Decoding Currency Volatility

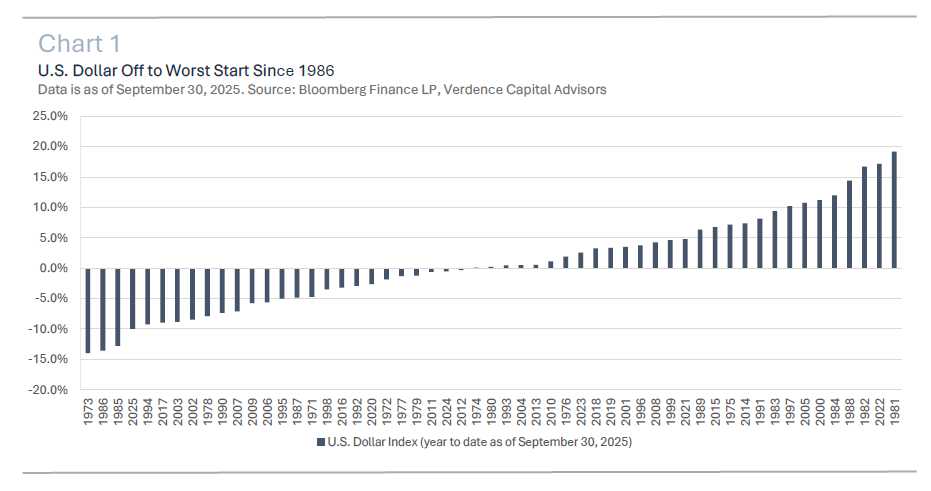

The U.S. Dollar is on pace to post its worst annual decline since 198 (This is -9.9% year to date as of September 30, 2025) (Chart 1) This is down 14% from its 2022 peak. A worsening fiscal outlook, the Fed resuming interest rate cuts, a complete overhaul of U.S. trade, slower economic growth and political wrangling have weighed on the Dollar. This weakness has opened the door to a surge in other stores of value (e.g. gold +132% over the past three years). And this has also opened the door and the rise in speculative investments that some believe can take over Government-backed currencies (e.g., bitcoin).

In this quarterly white paper, we seek to educate investors about the primary factors that influence the value of a currency, highlight the importance of the U.S. Dollar and look at its historical cycles. In addition, we will illustrate how movements in the U.S. Dollar impact American companies and investors and finish with our near and long-term view on the U.S. Dollar.

What Factors Influence the Value of a Currency?

Currently, there are ~180 recognized currencies by the United Nations across the globe. These distinct currencies can be free floating (float freely and the value is derived from foreign exchange markets), pegged (locked vs. another currency) or managed (Government allows direct intervention to manage currency value). There are several key factors that influence the value of a currency:

Interest rate differentials:

The higher the interest rate is in a particular country compared to its peers, the more attractive it is to invest in the country (and its currency) with higher interest rates. Therefore, higher demand pushes the value of the currency higher. The most recent example has occurred in the aftermath of the COVID pandemic when many countries needed to raise their benchmark short term interest rates to combat inflation.

However, the U.S. was able to raise interest rates more aggressively than their developed market peers which caused a wide interest rate differential. As a result, the U.S. Dollar Index (i.e. an index that measures the value of the U.S. Dollar versus a basket of other major currencies) rose sharply compared to a variety of

other majorly traded currencies. (Chart 2).

Inflation can erode purchasing power:

Inflation erodes the value of a currency as rising prices mean that the currency buys less of the same goods. This deters capital flow and can push the value of the currency lower.

There have been some historical scenarios where high inflation drove the currency higher. Take the U.S. Dollar during the hyperinflation of the 1980s. The U.S. Dollar Index hit a record high in 1985 as the Federal Reserve was hiking interest rates into double digit territory (thus widening the interest rate differential between the U.S. and other major currencies). The Dollar was able to rally in the face of higher inflation because of the aggressive rate hiking cycle by the Fed and the confidence investors had that the central bank could end the period of high inflation.

In contrast, investors can look at a currency like the Argentine Peso. This is considered a free-floating currency but decades of high inflation and loss of confidence in the central bank have resulted in a deterioration in the currency and central bank intervention.

