that being swayed by politics is detrimental for the Fed. If the Chairman gets too easy with monetary policy, they could be plagued with run-away inflation during their tenure. No chairman wants to be compared to Arthur Burns, who led the Fed during the 1970s and after political pressure he caused inflation and the unemployment rate to double. He has been considered the worst Federal Reserve Chairman post WWII.6

In addition, monetary policy is decided by a committee. Yes, the Chairman has a vote and influence, but their job is to get as close to consensus as possible. As we have shown, the broad committee in 2026 leans towards being more concerned about inflation than the labor market. This is unlikely to change, especially if economic growth accelerates like the current Fed forecasted at their December meeting.

What to Expect from an Investment Perspective

From an investment perspective, all we know is that we do not expect the ratio of “hawks” to “doves” to change. Neither the divisiveness in the committee. This will lead to more market volatility around Fed speeches and meetings.

With a Fed worrying about inflation, investors should realize that rate cuts in 2026 are not a sure thing. Even if Kevin Hassett brings his dovish views to the committee, if the Fed is looking too dovish when inflation is not at the Fed’s target, we could see inflation expectations rise. This is bad for long-term bonds and can be negative for high growth and highly valued areas of the equity market (e.g., growth and technology).

Verdence View

It is clear through this analysis that the FOMC in 2026 will be as divisive as we have seen this year. In fact, at the December 10th FOMC meeting, there were three voters who dissented to rate cuts, the most dissenters since 2019.

It is also clear why a President who wants lower rates may be interested in shaking up the consistency of the voters at the Fed. From an investment perspective we will monitor this outcome, but it will not dictate how we manage asset allocation.

We will be more focused on the outlook for the economy, inflation and earnings growth. We also do not think that the next Fed Chairman will be swayed by politics. These candidates are all well respected, very well-educated individuals that understand the damage that could occur if the Fed is not independent. It could have repercussions on the dollar, demand for U.S. assets and global liquidity that would have adverse effects possibly leading to years of structural damage.

If you have any questions or comments, please reach out to your financial advisor.

Megan Horneman | Chief Investment Officer Past performance is not indicative of future returns

1: https://www.swfinstitute.org/fund-rankings/central-bank In U.S. Dollar terms

2:https://www.federalreserve.gov/aboutthefed/fedexplained/who-we-are.htm

3: These are the top three predicted next Fed Chairman on predictit.org as of December 8, 2025

4: https://www.federalreserve.gov/monetarypolicy/fomc.htm?utm_source=chatgpt.com

5: https://www.federalreserve.gov/monetarypolicy/fomc.htm?utm_source=chatgpt.com