In this report, we will cover an economic review of 3Q24 and outlook for 4Q24.

Investors welcomed the Fed’s official pivot on interest rate policy in 3Q24 when they cut interest rates for the first time since 2020. Global equity markets rallied in the face of macroeconomic uncertainty and the spike in volatility. Volatility, as measured by the VIX Index, saw its biggest quarterly increase since 2Q22.

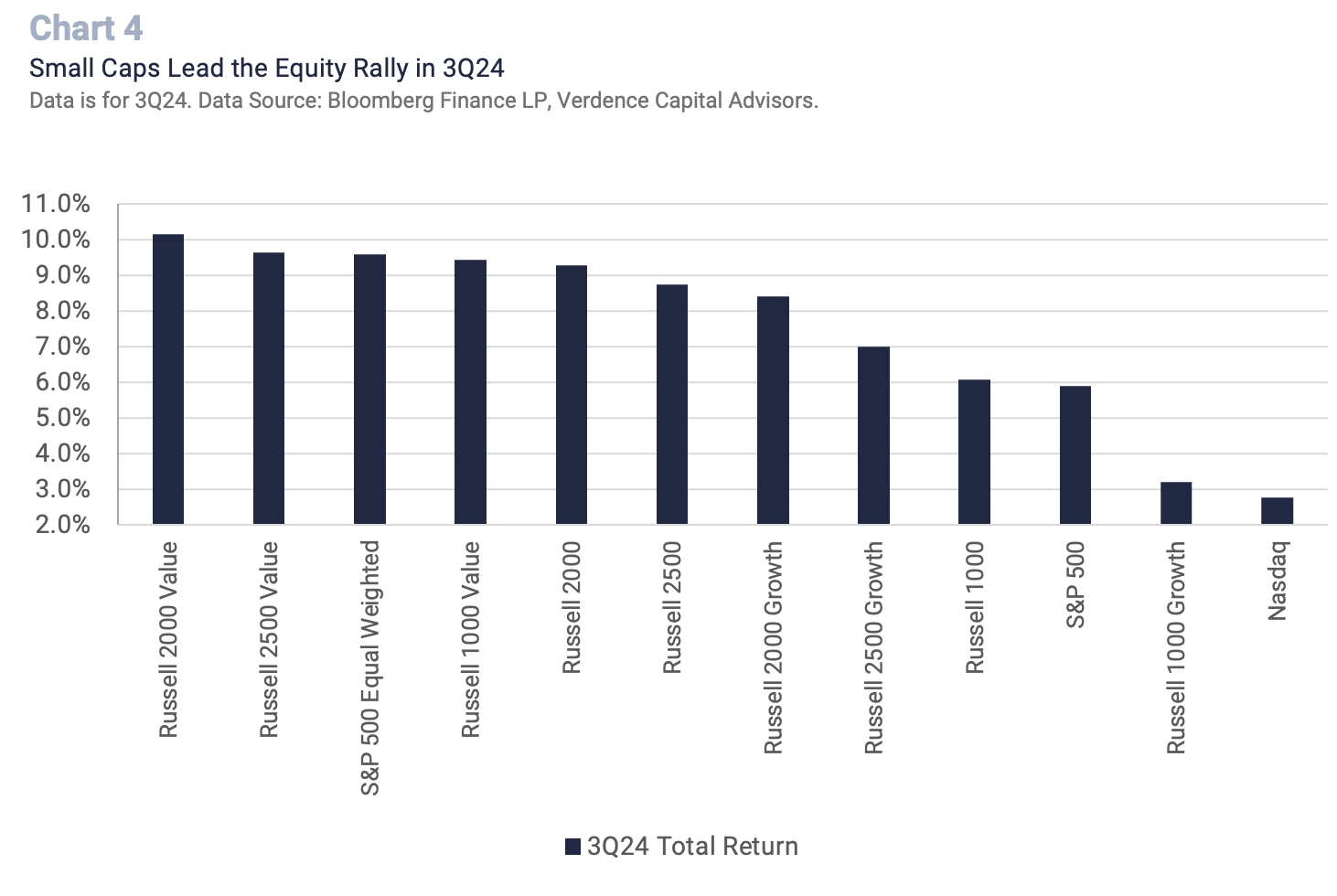

That did not stop the rally in equities as the MSCI AC World Index rose for the fourth straight quarter. The returns broadened out beyond the U.S. large cap growth and technology sectors. In fact, the S&P 500 Equal Weighted Index made a record high and outperformed the S&P 500 Market Cap Weighted Index by the most in seven quarters. Gains even went internationally with the MSCI EAFE making a record high.

Bond yields plummeted (prices rose) on U.S. growth fears and expectations for a string of Fed fund rate cuts. In addition, the yield curve (10YR U.S. Treasury yield – 2YR U.S. Treasury yield) turned positive for the first time since 2022.

As we move into the final months of 2024, investors should expect volatility to remain heightened. The economy has been surprisingly resilient, supported by consumer and government spending but headwinds are building.

Progress on inflation is beginning to show signs of stalling. The labor market is under stress and consumer confidence is being challenged by persistent inflation and weaker job prospects. In addition, a deeply contentious U.S. Presidential election is underway. Geopolitical environment is highly unstable.

We are concerned that investors may be complacent on the growing risks. They may be too optimistic on rate cuts and equity valuations may be pricing in perfection.

Is a Slowdown Coming in the U.S. Economy?

The surprising resiliency of the U.S. economy is highly bifurcated. Manufacturing, housing and leading indicators have pointed to a recessionary environment for at least a year. However, consumers and the government continue to support economic growth.