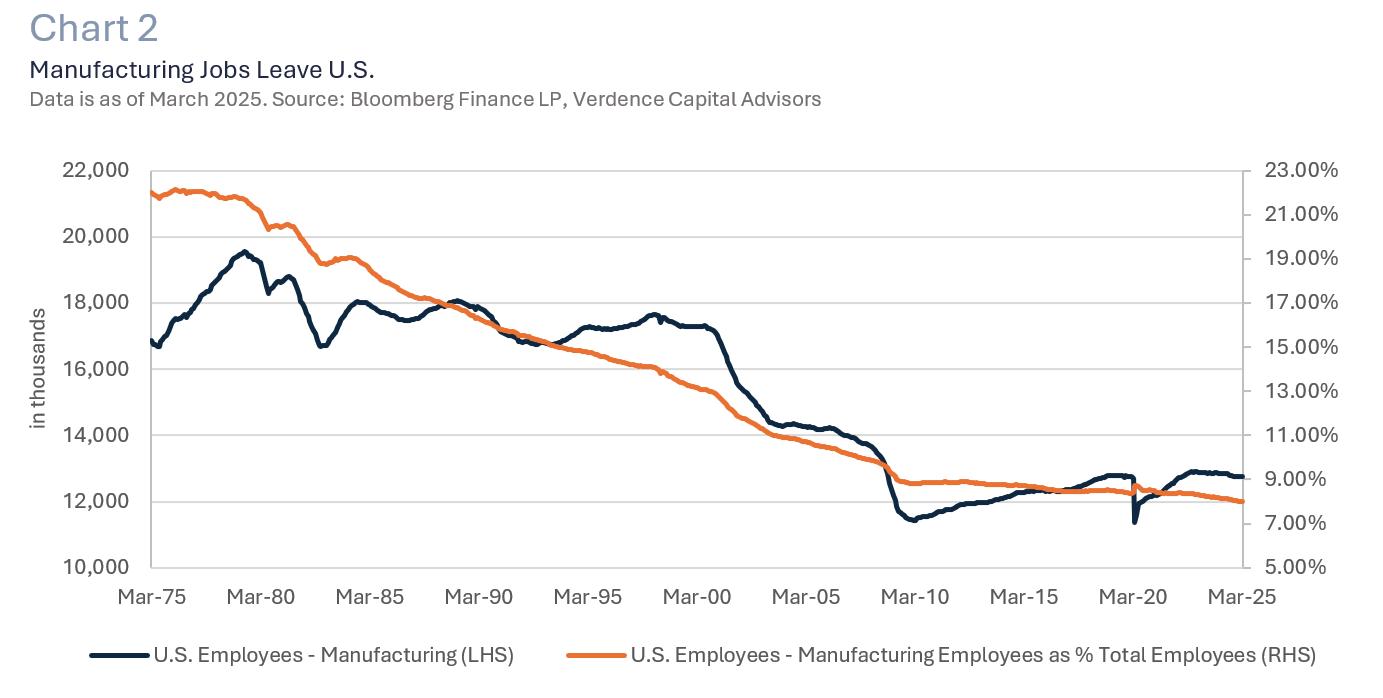

Economic growth can drive demand:

Valuing a currency can be compared to valuing a company. A company may be attractive if they exhibit strong long term earnings growth potential. If an economy has a solid long-term economic outlook this can attract capital and boost the currency. One example was during the early 2000s when the U.S. was struggling from a terrorist attack, the Iraq war and the bursting of the dotcom bubble.

However, commodity prices were surging as emerging market countries experienced robust economic expansion. This was when the acronym, BRIC, was developed which represented Brazil, Russia, India and China. As these economies were surging, their currencies rose, while the weaker U.S. economy and U.S. Dollar lagged. (Chart 3).

