November Market Review – A Late Month Rally Brings Relief to Investors

Up through Thanksgiving, the global equity market looked like it was going to deliver another disappointing month for investors. As we sat down for turkey and stuffing, every major U.S. Index was negative for the month as mixed economic data, uncertainty around future Fed rate hikes, ongoing weakness in tech and a bear market in crude oil hung over risky assets. If the S&P 500 did not notch its best one-week rally since December 2011 in the final week of the month, investors may have been disappointed with another month of red on statements. Here is a brief review of the month:

Economy: Economic data was mixed in November with the Citigroup Economic Surprise Index dipping into negative territory. Some key highlights on data include:

- Manufacturing cools. The ISM Manufacturing Index fell for the second consecutive month but remains well in expansion territory. The details suggest an impact from trade with weakness in new orders and production.

- Inflation moderates. The Fed’s preferred inflation measure (core PCE) rose at a modest pace (0.1%) for the month but year over year, it is slightly below the Fed’s target (1.8% YoY).

- Confidence continues to be strong. Consumer and business confidence slipped from the recent highs but are still at or near cyclical highs. Businesses still have strong confidence on hiring, compensation and CapEx plans.

- Employment strong. The U.S. economy added 246K jobs (October) while the unemployment rate remained unchanged (3.7%) at the lowest level since 1969. Wages (average hourly earnings) rose at the fastest pace (year over year) since April 2009.

Fixed income – Quality over Yield. The U.S. Barclays Aggregate Index rose for the first time in three months in November. However, it was quality over yield as risk appetite was challenged during the month. In addition, comments from the Fed chairman resulted in the anticipation of less Fed rate hikes in 2019 than originally estimated. As a result, broad interest rates declined and Treasuries outperformed credit.

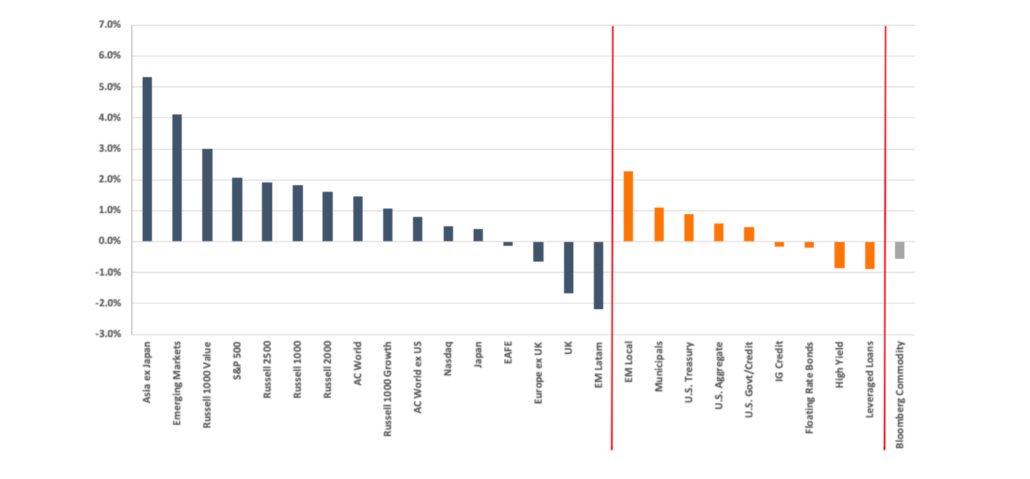

Global equities – Global turnaround. Despite most major global indices seeing at least a 5% pullback in November, optimism leading up to the G20 meeting on the last days of the month helped push global equities higher. The MSCI AC World Index rallied led by a strong rebound in the emerging markets, specifically Asia and late-month rally in U.S. equities.

November Asset Class Performance

Source: Data as of November 30, 2018.

Footnotes: Bloomberg Finance LP, Verdence Capital Advisors.