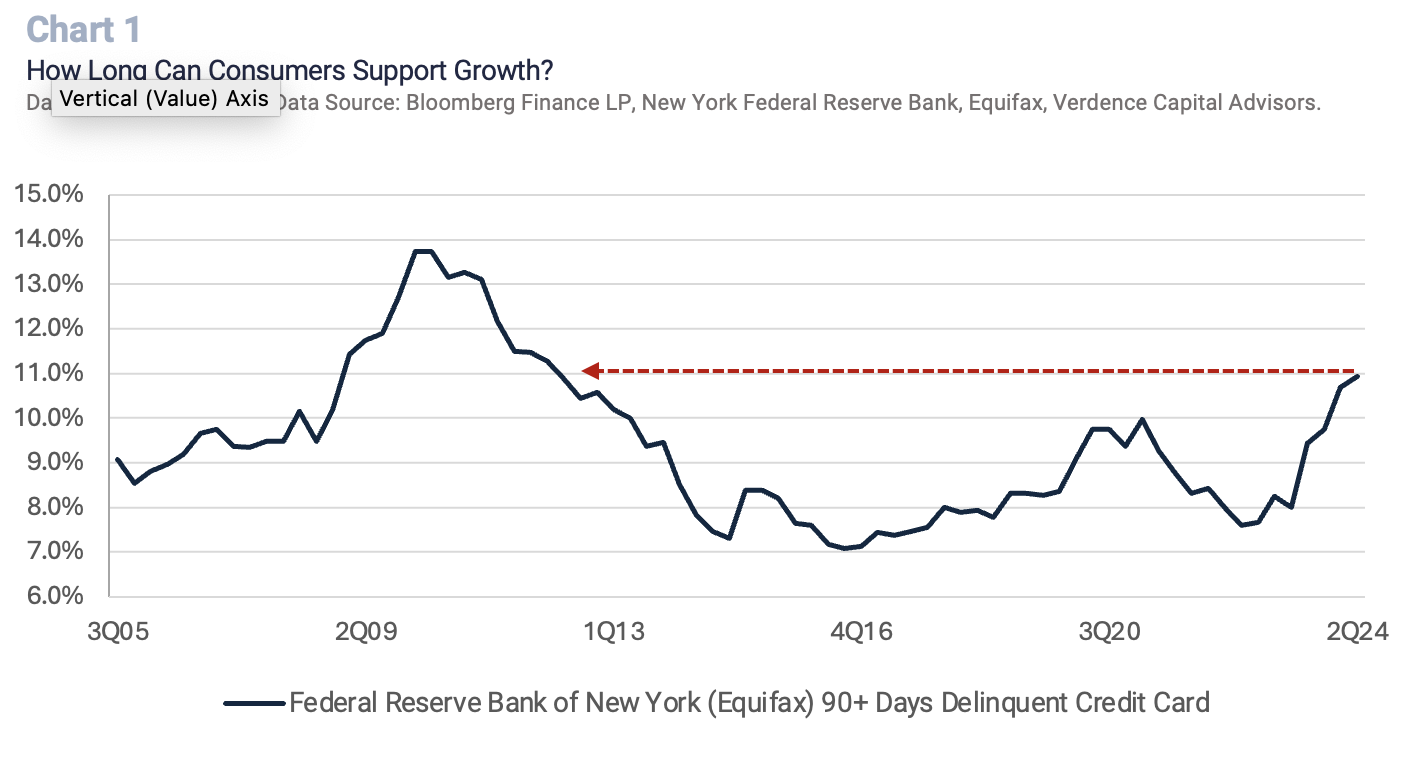

Now that the labor market is starting to show signs of weakening, we are concerned that the level of consumer spending is unsustainable. Especially, with credit card debt at a record high and consumer confidence mixed.

According to the Federal Reserve Bank of New York, the average household credit card debt is over $8,600 and is $1,000 more than levels seen prior to the pandemic.1 Unfortunately, in a recent survey of consumer expectations, the amount of Americans that expect to be delinquent on a debt payment over the next three months has risen to the highest level since April 2020.2

Why is this a concern?

This is a concern considering credit card delinquency rates are already at levels not seen since the Great Recession (Chart 1). In addition, while wages are growing, they have not kept pace with the rise in the costs of services (excluding energy) for the past 26 consecutive months. Service-related expenditures is where Americans spend most of their money.

