Key Takeaways:

- Cracks in labor market getting hard to ignore.

- Job openings fell below the number of Americans looking for a job for the first time since 2021.

- Foreign-born workers are leaving the workforce at the fastest pace in history.

- Government jobs trends could distort data in the coming months.

- Expect any Fed rate cut to be delivered with a very hawkish tone.

Taking Cues from the Labor Market

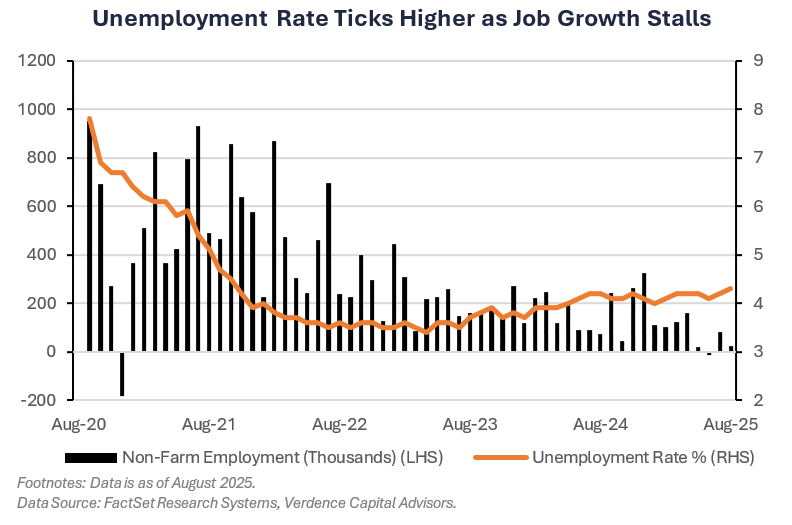

Last week, investors were delivered a better understanding of the health of the labor market. Unfortunately the weakness is getting hard to ignore. The Institute for Supply Management surveys showed employment in manufacturing and services is at the lowest level since July 2020 and December 2023, respectively. The July JOLTS report showed job openings decreased to the lowest level since September 2024 (7.18 million). In fact, job openings fell below the number of Americans that are looking for a job for the first time since 2021 (by 55K). Lastly, the Bureau of Labor Statistics reported the U.S. economy added 22K jobs in August. This brings the moving 12 month sum of job creation to the lowest level since 2021. The unemployment rate pushed up to a four year high (4.3%).

The data has likely confirmed a Fed rate cut at their September 16/17 meeting. This is with futures pricing in a ~90% chance for a 25 bps cut, while the remaining ~10% are pricing in a 50 bps cut. In this Weekly Insights, we look beyond the headlines and focus on some structural things to watch in the labor market and what it could mean for the economy.

Immigration impact is showing up:

According to BLS data, foreign-born workers historically account for ~17% of the workforce. The latest BLS report showed foreign-born workers account for 19% of the workforce, down from a peak of 20% in March. Immigrants have been leaving the workforce at a rapid pace this year. This is with a net ~1.0 million less foreign-born workers in the labor force today compared to the beginning of the year.1 However, native-born workers have offset this trend this year. Native born workers have contributed ~2.3 million to the labor force this year. This is the fastest pace since 2019 when total job additions for native-born workers increased by 2.5 million.

Job losses from government:

With Trump’s DOGE initiative, there is an estimated 148K federal employees who have left their government jobs.3 Some of these employees will start seeing their packages run out in 2H25 and re-enter the workforce which may distort the monthly data.

AI hiring trends:

As artificial intelligence gains traction, there are concerns about what it will do to the demand for workers. This far, we are not seeing a significant impact in jobs losses due to AI intergation. In fact, 11% of service firms said they have hired more because of adoption of artificial intelligence, according to the New York Fed.2 The report showed 13% of companies did plan to fire employees in the next six months, but that is unchanged from 2024.

The Bottom Line

The labor market is weakening enough that our view has changed and the Fed will deliver a 25 bps rate cut next week. We will receive several inflation indicators this week, but we do not see that data changing the Fed’s rate cut next week. The biggest question for investors now is how many more rate cuts we will receive. After this week’s inflation data, we will get a better picture on what the Fed can do with rates. However, we are not out of the woods with inflation. And the Fed may deliver a hawkish cut while reminding investors of their dual mandate, especially if inflation continues to move further away from their target

LISTEN NOW: Markets With Megan

Your Economic and Market Detailed Recaps

- Manufacturing activity contracts for sixth straight month.

- Job openings in the U.S. fall to the lowest since Sept. ‘24.

- U.S. economy adds fewer jobs than expected in August.

- Global equities rally on hopes for Fed rate cuts.

- Bond yields fall on prospect of lower interest rates.

- Commodities weaker driven by softs underperformance.

Weekly Economic Recap — Labor Market Cracks Getting Wider

According to the ISM survey, manufacturing in the U.S. contracted (a level below 5) for the sixth consecutive month in August. Seven of the 10 components in the survey were in contraction territory for the month. Employment led the weakness by remaining near the lowest level seen since 2020.

The ISM Services Index expanded at the fastest pace in four months in August. The strength was led by imports and new orders. While the prices paid component dipped slightly, at its current level, it suggests inflation may still be problematic.

The monthly JOLTS report showed that U.S. job openings declined to the lowest level since September 2024 in July (7.18 million) and June’s data was revised lower. The decrease in openings was led by the health care sector, which witnessed the lowest level of job openings since 2021. The quits rate, which measures the number of people leaving their jobs voluntarily, remained unchanged at ~2%.

U.S. economic activity across most of the Federal Reserve’s 12 districts reported “little or no change” according to the Fed’s Beige Book. Every region noted price increases, with 10 of the 12 reporting “moderate or modest” inflation, and two seeing “strong input price pressures.” Tariff-related price increases were reported across districts.

The U.S. economy added fewer jobs than expected in August (22K vs. 77K est.) and the unemployment rate increased to a four-year high (4.3%). In addition, the prior two months data was revised lower by 21K. The job weakness was led by goods producing, manufacturing, government and professional service jobs.

Weekly Market Recap — Global Equities Climb on Expectations for Fed Rate Cuts

Equities:

The MSCI AC World Index was higher for the fourth time in the last five weeks as weaker-than-expected economic data raised expectations for Fed rate cuts in September. Most major U.S. averages were higher, with the exception of the Dow Jones Industrial Average. The tech-heavy Nasdaq outperformed, and small and midcap stocks outperformed the S&P 500.

Fixed Income:

The Bloomberg Aggregate Index was higher for the fifth straight week as bond yields moved lower amid expectations for Fed rate cuts. All sectors of fixed income markets were higher for the week, with outperformance coming from investment grade corporate bonds.

Commodities/FX:

The Bloomberg Commodity Index was lower for the first time in three weeks. Crude oil prices were lower after OPEC+ announced plans to increase oil production starting in October. Soft commodities were lower for the first time in five weeks driven by lower coffee prices. The lower prices were in response to the expectation of lower demand given the recent surge in prices.