Volatility in the equity markets surged at the start of 2Q25 and reached the highest level seen since the pandemic. While trade policy was a focus of the Trump Administration’s campaign, the aggressive roll out of tariff rates on “Liberation Day” (April 1) left investors stunned.

Economic data responded with consumer and business confidence plunging. Inflation expectations climbed and risk appetite evaporated. Global equities as measured by the MSCI AC World Index notched the first 10% correction seen in over a year. Select U.S. indices entered bear market territory (e.g., Nasdaq, Russell 2000). Bond markets were in disarray, and the U.S. dollar saw its worst start to a year since 1973. Gold prices benefited as investors flocked to precious metals as a hedge with gold prices making 25 fresh new record highs through June 30, 2025.

It took the Trump Administration putting a pause on what was considered the most restrictive trade policy since the Smoot-Hawley Act in the 1930s to calm the market chaos.

LISTEN NOW: Alternate View Podcast

With Trump agreeing to allow time for negotiations, global equities recovered. They also recouped most, if not all, the losses experienced during the trade turmoil. In fact, the S&P 500 and the Nasdaq finished the second quarter at a new record high. As we move through the remainder of 2025 it is important to not be complacent to the reordering of global trade. And not be complacent to what that may mean for the economy, inflation, the Fed and corporate earnings.

In this outlook, we focus on the near-term challenges we see for economic growth. We warn investors that the Fed may not be as flexible with easing monetary policy as investors are anticipating. In addition, we reiterate one of our main themes for 2025 that reminds investors to pay an appropriate price for the level of risk.

U.S. Economy – Choppy and Slower Growth Ahead

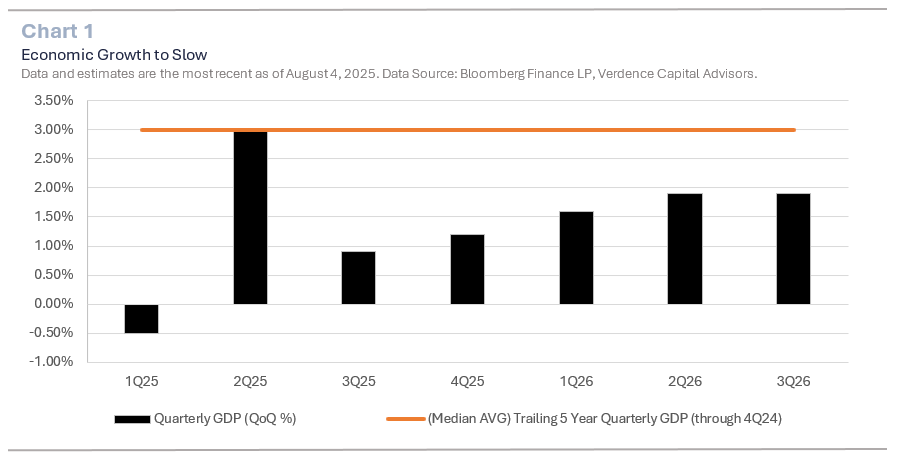

The economic data investors have witnessed in the first half of 2025 has been impacted by tariffs, a stretched consumer and stubborn inflationary pressures. While trade uncertainty is fading as trade deal frameworks with key trading partners take shape, the global economy is not out of the woods yet. We expect economic growth to continue but at a slower pace (Chart 1). for the remainder of 2025 for several reasons.