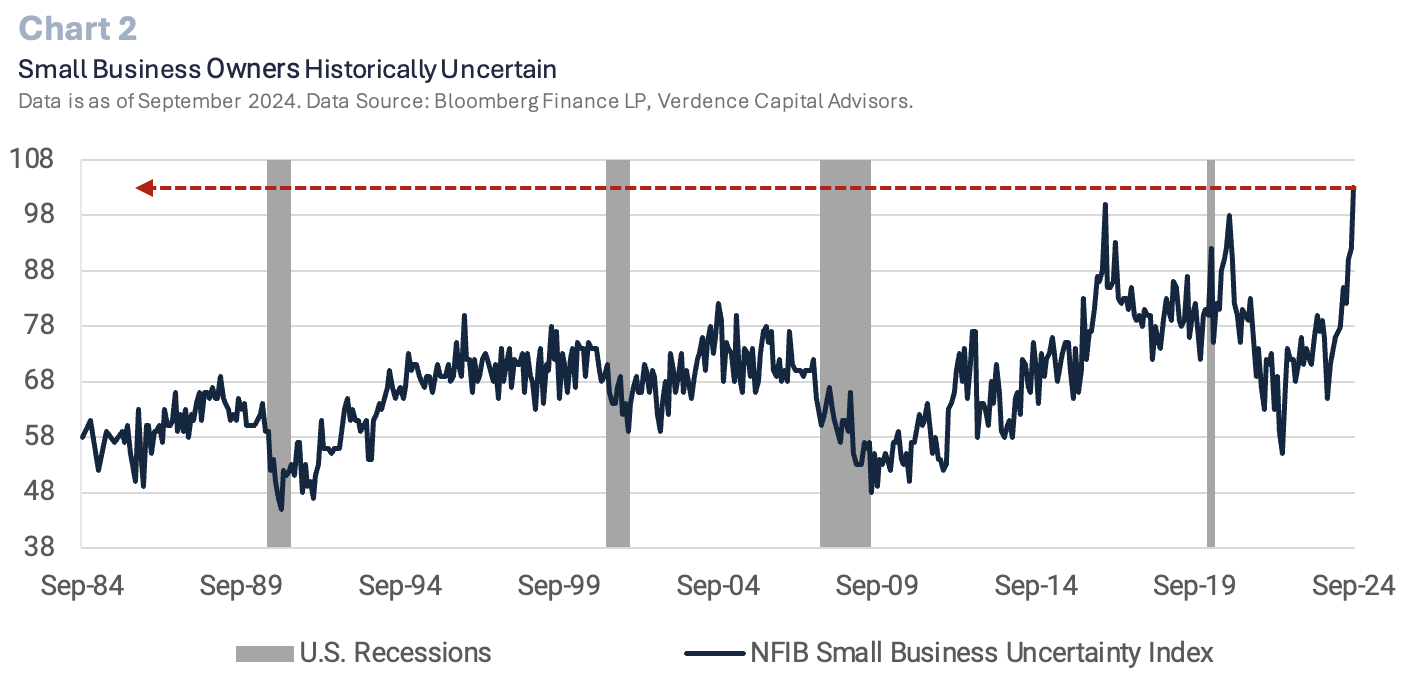

Business owners share this uncertainty. According to the NFIB Small Business Index, uncertainty amongst small business owners is at a record high (Chart 2). Inflation, quality of labor and taxes are some of the biggest concerns for small business owners.3 Even large company CEO’s have shown declining confidence about the next 12-month period with their biggest concerns around cybersecurity, geopolitical instability, and regulations.4

When you combine the challenging consumer fundamentals with business uncertainty and a weaker backdrop for the labor market, these will likely challenge economic growth as we move into 2025. We have already seen the rolling 12-month average of job creation move to the lowest level since March 2021. The unemployment rate has moved higher. Continuing claims are near the highest level since 2021.

All these factors lead us to be cautious about the prospect for economic growth over the next year. While it is rare for an economy to enter a recession in an election year, history tells us it is more probable in the first year of a Presidential term. In fact, 60% of the U.S. recessions have started in the first year of a Presidential term.

Does the upcoming election affect fundamentals?

Regardless of who takes office, the burgeoning fiscal situation will make major spending initiatives or tax cuts difficult to get passed, especially with a mixed make up of Congress. This is another challenge for growth in the coming year.

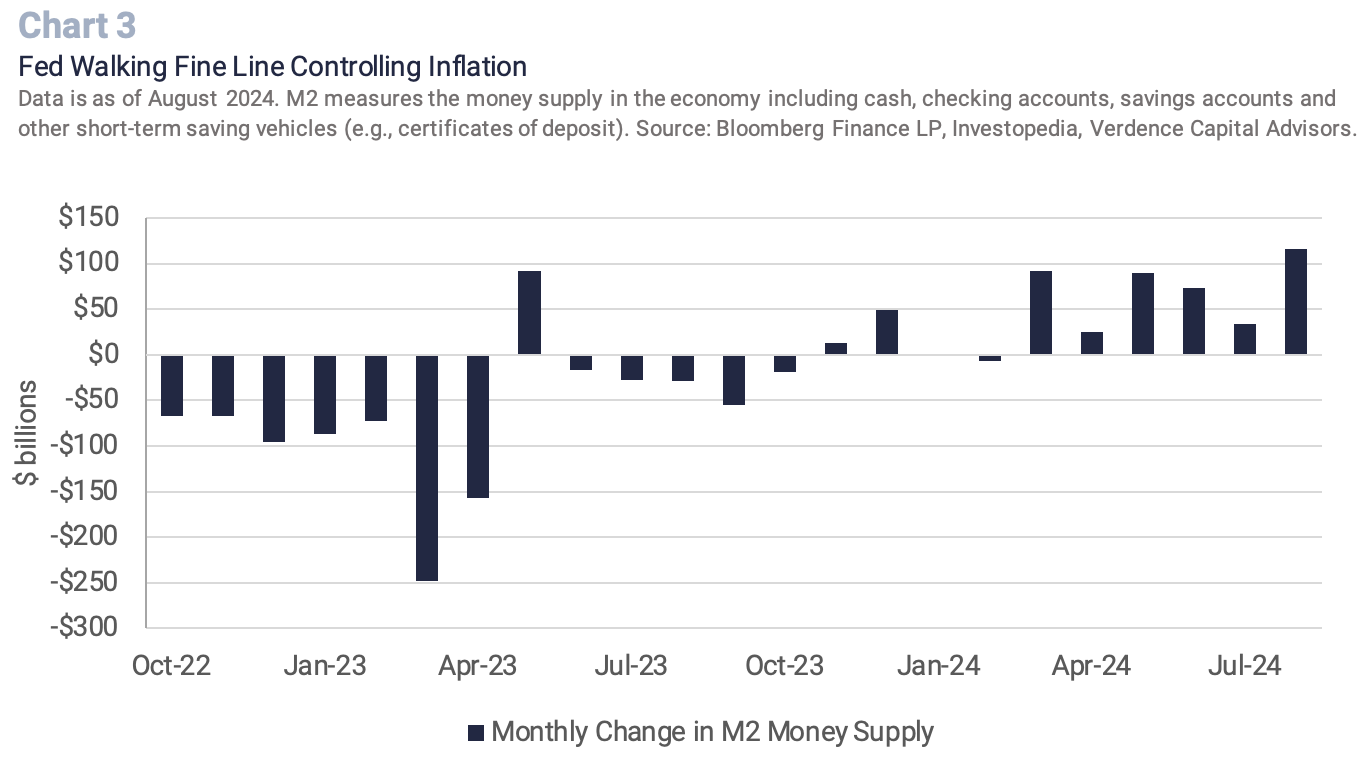

These downside risks will likely keep the Fed on its path of gradually cutting interest rates. However, the Fed is walking a fine line as to not reignite inflation. Especially since “sticky inflation” (e.g., services, housing) remains problematic and the money supply continues to accelerate.

