Is the Sell-off in Long-Term Yields Overdone?

The recent sell-off in long-term Treasury yields (10YR Treasury ~40 bps in the past six weeks) has spooked global equity markets. It is important to highlight some of the factors that have been pushing rates higher.

- Pension fund changes. The tax reform and jobs act gave corporations until Sept. 15, 2018 to make contributions and get the deduction using the old tax rate (35% vs. 21%). Now that the deadline has passed, there is speculation the reduced demand from pension funds is contributing to the rise in Treasury yields.

- Closing dislocations. The 10YR Treasury yield historically trades relatively close to the year over year change in nominal GDP. With nominal GDP growing 5.4% on a year over year basis (in 2Q18), long-term yields below 3% were not sustainable and a repricing in rates was warranted.

- Full employment not being reflected. Recent labor market indicators suggest we have reached or are close to full employment. If you look back over the past 40 years, when the unemployment rate reaches a cyclical low, the average real 10YR Treasury yield has been 3.00-3.50%. With the unemployment rate at or near its cyclical low, the real 10YR Treasury yield at 1.00% (as of September 28, 2018) was not reflecting the current economic environment.

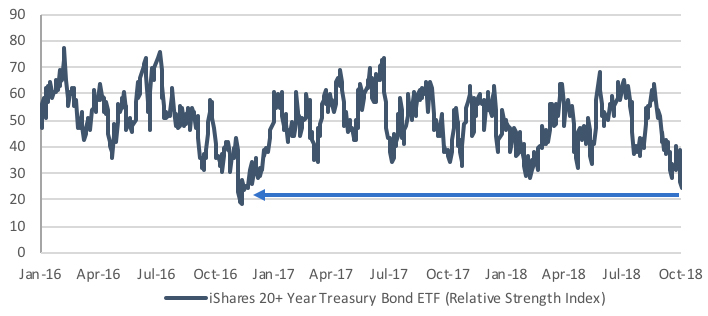

How High Can We Go? When yields move as rapidly as they have, it is difficult to pinpoint a near-term top. Technicals show the 10YR yield has crossed above both short- and long-term trend lines (tend to be a bearish signal). However, from a contrarian perspective, the RSI of the TLT (iShares 20+YR Treasury Bond ETF) fell to 24 on Friday, the lowest level since Nov. 2016. Lastly, relative to bonds, the difference between the earnings yield of the Russell 1000 and the 10 YR yield has narrowed to levels not seen since the end of the Great Recession. These indicators suggest the bulk of the near-term increase in yields may be behind us.

Positioning: Stay Defensive. While technicals may suggest the bulk of the rise may be behind us, we are not bullish on bonds for the long run. Bond yields are still lower than where the economic fundamentals suggest they should be. Therefore, we continue to recommend a short duration positioning, specifically through floating rate bonds.

Sell-off in Long-Term Yields: Is the Sell-off Overdone?