Key Takeaways:

- Price Stability – one of the two dual mandates from the Fed.

- Shelter costs remain stubborn.

- Egg prices lower for second straight month, still ~42% higher from a year ago.

- Isolated tariff-related price increases from CPI data.

- Not out of the woods yet on inflation; tariff-related price increase may come later.

- Fed to keep rates unchanged but SEP data more important.

The Fed’s Other Mandate – Price Stability

In last week’s edition of our Weekly Insights, we dove into the health of the labor market given that maximum employment is one of the Fed’s dual mandates. In this Weekly Insights, we wanted to examine the other side of the Fed’s dual mandate: inflation. We will evaluate the current state of inflation, offer insight into whether we are seeing tariffs show up in inflation data, and examine what the current inflation environment may mean for the Fed’s meeting this week.

Data may be hiding underlying risks:

- In May, the headline Consumer Price Index increased slightly less than expected (+2.4% year-over-year) and is approaching the Fed’s 2.0% target. In addition, the three-month rolling average of headline inflation is sitting at its lowest level since March 2021 (+2.37% YoY). When looking at core prices (which excludes volatile food and energy prices) they increased 2.8% YoY. The three-month rolling average of the core reading is sitting at its lowest since April 2021 (+2.78% YoY). Looking at the underlying components there is evidence that inflation is sticky (e.g., housing, services).

Inflation still a burden on necessity items:

- In May, shelter costs increased 3.9% YoY which is ~ 1.0% above the average annual rise we witnessed in the 30 years prior to the pandemic (+3.0% YoY). Construction costs, specifically higher prices for building materials, have fueled the rise in shelter costs. Food prices increased 2.9% YoY, only marginally higher than the 30YR average (2.8% YoY). However, egg prices contributed the most to upward pressure on the index, increasing ~42% YoY, substantially higher than the 30YR average (~5.5% YoY).

Services prices:

- Services prices within the CPI Index are growing 3.7% YoY which is nearly double what the average 30 years pre-pandemic showed (2.2% YoY). The U.S. is a service-based economy and nearly 78% of GDP is attributed to services. Average hourly earnings, on an annualized basis, have fallen in five of the last six months to ~3.9% YoY (from +4.15% YoY in November ’24). Should services prices continue to rise consumers may need to adjust their spending patterns here.

Tariff impact:

- There was isolated evidence of tariff-related price increases in the data. Prices for major appliances, including refrigerators, washers/dryers, etc., increased at the fastest monthly pace since August 2020 (4.3%). The monthly advance led to higher year-over-year prices for this category for the first time since October 2022. Additionally, toy prices increased at the fastest monthly pace since February 2023 (1.3%), leading to a year-over-year increase in prices for the first time since June 2023.

LISTEN NOW: Markets With Megan

The Bottom Line

We anticipate the Fed will keep interest rates unchanged at their meeting on Wednesday, but future meetings will be “live”, referring to the possibility for rate changes in the future. The geopolitical landscape remains highly uncertain as well, which could put upward pressure on inflation in the coming months. We will also be analyzing the SEP closely for any changes to future expectations, specifically as it relates to inflation and growth projections.1

Your Economic and Market Detailed Recaps

- Small business optimism improves for first time this year.

- Inflationary pressures ease further.

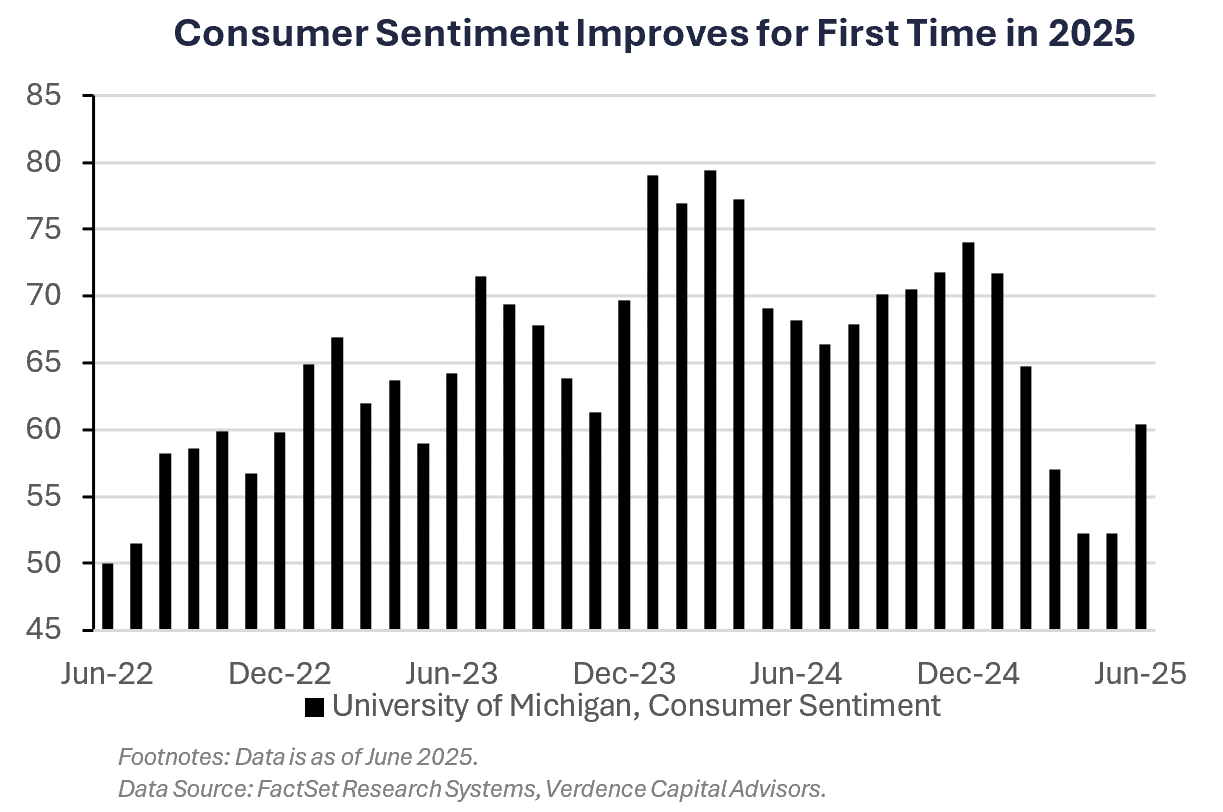

- Consumer sentiment improves for first time in six months.

- Global equities fall as geopolitical tensions rise.

- Yields fall as investors digest economic data.

- Crude oil prices surge as Israel launches attack on Iran.

Weekly Economic Recap — Inflation Softens but Risks Still Remain

Small business owner optimism improved for the first time in 2025 in May according to the NFIB Small Business Index. Seven of the survey’s ten components improved in May, led by better expectations for business conditions. There was still some weakness, however, as a net 31% of respondents said they plan to raise prices in the next three months, the most in over a year, amid tariff concerns.

Consumer prices increased less than expected in may (2.4% YoY vs. 2.5% YoY est.). Continued weakness in energy prices helped offset higher prices from food and shelter components particularly. Core CPI, which strips out volatile food and energy prices, was unchanged from the prior two months, increasing 2.8% YoY.

Producer prices remained muted in May as the Producer Price Index increased only 0.1% from the prior month. Goods prices excluding food and energy increased 0.2% for the month and contained signs of possible tariff-related price increases, including the largest increase in consumer durable goods since January 2023.

Continuing claims for unemployment benefits increased to the highest since the end of 2021(1.96 million), suggesting it is taking unemployed Americans longer to find a new job. The data is seen as volatile as it includes Memorial Day and the start of summer school breaks in some states.

WATCH NOW: Alternate View Podcast

Consumer sentiment improved for the first time in six months according to the University of Michigan sentiment index. An increase in both short and long-term expected business conditions led to the broad rally. Year-ahead inflation expectations plummeted from 6.6% last month, to 5.1%.

Weekly Market Recap — Global Equities Fall as Geopolitical Tensions Increase

Equities:

The MSCI AC World Index was lower for the first time in three weeks amid increased geopolitical tensions. Major U.S. averages were mostly higher through Thursday’s trading, but sentiment quickly deteriorated on Friday after reports of Israel launching airstrikes in Iran. Small-cap averages underperformed on a relative basis. The Dow Jones Industrial Average fell back into negative territory for the year.

Fixed Income:

The Bloomberg Aggregate Index was higher last week as yields broadly declined after last week’s economic data (bond prices higher). The US 10-year note auction showed strong demand last week as well, increasing sentiment around the market despite fiscal policy concerns. All sectors of fixed income were higher as yields fell.

Commodities/FX:

The Bloomberg Commodity Index was higher for the second straight week. Crude oil prices posted their best return since October 2022 as geopolitical tensions between Israel and Iran caused investors to grow concernd about potential supply disruptions. Gold prices rallied as investors flocked to the safe-haven amid the escalation in tensions.