The money supply as measured by the Fed’s M2 measure has increased for the past six consecutive months (Chart 3 ). At more than 70% of nominal GDP, the money supply is much higher compared to GDP than it was before the pandemic (historical average from 1959-2019 is 56%).

We realize that economic growth has defied most expectations in 2024. While we remain optimistic about growth in the long run, we expect growth to slow in 2025. The Fed has room to cut rates to support the economy in a downturn, but they may not have the flexibility they have had in prior decades.

Inflation remains a headwind for consumers. With burgeoning fiscal deficits and money supply, the Fed may be limited on how much support they can offer.

Inflation remains a headwind for consumers with burgeoning fiscal deficits and money supply.

Global Equities – Be Patient as we Believe the Reward is Not Worth the Risk…Yet!

The MSCI AC World Index posted its fourth consecutive quarter of gains in 3Q24. However, this time it was not led by the U.S. large cap space like we have seen with the rise of the “Magnificent Seven” in prior quarters.5 Instead, the MSCI AC World Index excluding the U.S. outperformed the U.S. tech heavy S&P 500 for the first time in seven quarters. In addition, within the U.S., value outperformed growth at every market cap level. Even small cap stocks started to participate in the rally. (Chart 4).

We favor equities over bonds for the long run, but we prefer to increase equity exposure when we believe valuations are pricing in the downside risks and investors are being rewarded for that risk. Unfortunately, especially in the U.S., equity valuations are not pricing in the downside risk that is growing for the economy and earnings. Instead, valuations are pricing in a perfect soft landing for the economy, they are not considering that inflation is rarely a smooth ride lower. Valuations are predicting the Fed will be able to aggressively cut interest rates over the next year.

Soft landing?

In fact, if there is this perfect (albeit rare) soft landing for economic growth why will the Fed need to aggressively cut interest rates? Instead, we believe equity investors need to reprice the expectation that rates may not come down as dramatically as they expect. Valuations need to reflect an environment where short term and long-term rates are higher than we have been accustomed to in recent decades.

This is a risk to the elevated multiples that investors are paying, specifically in the U.S. large cap growth and tech space. (Chart 5). In addition, we have entered the third year of this bull market that started in October 2022. History tells us that the third year of a bull market is when the returns are the most muted as the outsized gains in the start of the bull market are difficult to replicate.

