Oil Assets on a Slippery Slope (audio available)

Opinion: By Charles S. Holt

On April 20th oil prices plunged an unprecedented 300% in a single day. Some analysts stated, “oil prices crashed or collapsed.” No. They disintegrated. The once-scarce commodity valued at $145 in 2008 is now literally drowning in surplus, hitting a negative value of -$37/barrel on April 20, 2020.

Year-to-date, crude oil prices had a shear decline of over 70%, as Saudi Arabia and Russia have engaged in a price war, which Saudi Arabia initiated in response to Russia’s reluctance to reduce production. This only exacerbated a bad-to-worse situation that has been unfolding since 2015, when Saudi Arabia flooded the market with cheap oil, bankrupting many small-scale shale oil drillers in the United States.(1)

On Monday, April 20, oil futures contracts started the morning at +/-$20 barrel. By the close of the day and for the first time in history, oil plummeted a mind-numbing $37.63 per barrel. That’s a one-day loss of 300%, an unprecedented collapse that left oil traders reeling.

An overflowing oil supply, a staggering global decline in demand resulting from travel restrictions and shutdowns in response to the COVID-19 pandemic, and a lack of storage space had sellers paying buyers to unload at any price. If they find no markets for their contracts, investors would be forced to take physical delivery of the oil themselves – NOT something investors are even remotely prepared to do.

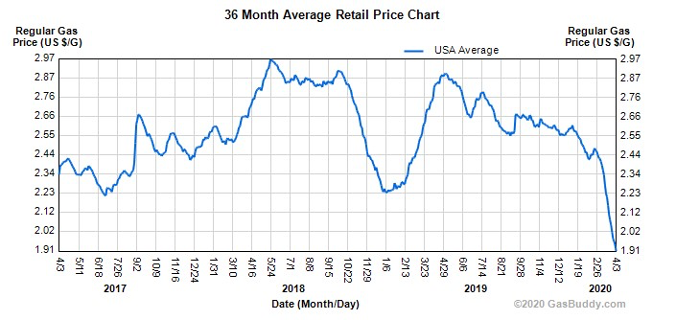

With investors already feeling such overwhelming pressure, it is particularly troubling that global liquid fuel inventories are estimated to grow by an average of 3.9 million barrels per day in 2020; the greatest impact of COVID-19 travel restrictions are expected to occur in the second quarter of 2020 with a slow, 18-month return to normal; and U.S. regular gas prices are forecasted to average $1.58/gallon for the April – September 2020 summer driving season, down from an average of $2.72/gallon last summer. (2)

Oil futures contracts are agreements to buy or sell a stated number of barrels of oil at a predetermined date and price. Investors buy futures to essentially gamble on what the price will be down the road and profit by guessing correctly. Typically, they will liquidate or roll over their futures contract before they would take physical delivery. (4)

With nowhere else to turn, oil-filled tankers off the California coast are waiting for a change in the oil markets or a new buyer.

Oil supertankers are cramming the Los Angeles seacoast, sitting on oil hoping for higher prices. However, there’s little oil value if refineries stop buying, and potential negative value if you exhaust storage options. If future production demand wanes and we discover every storage tank and vessel is already full, a greater reduction in oil may be necessary. Not to put too fine a point on it, this may not be the last time we see oil futures dip into negative territory. (3)

It’s nearly impossible for U.S. oil producers to make a profit at $30 per barrel, much less when confronted with sub-zero prices. Larger oil firms (Chevron, Exxon & BP) will likely weather the storm. However, smaller producers may be forced to seek financing to assist in infrastructure and overhead costs. If this fails, bankruptcy and production shutdowns may be the only option, ultimately allowing private equity firms to swoop in and buy assets for pennies on the dollar. (4)

Since the global oil demand spike in 2008, gas prices at the pump throughout the United States have steadily declined. On Friday, April 24th, AAA said the national average cost at the pump for a gallon of regular gas was $1.83, nearly 41 cents cheaper than just one month ago.

The cheapest gas is recorded in Wisconsin, where a driver filled her tank for just $11, or 89 cents per gallon. (5)

Bottom Line

With stunning, across-the-board decline in demand as a result of the global response to COVID-19, commodities, in general, will be under pressure, and we can expect volatility to continue in the near term. Oil demand has been weakening since the 1970s, and a negative price can’t be overlooked. The industry is marred. The production war between Saudi Arabia and Russia may have triggered the beginning of oil’s demise. Without sensible checks and balances, cooler heads, and multilateral agreements, at best the industry’s fate is unstable. Quite simply, oil manipulation and overproduction must cease before our next market downturn in order to protect this asset class. Otherwise, hungry competitors in other energy sources will be given an open invitation to replace it. (6)

A Historic Footnote

Oil and oil wells are literally as old as the hills. As far back as 347 AD, China drilled to depths of up to 800 feet, using stone bits on bamboo poles to reach the liquid gold. Ancient Greek historian, Herodotus, wrote of a natural asphalt that was used to build the walls and towers of Babylon nearly 4000 years ago.

Ancient Asian records reveal the use of natural gas for light and heat; petroleum was the “burning water” of Japan by the seventh century. By the ninth century, it’s believed that the streets of Bagdad were paved in tar, and the first oil well and refinery built in Russia provided light from oil lamps in churches and monasteries in the early 1700s.

In 1865, with the founding of Standard Oil Company by John D. Rockefeller, it was clear that big oil in the United States was here to stay. Today, the top three oil-producing countries – Saudi Arabia, Russia, and the USA – provide 90% of all oil to meet the world’s fuel needs. This is in stark contrast to the centuries leading up to the 1950s when coal lead the world’s fuel consumption. (7) (8)

- Yahoo Finance “Do Saudi Arabia and Russia Really Want to Kill U.S. Shale?

- S. Energy Information Administration Short-Term Energy Outlook, April 7, 2020

- CNBC “Why oil prices went negative and why they can go negative again” April 26, 2020

- Investopedia Crude Oil April 21, 2020

- UPI US gas prices way down from last April – April 17h, 2020

- CNBC/FactSet April 21, 2020

- Wikipedia “History of the petroleum industry”

- Offshore Technologies “History of oil & gas industry from 347 AD to today” March 7, 2019

Important Disclosures and Disclaimers

This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those Verdence Capital Advisors, LLC “Verdence”, or any of its affiliates and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security referenced herein. It is being provided to you by the registered representative referenced above on the condition that it will not form the primary basis for any investment decision.

The information contained herein is as of the date referenced and Verdence does not undertake an obligation to update such information. Verdence has obtained all market prices, data and other information from sources believed to be reliable although its accuracy or completeness cannot be guaranteed. Such information is subject to change without notice. The securities mentioned herein may not be suitable for all investors. Clients should contact their Verdence representative at the Verdence entity qualified in their home jurisdiction to place orders or for further information. Verdence Capital Advisors, LLC is a member of FINRA, the MSRB and SIPC.