How Worried Should we be About Inflation?

We’d like to wish everyone and their families a Happy Thanksgiving this week!

As we sit down and reflect about all the things we are thankful for, one that you can count is we have not seen the rise in broad prices that some had anticipated this year. In fact, as we load up on turkey and stuffing you can appreciate the fact that the average cost of your Thanksgiving dinner declined this year. According to the American Farm Bureau Federation’s 33rd annual survey, the cost to feed 10 people for Thanksgiving dropped $0.22 this year compared to last year (to $48.90). In fact, the survey showed the cost has declined persistently in recent years and is now at the lowest level since 2010.

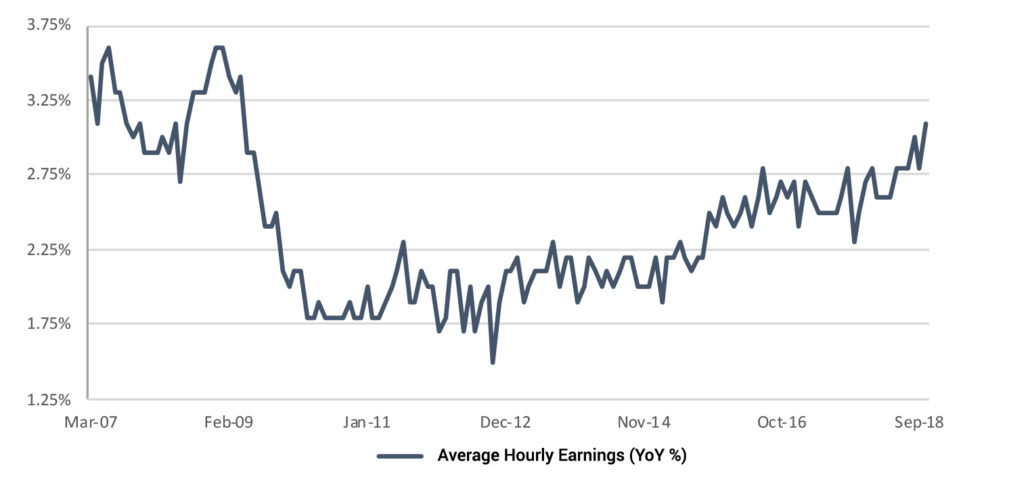

This is what brings us to the discussion about inflation. Last week, headline consumer prices showed that inflation is relatively tame, with year over year prices rising 2.5% and 2.1% if you exclude food/energy. Since 1958, the average YoY rise in consumer prices ex food and energy has been 3.7%. However, we are seeing pockets of inflation in areas of the economy that can have negative implications for consumers. Especially in services, since services make up 65% of personal spending. In fact, the cost of items such as auto insurance, banking services, lawyer fees, haircuts and nursing homes are all rising at a faster pace than wages. The concern with these rising costs is that most of the expenses are unavoidable.

This is the danger of inflation you may not see in the headline data. While consumer spending has remained relatively resilient in the face of rising interest rates and service costs, if wages do not pick up at a faster rate, we may see some cooling in consumer spending in the coming quarters. There is already evidence that these rising costs are straining consumers. If you look at the amount of debt consumers have taken on, it is rising at an uncomfortable pace. In 2Q18, consumer credit reached a record high ($3.9 trillion) and grew 5% over the past year. Credit card debt alone is at a record high ($1 trillion) and is growing at a faster pace than wages. The one reprieve for consumers as we enter the holiday shopping season is the decline in gasoline prices. Gasoline prices have fallen ~$0.30 over the past six weeks.

While earnings are finally rising, select service costs are rising faster and may drag on spending

Source: Data as of November 19, 2018.

Footnotes: Bloomberg Finance LP, Verdence Capital Advisors.