On earnings

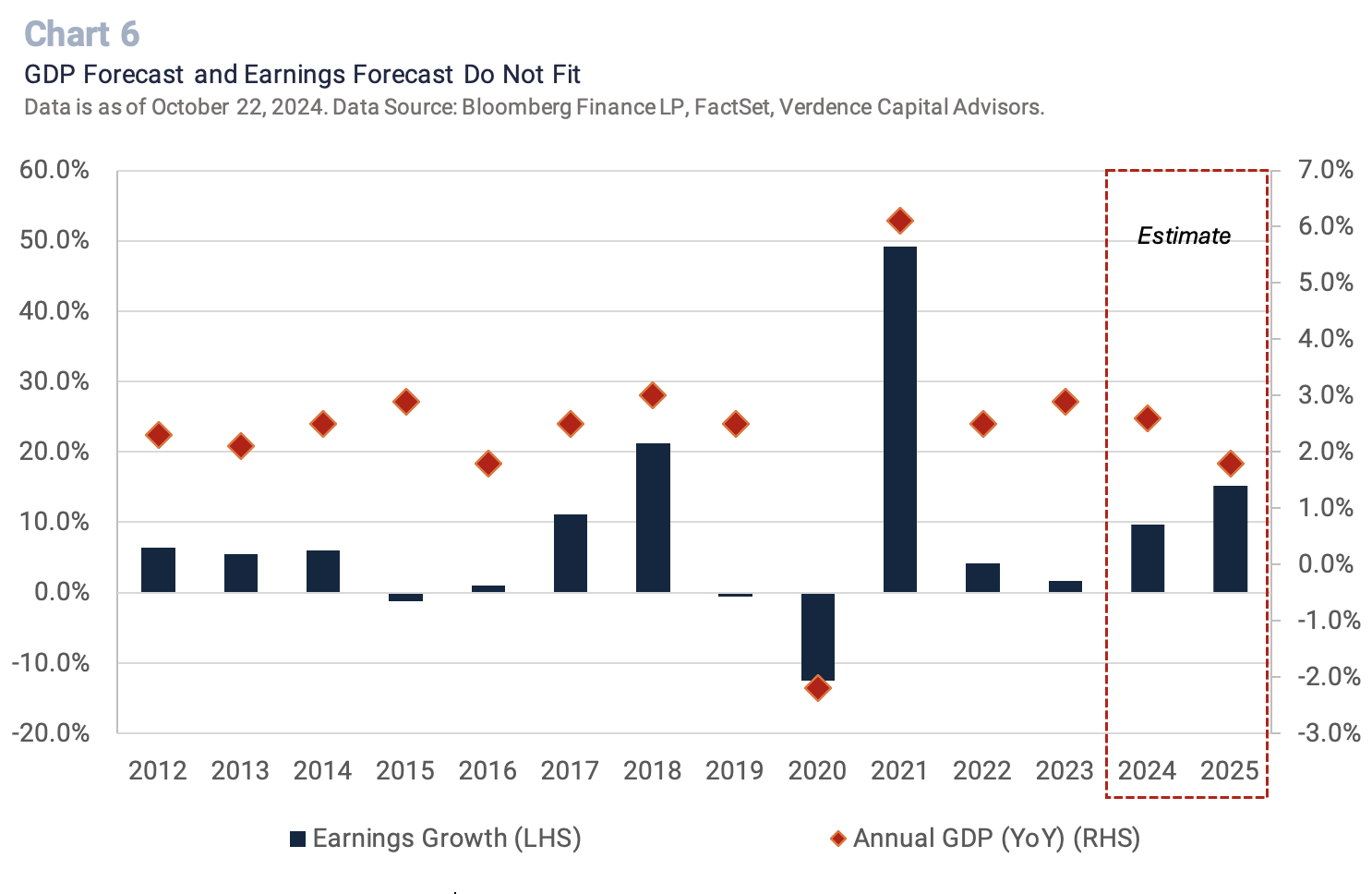

From an earnings perspective, estimates for 2025 have barely moved to reflect the slowing economic backdrop. Instead, the earnings growth of 15% for 2025 is highly unlikely given the expectation for a slowing economy. In fact, according to Bloomberg Finance, the economy is expected to grow a paltry 1.8% in 2025.

The last time we had economic growth of 1.8%, S&P 500 earnings only grew 1.0% (2016). (Chart 6). Companies do not have the same pricing power they once had and in an economic downturn pricing power becomes limited. This is a risk to margins which have been resilient in this inflationary environment.

Investors have also grown optimistic with the recent rotation from the expensive large cap growth stocks into small and midcap stocks. However, we are concerned that this may be based on a fear of missing out as opposed to improving economic and earnings fundamentals.

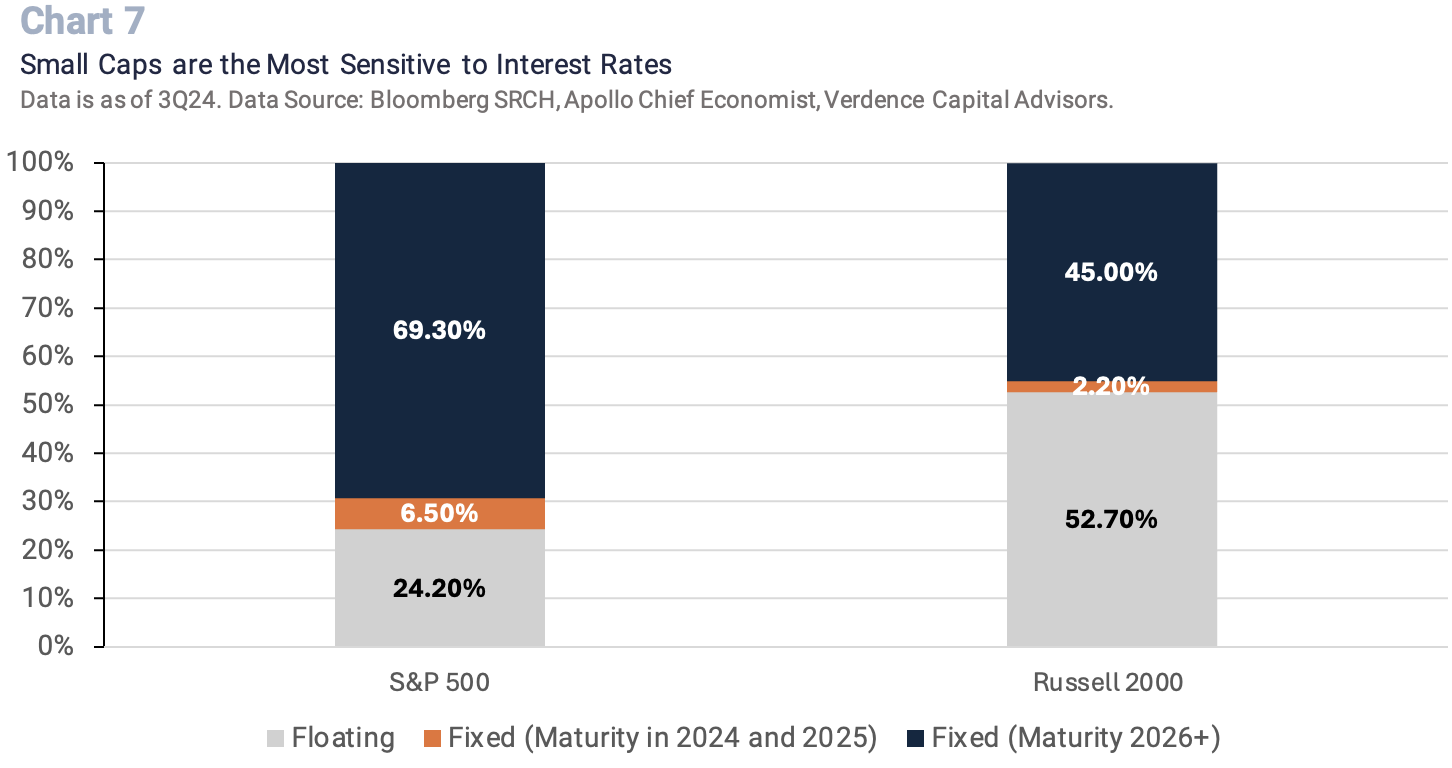

Earnings estimates for small caps have barely been adjusted for the weaker economic growth expectation, and valuations, while not as stretched as large cap stocks, remain heightened. In addition, small cap stocks are the most sensitive to interest rates. Roughly 55% of the Russell 2000 has either floating rate debt that needs to adjust in a higher interest rate environment or debt coming due in 2024 and 2025. (Chart 7 ).

History does suggest that the small and midcap space sees the best rebound coming out of an economic slowdown; However, we think we will find a better opportunity to consider this portion of the U.S. equity market.

