BOOK A CONSULTATION

Are you ready to take control of your financial future? We offer two convenient options to get started:

- Phone Consultation: Call us at 888-698-6698 for a complimentary, no-obligation discussion. We’ll take the time to understand your current financial situation and future aspirations.

- Online Booking: If you prefer to schedule a consultation at your convenience, simply click the Schedule a Discovery Call button below to select a date and time that works best for you, and we’ll be in touch.

FAQ

What can I expect during my discovery call?

A member of our AdvisorConnect Team will take the time to understand your current financial situation, goals, and unique needs. We’ll ask targeted questions to gain a clear picture of how we can best serve you. While we won’t provide specific financial advice during this initial call, it’s an opportunity for us to determine how our services can support your financial objectives.

How do I choose a financial advisor or wealth management firm?

Selecting the right financial advisor is a personal decision. Take the time to research, ask questions, and compare options to find the firm that best aligns with your needs and values. When choosing a financial advisor or wealth management firm, focus on five key criteria:

- Ensure they act as fiduciaries, morally and legally bound to the fiduciary duty of prioritizing your best interests first.

- Consider their experience, and investment approach, ensuring they align with your goals and risk tolerance.

- Evaluate their transparency regarding fees and the range of services they offer.

- Assess their commitment to regular communication, accessibility, and personalized attention.

- Choose an advisor with whom you feel comfortable building a long-term relationship based on trust and compatibility.

What is the difference between wealth management and financial planning?

Financial planning is usually one component of wealth management services that focuses on creating a clear path to reach long term financial goals. Wealth management focuses on a holistic approach to your finances providing guidance around investing, estate planning, tax strategies, and wealth preservation.

What is the difference between wealth management and multi-family office services?

In a word, complexity. Typically, multi-family office services are best aligned with ultra-high net worth individuals and families. The key difference is the scale and complexity that significant wealth can bring. (Read our white paper “Beyond Lifestyle Management: Achieving Excellence in the Multi-Family Office”). In addition to wealth management services, multi-family office addresses additional complex planning, such as public and private investments, cash management, trust, estate planning, oversight of “real” assets—such as real estate, fine art, jewelry—, family governance, and lifestyle services that may include activities like bill pay and concierge services.

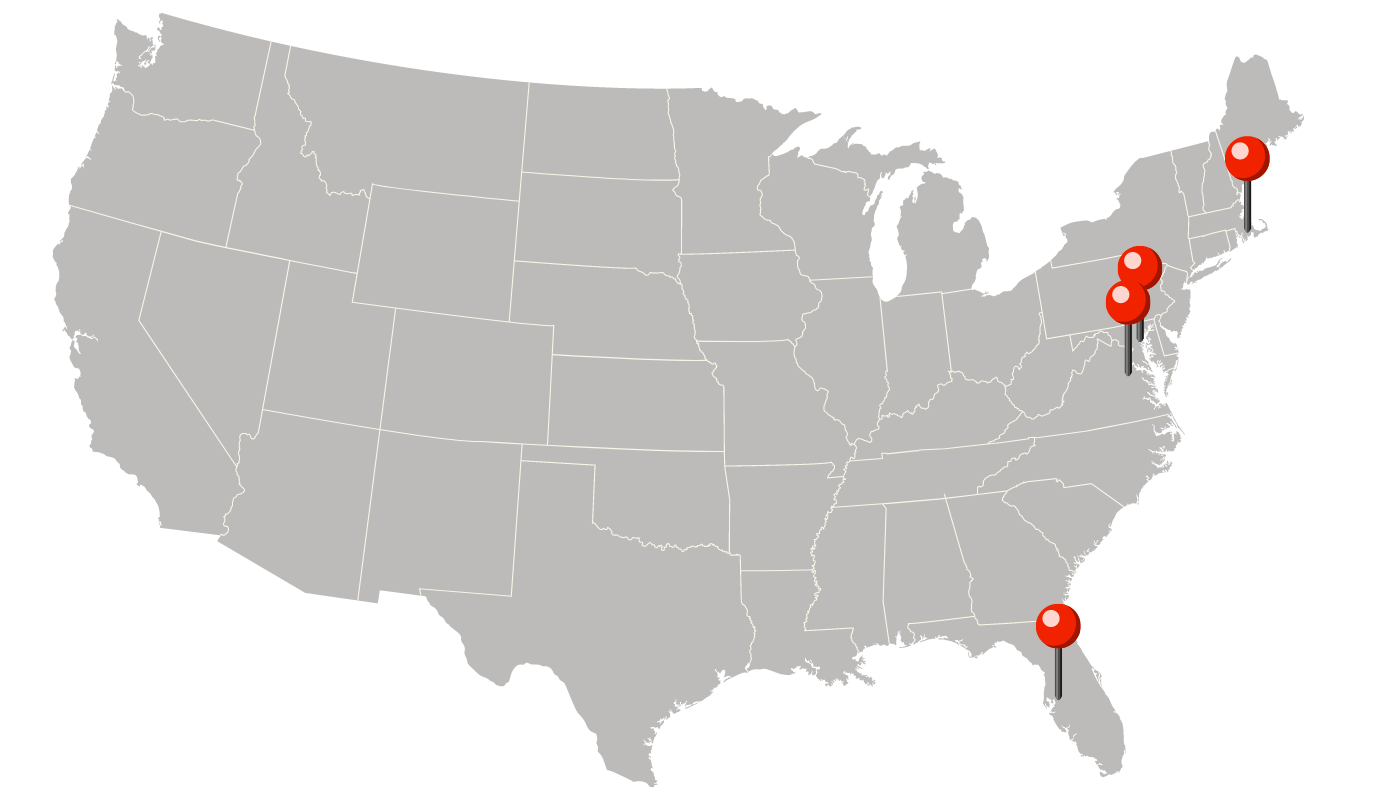

LOCATIONS

Hunt Valley, MD | Alexandria, VA | Naples, FL | Boston, MA