Europe Discount Deepens—Looks Attractive Versus Rest of the World

Given our view that international equities should outperform U.S. equities over the next 18-24 months, we found it useful to revisit the underlying economic fundamentals overseas and this week focus on the fundamentals in Europe. Europe’s growth has hit a soft patch this year due to fiscal restraints, trade uncertainty, weak confidence, a slowdown in personal spending, changes in emission laws impacting auto production and the slow implementation of economic reforms. However, a soft patch does not mean recession. The economy is producing moderate growth and the negative sentiment towards European equities may be overdone. We remain long-term positive on European equities due to:

- GDP slowing but above average: The IMF downgraded their outlook for European GDP in 2018 (to 2%) and 2019 (to 1.9%). However, both these readings are above the average annual growth rate since 1995 (1.7%) and come after Europe produced a decade high growth rate in 2017. As auto disruptions wane, and if economic reforms can be implemented and/or fiscal health becomes clearer, there may be upside to these estimates.

- Manufacturing: Glass half full or totally empty? The Manufacturing PMI in Europe has fallen every month except one this year. However, it is important to remember that at 52, it is still in expansion territory and some of the weakness is attributed to autos. In fact, manufacturing in other areas has been growing (e.g. consumer goods and energy). While year over year broad manufacturing orders have dropped there may be a sign of troughing as German orders have picked up for the past two consecutive months.

- Unemployment high but improving. The Eurozone aggregate unemployment rate has fallen to the lowest level since November 2008. Germany’s unemployment is at the lowest level since at least 1991, Spain is at a ten-year low and Italy remains high but has fallen in five out of the past six months.

- Accommodative policy. The ECB is moving towards normalizing monetary policy by ending their asset purchase program next month, but they are nowhere near tightening policy. When looking at the real benchmark rate (using CPI YoY), Germany, France, the UK and Italy have the most negative real benchmark rate of all the G20 countries.

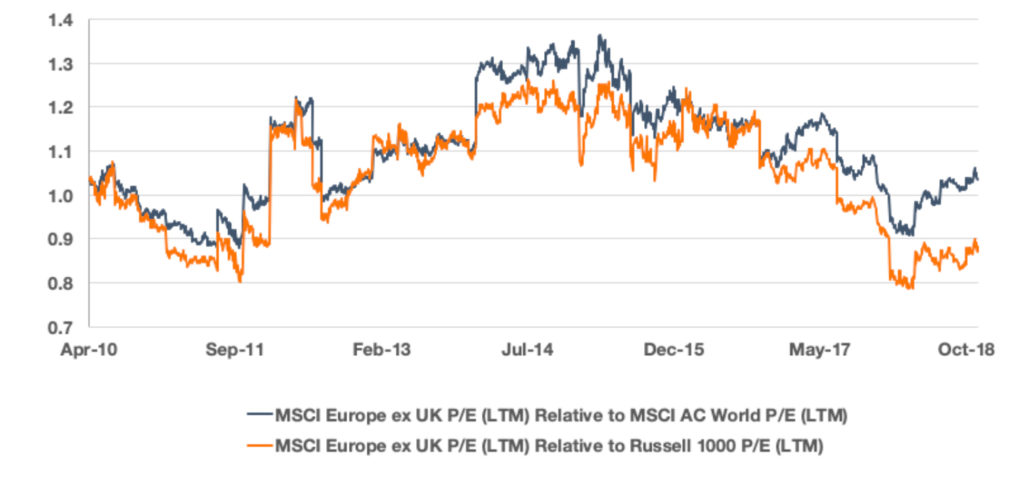

- Valuations compelling. The MSCI Europe ex UK Index P/E (LTM) typically trades at a premium to both the MSCI AC World and the Russell 1000. However, the underperformance has resulted in the P/E trading at a discount to both, specifically the U.S. where it is trading 25% below the historical average.

- There is no alternative! In Europe investors have little alternatives but equities for income. For example, the dividend yield on the EuroStoxx 50 is over 300 bps above the German 10YR yield and ~40 bps above the 10YR Italian bond yield.

Risks remain but prices reflect them? We are not ruling out further volatility and possible underperformance in European equities but current prices may be reflecting a worst case scenario for politics, earnings and trade. Therefore, we see better upside potential for investors who have a long-term horizon.

Europe Discount Deepens. Europe Looks Attractive versus Rest of the World