International

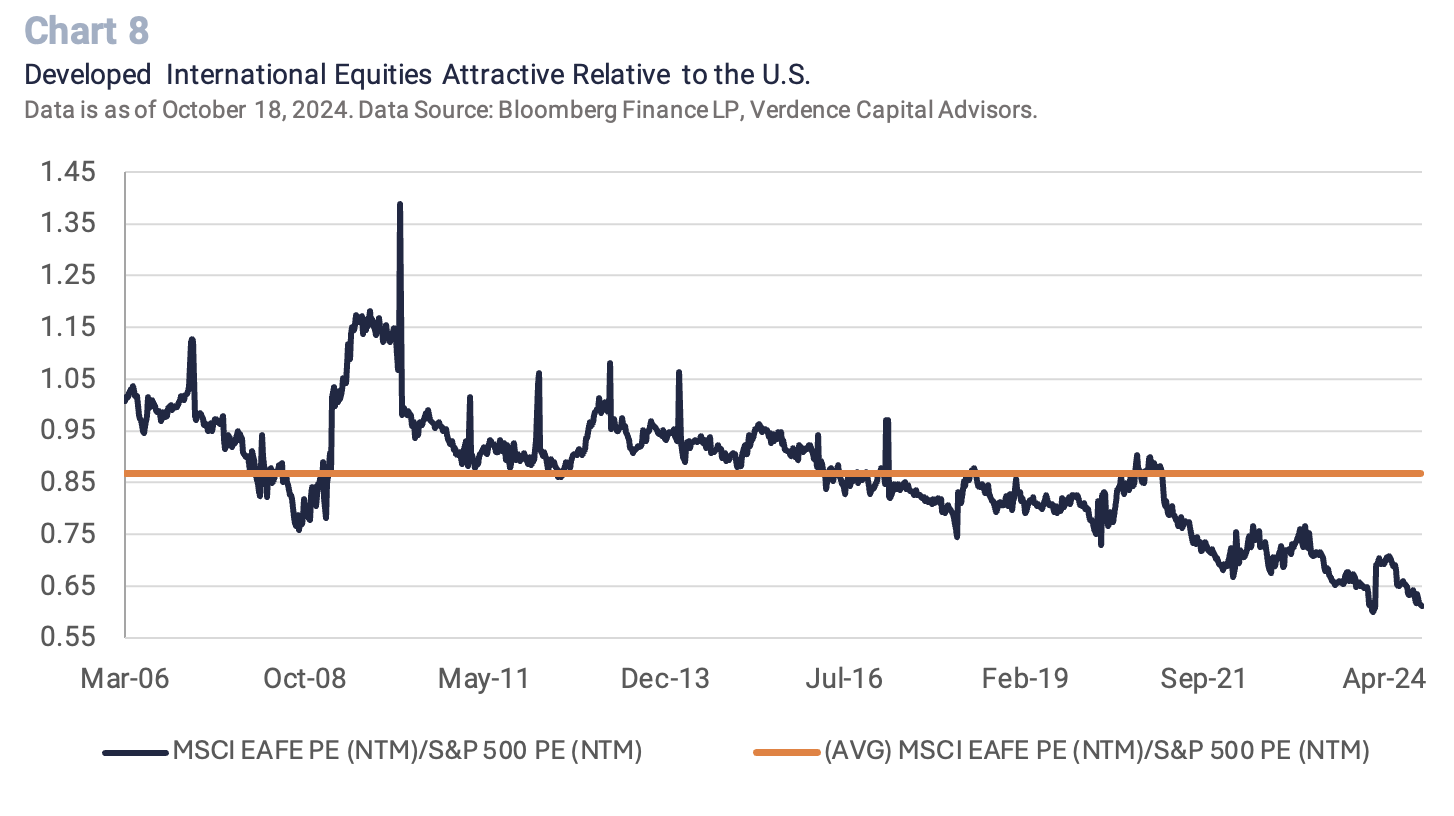

The one area of the global equity market that we find attractive is the developed international markets. This is not because their economies or earnings expectations are so much better than the U.S. It is because valuations are more realistic than in the U.S. equity market and may be reflecting the downside risks. (Chart 8).

While we are cautious in the near term, we are anxiously awaiting better entry points to add to our equity exposure. Equities are far superior to bonds over the long run. Our team expects volatility to remain heightened. We believe that volatility will present us with opportunities where the risks are reflected in prices.

Within the U.S., we still believe value is more attractively priced than growth at all market cap levels. We must acknowledge that value has seen such an impressive turnaround that valuations are looking stretched at most market cap levels. At this point we are being patient and believe having flexibility with cash in these highly uncertain and volatile times. Having cash should prove beneficial for good entry points to achieve long-term returns.

we are being patient and believe having flexibility with cash in these highly uncertain and volatile times should prove beneficial

Fixed Income – Be Defensive as Supply a Concern

Fixed income rallied in 3Q24 as the Fed’s first interest rate cut since 2020 pushed yields lower and resulted in the yield curve (10YR Treasury yield – 2YR Treasury yield) turning positive. While all major sectors within fixed income rallied in 3Q, the decline in yields led to an outperformance of long term over short term bonds.