Deficits matter:

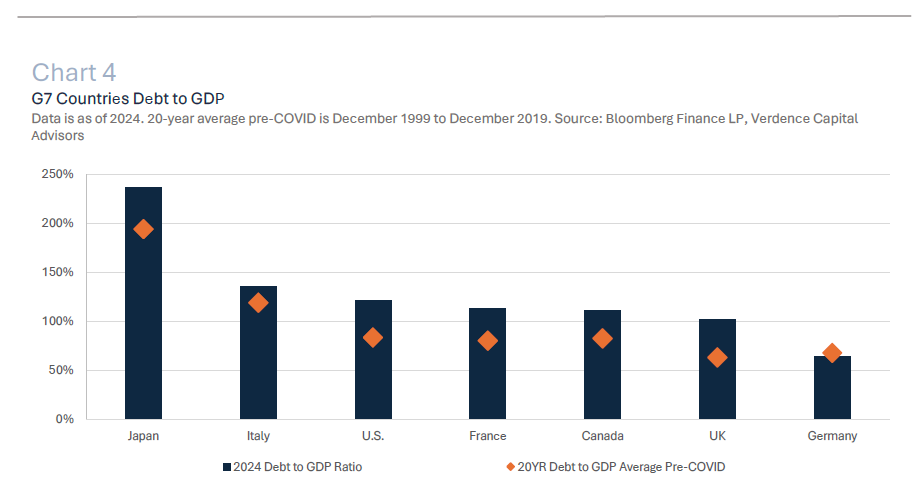

If a country spends more than they collect from revenue, this creates a fiscal deficit. In addition, if a country imports more products than they export, that becomes a trade deficit. While global investors tolerate deficits to an extent, a persistent fiscal deficit with irresponsible spending can reduce confidence and reduce demand for a currency.

This factor has had less influence on a country’s currency over the past decade. This is partially because most global governments are still heavily in debt due to actions taken to avoid an economic collapse during COVID. (Chart 4).

Geopolitical/political risks:

If a country faces a war or geopolitical tensions, those currencies involved may weaken. However, domestic politics can also impact a currency, especially as it pertains to central banks and their independence. A central bank needs to be independent so that setting interest rates is not influenced by politics.

There are countless historical events where government instability or loss of confidence in central bank independence caused sharp volatility in the currency. The Asian Financial crisis in the late 1990s, Argentina’s current fiscal woes and Turkey’s deteriorating currency in 2018 are just a few examples.

The Importance of the U.S. Dollar and its Historical Cycles

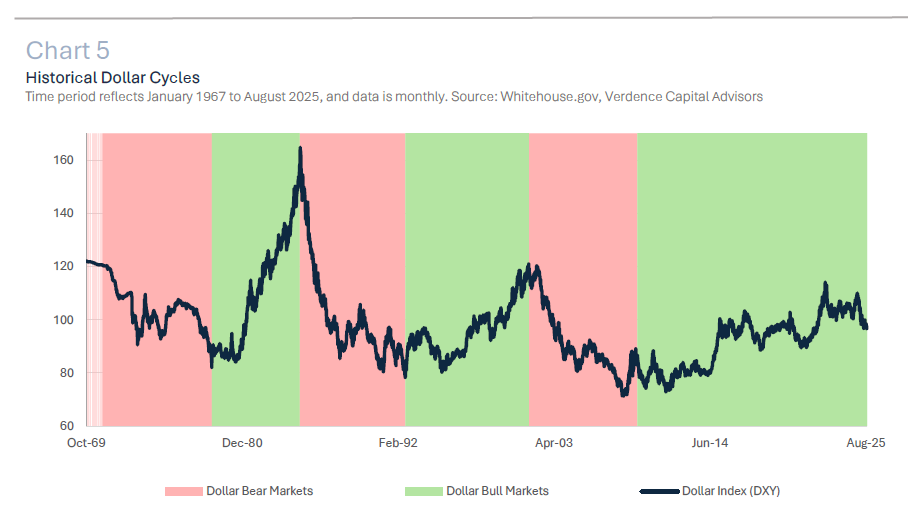

Currency cycles do not always coincide with economic cycles. For example, since 1969, the U.S. Dollar Index has experienced three bear markets. (Chart 5). This compares to eight economic recessions in the U.S. since 1969. The current bull market for the Dollar has been the longest (since 1969) and started in 2008. It has not been an easy run and there have been several near-bear market declines during this time (several between 2008-2011).

The Dollar has been able to enjoy long cycles because it is considered the world’s reserve currency. According to the Federal Reserve, the U.S. Dollar makes up ~60% of the global currency reserves, this is more than double the size of the next largest currency (i.e., Euro). In addition, the Brookings Institution estimates that ~50% of global trade is in U.S. Dollars.

The U.S. Treasury market is the largest government bond market in the world with nearly $30 trillion worth of debt outstanding and ~25% of it is owned by international buyers. While this percentage has moderated over the past decade, the U.S. Dollar is still widely used by central banks and in international transactions.

How Does the Dollar Impact Investors and Businesses?

If you are a U.S. investor buying investments that are denominated in the U.S. Dollar, fluctuations in the currency may mean little to you. However, if you are a U.S. investor and buy something that is denominated in a different currency, your total return carries currency risk.

For example, if you buy a stock denominated in a foreign currency and that stock increases 10% but the foreign currency declines by 10%, the currency has detracted from your total return. Since currencies can be volatile, it is important for an investor to understand the potential risk when purchasing investments in a foreign currency. Over the long run, this can have beneficial characteristics from a diversification perspective, but investors must be comfortable with the level of risk.

Currency Impact on Global Business

From a business perspective, a weak currency can make exports more competitive. As a result, those businesses that are considered multi-national may have a competitive advantage. In contrast, if the currency is strong that advantage fades.

Economic Implications of a Weak Dollar

From an economic perspective, a weak Dollar can cause inflation as imported goods become more expensive. That higher cost may be passed onto consumers and cause a rise in inflation.

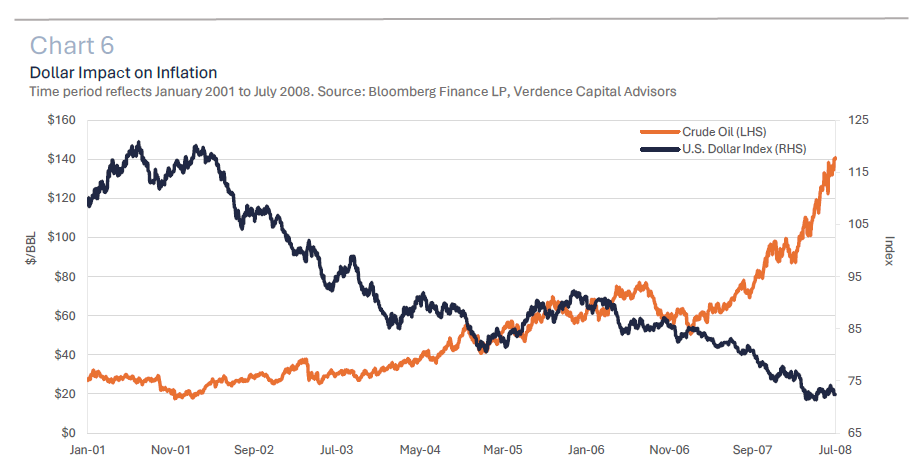

Commodities and Currency Connection

Commodities are an example of how a weak Dollar can cause inflation as most globally traded commodities are priced in U.S. Dollars. When the Dollar is weak, foreign buyers can buy more of the commodity, which can inadvertently raise the price of the commodity for all global buyers, and feed inflation. A most recent example was in the early 2000s. The Dollar fell ~40% during 2001-2008 and the price of oil rose over 340% to hit a record high of $145. (Chart 6).

Since currencies can be volatile, it is important for an investor to understand the potential risk when purchasing investments in a foreign currency.

Verdence Short- and Long-Term View

Now that investors can understand the factors that influence a currency and how it can impact an economy, businesses and investors, we offer our near and long-term view on the U.S. Dollar.

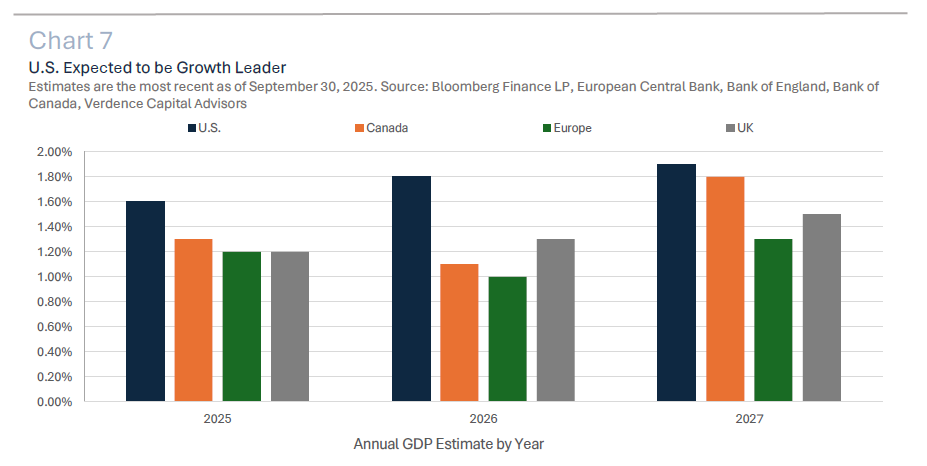

It is important to remember that currencies are valued relative to each other. The U.S. Dollar Index is the average exchange rate between the U.S. Dollar and other major world currencies.1 Therefore, despite the Fed cutting interest rates, the economy slowing and domestic political wrangling, the U.S. is still stronger and expected to remain superior relative to its major currency counterparts in terms of economic growth. (Chart 7 ).

Short Term Outlook

We expect the Federal Reserve to continue its easing cycle but so are other major central banks, leaving interest rate differentials in favor of the U.S. Dollar. In addition, the U.S. Dollar is the world’s reserve currency, so demand remains solid, and it consistently serves as a flight to safety in the event of a global growth scare, geopolitical event or financial crisis. While the U.S. Dollar may not have a catalyst for moving higher in the near term, the downside should be limited due to these factors.

Long Term Outlook

In the long term, it is hard to ignore the burgeoning U.S. fiscal deficit and how that impacts economic growth prospects, inflation and investor confidence. We have seen central banks move to diversify into other stores of value (e.g., gold) as a hedge against the Dollar in the long run. However, we have not seen demand for Treasuries weaken nor have we seen mass selling of U.S. assets that would indicate that the U.S. Dollar may lose its world’s reserve currency status.

The Role of Cryptocurrencies and Digital Assets

Despite the surge in cryptocurrencies, in their current form, they cannot replace the U.S. Dollar. They also do not exhibit any realistic characteristics that define a fiat currency (e.g., Government backing, regulated, store of value, legal exchange of value). While we do not rule out central bank issued digital assets in the future, they would likely still be backed by a country’s Government. And a country’s government could then see their value fluctuate for the same reasons that fiat currencies do now.

Investment Positioning and Hedging Dollar Weakness

At this time, as a U.S. investor, we believe the best way to hedge against weakness in the Dollar would be global diversification with exposure to other currencies. In addition, real assets such as select commodities, infrastructure investments, and select real estate/land should serve to mitigate downside to the U.S. Dollar. We continue to monitor the growing landscape of real assets and direct necessary investments when the price is rewarding investors for their risk.

Trade Negotiations and Policy Uncertainty

We think discussions will proceed country by country and concessions will be made on both sides of the table. We also think this will be resolved in the coming months as President Trump has a much bigger campaign promise to satisfy with the extension of the Tax Cuts and Jobs Act that expires at the end of this year. That does not mean it will not come with short term pain.

Market Implications and Economic Resilience

We have seen that in the financial markets and could see temporary disruptions from a supply chain perspective and a slowdown in growth if not a short and shallow recession. It may also temporarily impact inflation and keep the Federal Reserve in a difficult position on flexibility with interest rates. However, we are looking at dislocations in the market due to the volatility around the constant headlines as buying opportunities. We do not see this as a long-drawn-out disruption. Countries around the world are too intertwined and dependent upon each other to not see some agreements made sooner than later.

Looking Ahead

Lastly, it is important to remember that our economy is resilient, and U.S. companies are highly innovative and resourceful; we will get through this, and we may even see added benefits when we get to the other side. We have already seen major companies, U.S. and international, commit to considerable investments in the U.S. which can have long term benefits for the U.S. economy. We will continue to monitor the situation and focus on our long-term investment philosophy and take advantage of dislocations when the price is reflecting near-term risks.

If you have any questions or comments, please reach out to your financial advisor.

Megan Horneman | Chief Investment Officer Past performance is not indicative of future returns

1 Definition is according to Bloomberg Finance LP for the DXY Index.