Consumer challenges

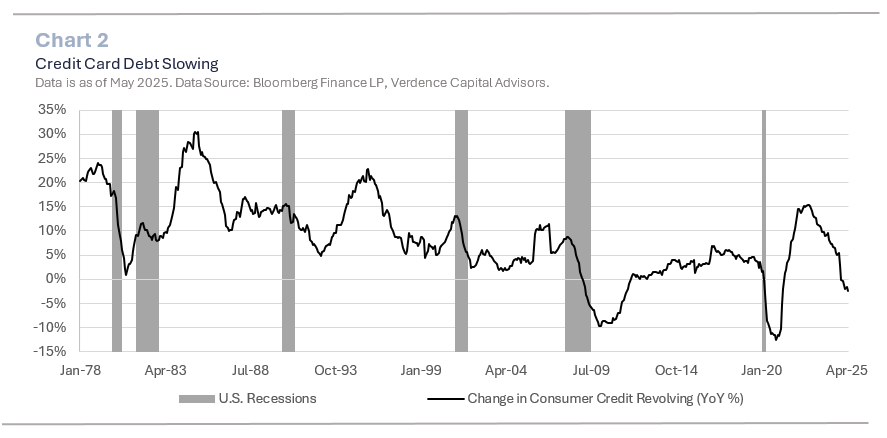

Consumers continue to be burdened by stubborn inflation, political uncertainty, high credit card debt and a weakening labor market. We have seen consumers rely on credit card debt in recent quarters to fund spending habits in an elevated inflationary environment. However, after peaking in early 2023 we have seen consumers’ reliance on credit cards slow on a year over year basis. (Chart 2). Declining credit card debt on a year over year basis has historically led to a slowdown or even recession. While it is good news for the long-term health of the consumer, without a meaningful change in income, spending should remain under pressure.

Labor market weakness

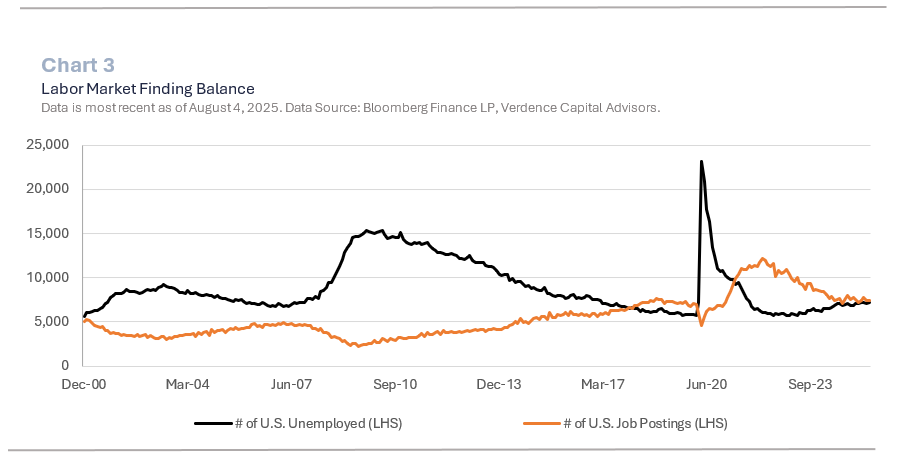

The labor market has been surprisingly resilient during the political and economic uncertainty this year. The COVID related labor market impacts caused a distortion in the labor market that has taken years to balance. However, this year there is evidence that the labor market is finding an equilibrium, and cracks are widening. (Chart 3).

The three-month moving sum of job creation has dipped to the lowest level since June 2020 and continuing claims for unemployment insurance have increased to the highest level since 2021. In addition, the duration of those unemployed has increased to 10.2 weeks, well above the median average since 1950 (8.8 weeks). Historically, duration of unemployment at these levels has coincided with an increase in the unemployment rate.

LISTEN NOW: Markets With Megan Podcast

Business spending slower

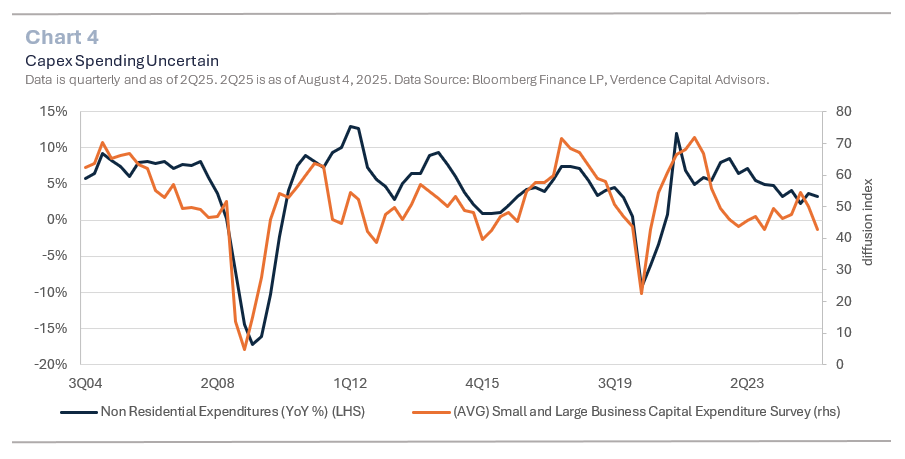

Capex spending has been tepid over the past year as the economic outlook has been weaker. In addition, the uncertainty around the impact of trade changes has caused business leaders to evaluate current and future capex spending plans. When using survey data from business leaders, sentiment suggests that both small and large business owner’s outlook for capex is weak. (Chart 4). This survey data has historically had a strong correlation to actual business spending.