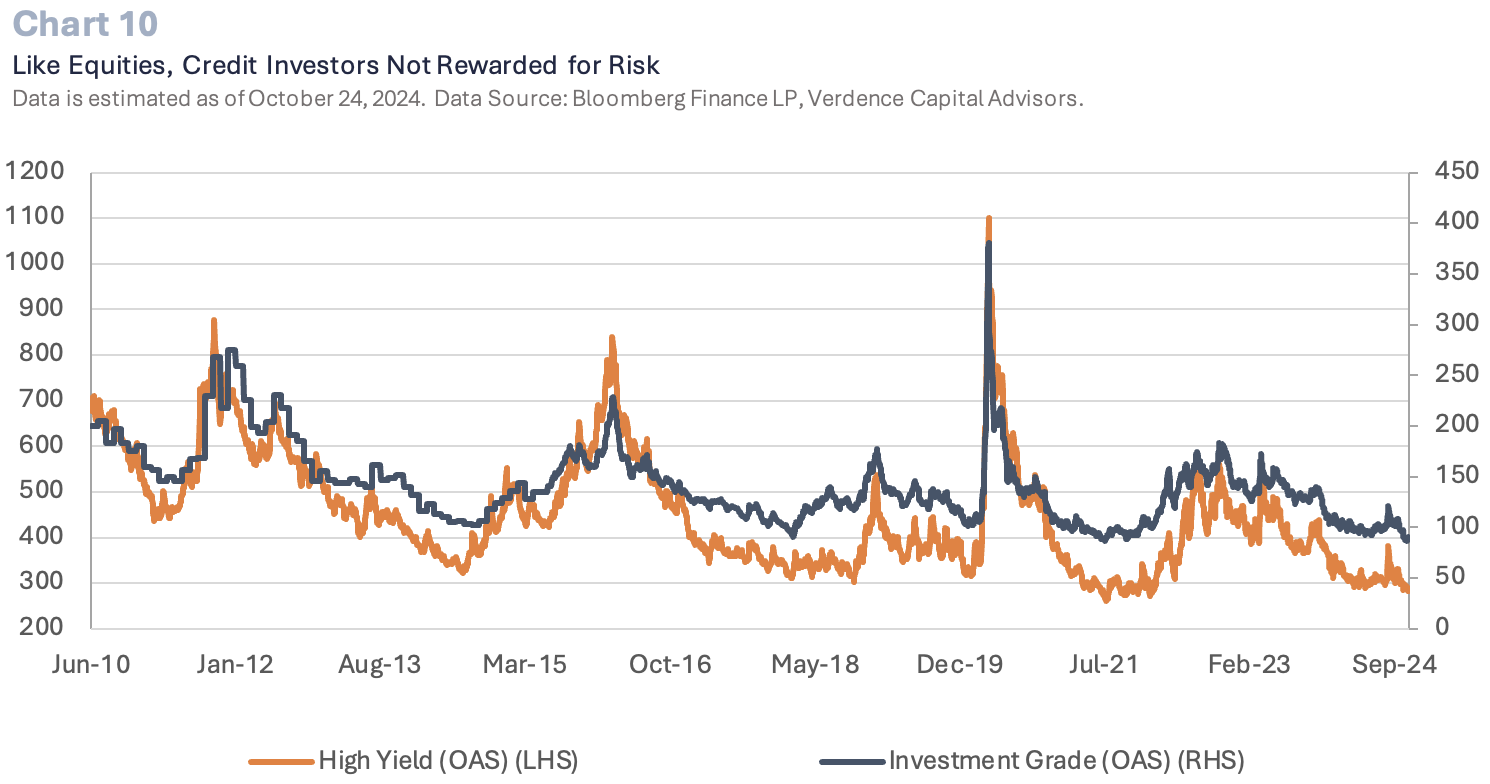

In addition, credit continued to rally and spreads (the difference in yield between corporate bonds and similar Treasury bonds) continued to grind lower along with the rally in equities

Fixed income should always be part of a well-diversified asset allocation and typically does well when we encounter an economic slowdown or recession. However, this environment for bonds is unique in nature and we would approach fixed income in a defensive manner from a maturity and credit perspective.

What about maturity?

