Key Takeaways:

- Fed cuts interest rates by 25bps, marking first cut since December 2024.

- Interest rate cut likely to have little impact on consumers’ credit card rates.

- The housing market is still in limbo.

- Government interest payments remain a key issue.

- We are not as optimistic as market participants on the future of rate cuts.

What to Expect Now That the Fed has Cut Rates?

Last week, the Federal Reserve cut interest rates by 25 bps to a range of 4.00% – 4.25%. This was the first interest rate cut since December 2024. The latest downward revisions to BLS payroll data and a soft August employment report gave the Fed the flexibility to cut interest rates despite persistent inflation pressures. The committee highlighted that, at this time, risks to the labor market outweigh inflation. During his press conference, Fed Chairman Powell stated, “… think of this as a risk management cut” given that a “very different picture” of risks has emerged. In this Weekly Insights, we aim to provide an overview of how interest rate cuts may impact the economy and consumers.

Credit card rates to be little changed

The Federal Reserve’s benchmark rate helps set the prime rate, which banks use to help determine how much to charge on credit card loans. After the 25 bps cut, the prime rate fell to 7.25% (from 7.50%), the lowest since November 2022. According to Bankrate, the average credit card balance is ~$6,500, with an average interest rate of 20.12%.1 Consumers will welcome any relief from the high level of interest rates on credit cards, but they shouldn’t count on much help. In fact, it is estimated that if credit card rates fall by 25 bps, a cardholder carrying the average balance would only see savings of ~$1/month.1

Housing market still in limbo

The 25 bps cut by the Fed was already largely priced into 30YR fixed mortgage rates. In fact, last week, mortgage rates fell to their lowest level since October 2024 (6.39%). To understand this impact, let’s consider a $400K mortgage. At 6.39%, the monthly mortgage payment comes to just under $2,500 (interest and principal only). In January, mortgage rates were at 7.09%, and the same $400K mortgage would have cost $2,685. The savings comes to ~$200/month. While potential homebuyers welcome the cost savings, mortgage rates are based off of long-term Treasury yields. Unfortunately, long term bond yields rose after the Fed’s rate cut (10 and 30 YR Treasury +10 bps from Tuesday to Friday) as investors view that inflation is still a concern over the long term.

Impact on the federal debt

The U.S. government has spent ~$1.13 trillion this year on interest payments, at an average rate of 3.372%.2 This pales in comparison to 2021 (before the Fed started raising interest rates) when the government spent $562 billion on interest payments, at an average rate of 1.605%. According to the U.S. Treasury, the average weighted maturity of our Treasury debt is ~6 years. Unfortunately, yields are rising in this portion of the curve which continues to put pressure on the Federal budget

The Bottom Line

Equities continue to rally after the Fed cut rates with all four major U.S. averages (i.e., S&P 500, Nasdaq, DJ Industrial Average, Russell 2000) hitting a record high last week. Currently, the futures market is pricing in two more rate cuts this year and two to three in 2026. With valuations extended, equities are not pricing in the risk that the Fed cannot be this flexible. Unfortunately, inflation is a problem that cannot be ignored forever. This realization could lead to a valuation correction.

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Consumer spending strong.

- Housing remains challenged.

- Fed delivers on highly expected rate cut.

- Equities rally to record highs after Fed cuts rates.

- Bond yields rise amid concerns of inflation.

- Commodities falter on energy inventories.

Weekly Economic Recap — Fed Delivers Rate Cut Amid Downside Risks to Employment

U.S. retail sales increased for the third consecutive month in August. Nine of the thirteen categories posted monthly increases, led by online retailers and clothing stores, likely driven by back-to-school spending.

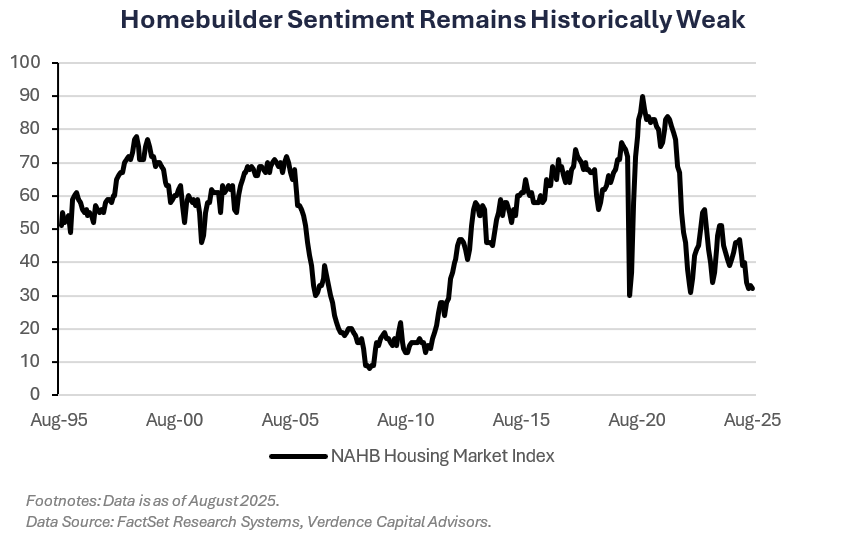

Homebuilder sentiment as tracked by the NAHB was unchanged in September but remains historically weak. The Index was weighed down by dismal prospective buyers’ traffic and current sales. Expectations for sales over the next six months increased to the highest level since March on expectations of lower mortgage rates.

Housing starts in the U.S. fell to a three month low in August (1.307 million annualized pace). Starts of single-family homes decreased 7% to the lowest level since July 2024, while multi-family home construction fell 12%, the lowest level since May.

As expected, the Federal Reserve cut interest rates for the first time in almost a year (by 25 bps to 4.00% – 4.25%). The committee voted 11-to-1 to cut interest rates, with the only dissent coming from newly-appointed committee member Stephen Miran, who advocated for a 50 bps cut. In the post-meeting statement, the committee highlighted “risks to both sides of their dual mandate and judges that downside risks to employment have risen.” In the committee’s Summary of Economic Projections, the dot plot suggested divergence among committee members widened, with nine members anticipating just one more 25 bps cut by year-end, while 10 members expect two more 25bps cuts.

The Leading Economic Indicators Index fell by the most in four months in August (-0.5% MoM). The decline was led by weakness in consumer sentiment, the labor market and building permits.

Weekly Market Recap — Global Equities Climb to Record Highs After Fed Rate Cut

Equities:

The MSCI AC World Index was higher for the third straight week as the Federal Reserve lowered interest rates for the first time this year. All major U.S. averages were higher. Large-cap growth outperformed, specifically communications and technology. The small-cap Russell 2000 was higher for the seventh consecutive week as these companies tend to be more interest rate sensitive.

Fixed Income:

The Bloomberg Aggregate Index was lower for the first time in five weeks as bond yields rose despite the Fed cutting interest rates. Long term bonds led the weakness as long term inflation fears increased. High yield and municipal bonds were the only major sectors to rally.

Commodities/FX:

The Bloomberg Commodity Index was lower for the second time in three weeks. Energy prices were lower as crude oil and natural gas inventories rose last week, calling into question the demand outlook. The Bloomberg Soft Commodities sub-index fell by the most since February as coffee prices plummeted after Brazil weather forecasts see intense rainfall in the region, benefiting the crop.