While we are cautious about the economy in 2H25, on a long-term basis we are optimistic about growth prospects. In the near term the uncertainty around trade impacts, the labor market and inflation should negatively impact consumer spending and business investment. These two components make up over 80% of U.S. GDP. Over the long run, the evolution of artificial intelligence and its need for infrastructure and a favorable tax environment should support the economy.

Inflation and the Fed: How much can the Fed cut rates?

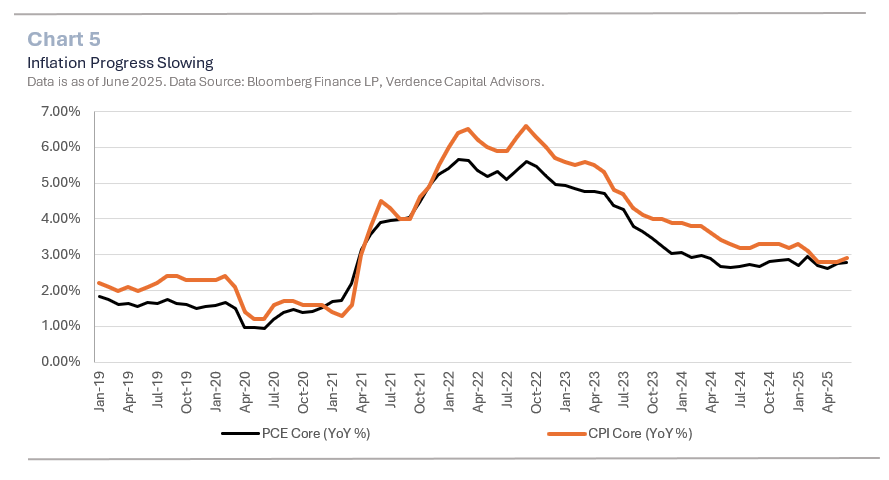

There has been great debate about the timing and magnitude of interest rate cuts in 2025. Inflation is not expected to reach the Fed’s target rate until 2027. And the progress on its downward trajectory is slowing. Therefore the Fed has maintained a “wait and see” approach to interest rate policy.

Inflation has improved substantially since its peak after the pandemic. But the growth in core inflation (on an annual basis) has been above 2.5% each month this year. In fact, for the past two consecutive months (May and April), the annual growth rate of PCE core has accelerated. (Chart 5).

This lack of progress may be reflecting the first wave of tariffs (10% baseline). But the frameworks approved ahead of the August 1st deadline and any reciprocal tariffs imposed after the deadline may not be reflected in data until 4Q25. In addition, the components of inflation that the Fed considered “sticky” are still well above levels the Fed would feel comfortable with easing policy.

As a result, we expect the Fed to err on the side of caution. We do expect the Fed to continue easing monetary policy but the magnitude of rate cuts that are currently priced into futures markets (4-5 rate cuts by the middle of 2026) may be too optimistic. We expect one rate hike in 2H25 (likely December) and the Fed to deliver another commitment to waiting to see how the tariffs impact inflation and the labor market.

Global Equities – Is Volatility Too Low Given Risks?

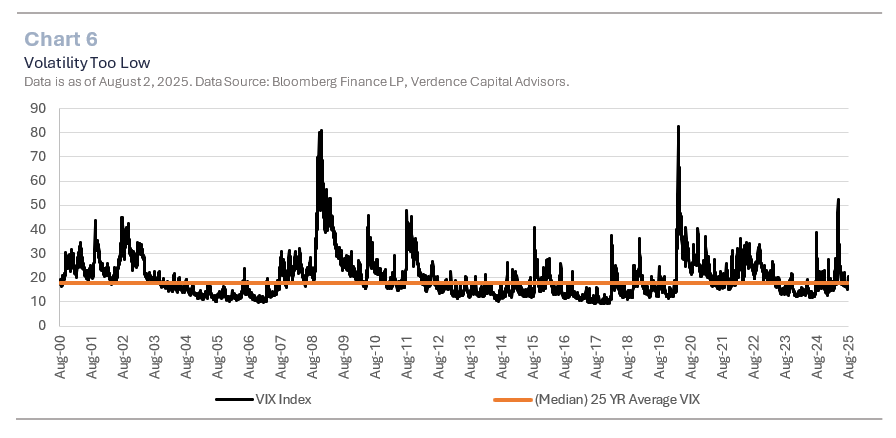

The MSCI AC World Index has made 21 record highs in 2025 despite experiencing the first 15% correction since 2022. At the same time, volatility as measured by the VIX Index spiked in the aftermath of “Liberation Day” but has since settled back to levels that are below the 25 year historical average. (Chart 6).

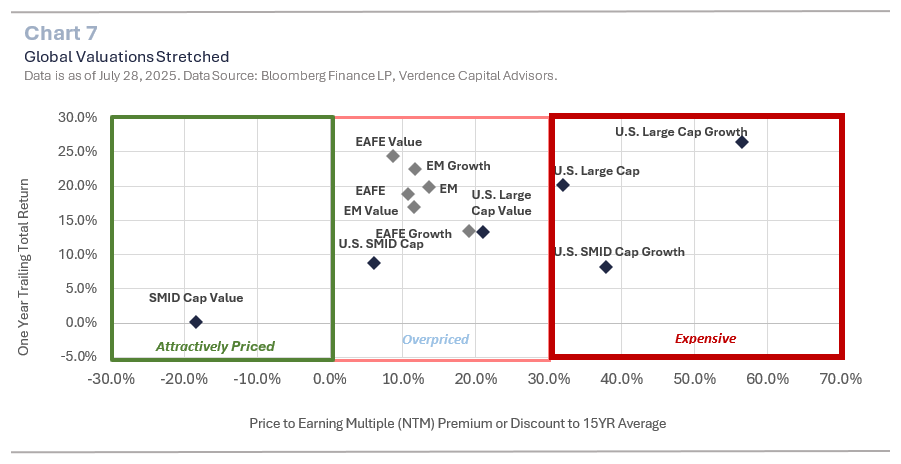

With many global indices sitting at or near record highs, it is important to remind investors about paying the appropriate price for the level of risk. Unfortunately, valuations (price to earnings multiples) for many global indices are trading at levels that we see as overpriced and are not rewarding investors for the risks we see looming in 2H25. As can be seen in (Chart 7), all the developed market indices we monitor are trading with multiples that are overpriced or expensive, with U.S. equities the most expensive. As a result, we would recommend the following for 2H25:

Rebalance where necessary

The impressive recovery of many global indices may have resulted in select investments increasing in value so much that the allocation may be above the recommended target. Given the rapid rally and being the middle of the calendar year, it is prudent to revisit your asset allocation to be sure that you are aligned with your long-term goals. In some instances, profit taking may be necessary, especially with our expectation that volatility is likely to accelerate into 2H25.

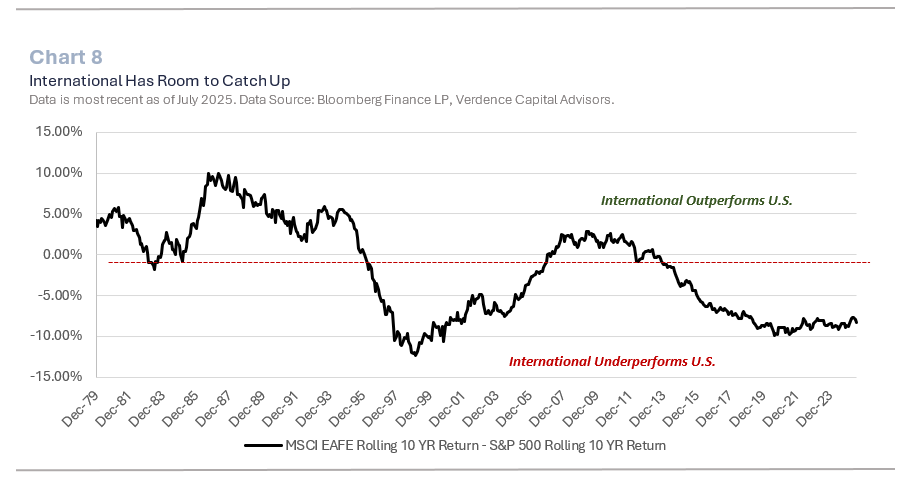

Make sure you are globally diversified

It is easy to fall into the fear of missing out mentality when watching select stocks (primarily the “Magnificent 7”) repeatedly hit fresh record highs. We caution investors to remain disciplined and not overpay for an investment. Instead, focus on the long term and be sure to be diversified from a sector, style and regional perspective. While developed international markets have outperformed in 2025, over the long term we believe there is still room to catch up to U.S. equities. (Chart 8).

Small and midcap a better opportunity than large cap

Small and midcap stocks can be economically sensitive and struggle in times of an economic downturn. Given our expectation for economic growth to be challenged in the near term, recommending these equities may seem counterintuitive. However, small and midcap stocks at current levels may be reflecting the downside risk to growth much more than their large cap counterparts. We believe valuations at current levels and the underperformance compared to large cap stocks (the Russell 2500 has underperformed the Russell 1000 by ~4.0% per year over the past five years) that small and midcap stocks are rewarding long term investors for the risk.

In 2H25 investors should get accustomed to higher levels of volatility. While the headline risks are fading as it relates to trade, we should begin to see the impact that tariffs and a slowing economy have on corporate earnings in 2H25. We have witnessed resilient earnings growth despite the uncertainty, but this will be more challenging as companies either absorb some of the tariff impact or pass it onto consumers. Either solution can challenge earnings and/or margins. However, we believe this will be short term pain as companies assess the new global trade regime. In fact. we believe some of the trade deals can ultimately benefit U.S. corporations over the long run. Therefore, we will continue to evaluate pullbacks as potential buying opportunities.

In 2H25 investors should get accustomed to higher levels of volatility.

Fixed Income – Long Term Challenges Remain

Fixed income has delivered investors the diversification benefit that is necessary. Bonds rallied during the equity downturn in 1Q25 and even delivered modest returns in 2Q25 when demand for risk assets was high. However, investors should be cautious about the long-term structural risks associated with a burgeoning trade deficit, slower demand and uncertain inflation outlook. We would generally recommend the following for fixed income investors.

Duration is important

Long term interest rates are much more sensitive to expectations for the deficit and inflation. We expect both factors to negatively impact long-term bonds. As a result, we believe that investors should focus on intermediate maturing bonds as a portfolio diversifier. Intermediate bonds can help mitigate interest rate risk and offer price return potential as we get closer to the next Fed rate cut.

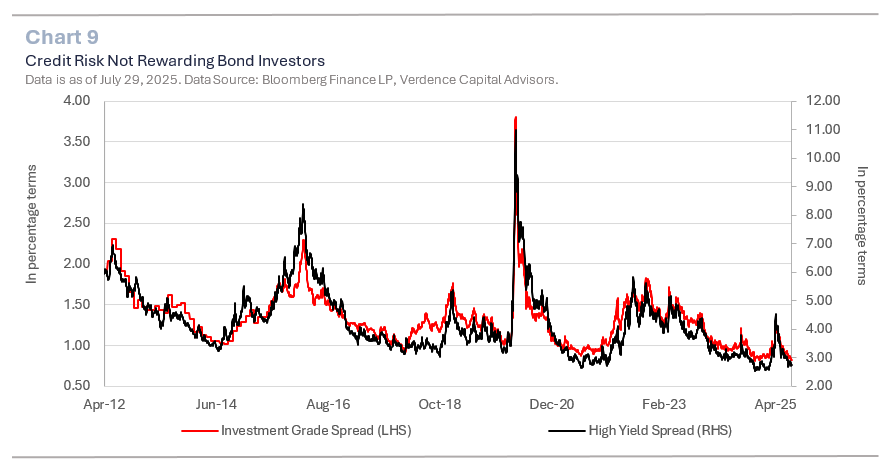

Be patient with credit

Corporate bonds (both high yield and investment grade) are not rewarding investors for the risk. The extra yield that investors demand from corporate bonds over the safety of a Treasury bond is hovering near historically low levels. (Chart 9). Instead of riskier bonds, investors should consider focusing on quality over yield.

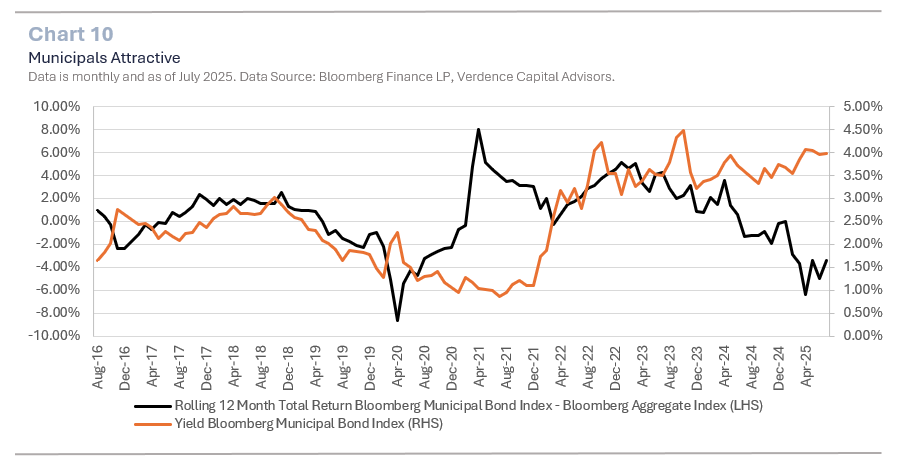

Municipal bonds attractive

An increase in supply ahead of tax changes without strong demand to match and volatility around Treasuries have negatively impacted Municipal bonds this year. In fact, on a rolling 12-month basis, Municipal bonds are underperforming the broad bond market index (i.e. Bloomberg Aggregate Index) by the most since the pandemic. In addition, the yield on Municipal bonds is hovering near the highest level since 2009. (Chart 10). This offers an attractive opportunity for those in more than just the top tax bracket.

Bonds should serve as a portfolio diversifier, but investors should be aware that selected fixed income sectors are overpriced (e.g., credit). Long term fixed income returns should be hampered by supply and inflation volatility. Instead, investors should be patient and look for opportunities in intermediate maturing bonds and municipals.

Alternatives – A Shelter from Expensive Public Market

For qualified investors, alternative investments can perform well in periods of stretched public market valuations and slowing economic growth. On the private side, managers have more flexibility and time to be able to find and make good long-term investments. For clients that invest in private investments, they are spared the daily volatility seen in public markets. They also historically have been offered an uncorrelated asset with robust risk adjusted return opportunities.

Not only are alternatives good for an added layer of asset class diversification. From a vintage year perspective, it is important to have some diversification. Historically, periods of economic weakness have offered private equity managers the opportunity to find attractive long-term investments. We like private credit but admit the space is getting crowded and due diligence is crucial.

We believe that one of the more attractive long-term areas of alternatives is in the real asset space. Real assets can not only perform well in periods of stubborn inflation but also in periods of infrastructure investment. The infrastructure investment that is occurring due to artificial intelligence (e.g. electricity), aging infrastructure being highlighted with natural disasters and the potential for price appreciation and income should benefit investments in the real asset space. But diversification and active management is important in a period of slowing economic growth.

Alternative investments can perform well in periods of stretched public market valuations and slowing economic growth.

The Bottom Line

A fading of political uncertainty and economic growth that is good but not great has led investors to price in the perfect environment for interest rate policy, inflation and the recovery in growth. This has led to valuations across many asset classes looking expensive on an absolute basis and relative to historical levels. In times of euphoria when many investments are making fresh record highs, it is easy to let emotions override long term investment discipline.

We remind investors that long-term investment success is not dictated by politics or momentum. Instead, valuations and the outlook for the economy and earnings are more important. We continue to favor equities over bonds for the long term. But caution investors that equities may be overly optimistic about the near-term outlook for the economy, inflation, earnings and the Federal Reserve.

As a result, we expect volatility to accelerate as equities at current levels are susceptible to shocks. This may challenge excessive optimism. We will evaluate periods of market weakness as a potential buying opportunity. But will only look at areas of the market that are rewarding investors for the risks associated with investing.

As always, if you have any questions about our perspective, please do not hesitate to reach out to your advisor.

Author: Megan Horneman | Chief Investment Officer Past performance is not indicative of future returns