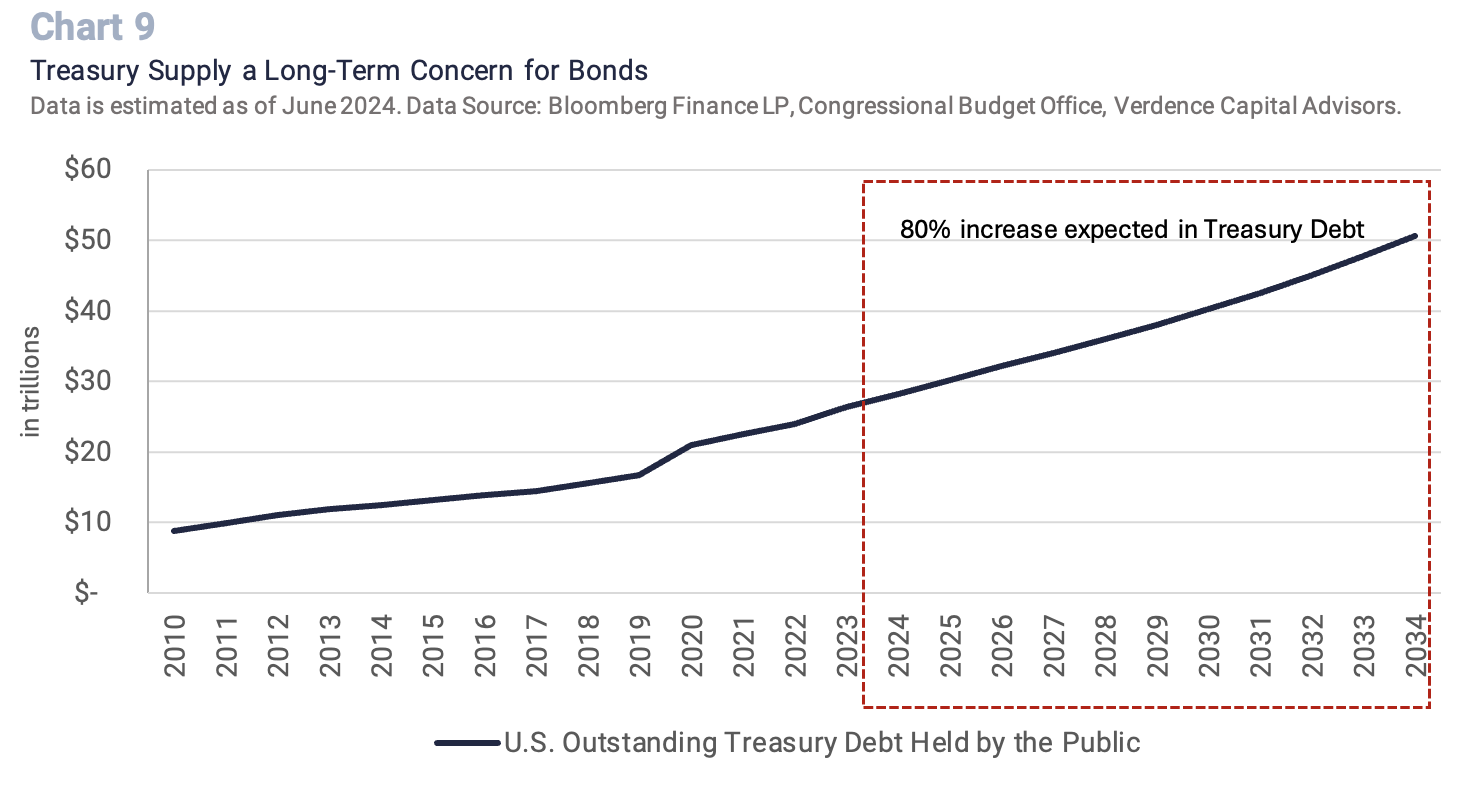

From a maturity perspective, we would still stick relatively close to the Bloomberg Aggregate benchmark (intermediate maturities). This is due to the deteriorating situation with the budget deficit that may push long term yields higher over the long run.

The Congressional Budget Office released 10-year budget projections in June and showed the amount of Treasury debt is expected to rise by ~80% over the next 10 years. (Chart 9).

This is coming at a time when the U.S. is not the only bond market in which investors can participate. In fact, while most central banks have been cutting rates, interest rates for many of our trading partners are now offering attractive yields with little currency risk.

In addition, corporate bonds, both investment grade and high yield, are not offering investors reward for the added risk. (Chart 10).

Risk

The increase in risk appetite in 2024 has spread into bond markets and the extra yield investors earn on corporate bonds (spread) continues to grind lower. We believe there will be a better opportunity to add to this sector of fixed income when the risk reward ratio looks more appealing.

Despite our view that the economy is expected to slow, which should lead to attractive returns in long term bonds, we remain cautious given the deteriorating fiscal health of the U.S. government. In addition, inflation remains a risk for bonds. Therefore, yields on long-term bonds will likely remain volatile and the interest rate risk high.

Where do we focus?

We would focus on intermediate term bonds for the long run. We are also patiently awaiting the chance to add to credit (high yield and/or investment grade) but the extra yield investors earn over Treasuries is still too small to justify the risk. Our team will watch them closely for opportunities as the economy weakens.

the extra yield investors earn (adding credit) over Treasuries is still too small to justify the risk.

Alternatives and Commodities – Diversification and Risk

For qualified investors, we continue to favor a well-diversified allocation to alternative investments. Alternatives have historically performed well in periods of economic uncertainty and volatility in the public markets. On the private side, managers have more flexibility and time to find and make good long-term investments.

Clients qualified to invest in private investments they are spared the daily volatility seen in public markets. Historically they have been offered an uncorrelated asset with robust risk adjusted return opportunities.

Not only are alternatives good for an added layer of asset class diversification but from a vintage year perspective, it is important to have some diversification. In the past, periods of economic weakness have offered private equity managers the opportunity to find attractive long-term investments. We like private credit but admit the space is getting crowded and due diligence is crucial.

Real Assets

Real assets present additional opportunities given the growing fiscal deficit and ongoing inflation risks. We like low volatility hedge funds as a hedge for investors’ public market exposure.

Commodities

From a commodity perspective, geopolitical tensions, global debt concerns and uncertainty surrounding the U.S. Presidential election have supported select commodities, especially gold.

We are watching commodities (e.g., oil) as a potential long-term opportunity. However, commodities typically do not see the worst of their weakness until we are in an economic downturn.

Alternatives are a broad asset class with the capability to invest in different vintage years and strategies for diversification. For example, private equity, real assets, and hedge funds.

For qualified investors, we continue to favor well-diversified exposure to the alternative space. This is seeking the opportunity for attractive long-term risk adjusted returns that have little to no correlation to public market asset classes.

Alternatives have historically performed well in periods of economic uncertainty and volatility in the public markets.

The Bottom Line

The U.S. economy has defied most expectations by avoiding a recession this year. However, we remain skeptical that the level of growth is sustainable over the next 12 months as the consumer is spending on fumes and the labor market is starting to weaken.

Despite our less than optimistic outlook for economic growth, we will look at periods of weakness in the global equity markets as opportunities as we still favor equities for the long run. At this time, we will be patient, we will look at the downside and upside risks and monitor if valuations reflect these risks in both equity and bond markets before we consider them as an opportunity.

We acknowledge that cash is no longer providing the returns it did a few months ago, but cash still offers a decent return and having dry powder in this highly uncertain environment is important. We will continue looking for opportunities that are better than cash given the expectation cash rates will continue to move lower. However, we will only deploy cash when we believe the valuation for an asset is attractive.

If you have any questions or comments, please reach out to your financial advisor.

Author: Megan Horneman | Chief Investment Officer Past performance is not indicative of future returns

1:https://www.newsnationnow.com/business/your-money/average-amount-credit-card-debt/

2:https://www.newyorkfed.org/microeconomics/sce#/

3:https://www.statista.com/statistics/220371/single-most-important-problem-for-small-businesses-in-the-us/

4:https://www.conference-board.org/topics/CEO-Confidence

5: The “Magnificent Seven” is referred to as Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla.