The ABC’s of Tariffs

Tariffs have dominated the headlines this year as President Trump has aggressively acted on his “America First” trade policy by imposing a universal tariff on all imports coming into the U.S. and dramatically increasing tariffs on many global trading partners. While there is currently a temporary hold on most tariffs, the trade war has intensified between the U.S. and China.

The uncertainty about the damage to the global economy and corporate earnings has fueled volatility for global investors. The S&P 500 Index has flirted with bear market territory (a drop of 20% or more). Also small cap stocks entered bear market territory. And many international indices have fallen into correction territory (a drop of 10% or more). Consumer sentiment has deteriorated, earnings estimates are falling, recession risks are rising and the tariff impact on inflation is highly uncertain.

President Trump’s trade policy was a campaign promise to “level the playing field” from a global trade perspective. The use of tariffs was also a focal point of his first term in office with some tariffs even remaining in place through Biden’s presidency. What is rattling investors this time is the speed and scope at which he is using tariffs to “reorder global trade.”

In this quarterly white paper, we offer a nonpartisan explanation of the state of our trade deficit and why President Trump is using tariffs as a primary tool in his trade policy. Lastly, we will offer our opinion about what tariffs mean for the economy and asset classes.

Understanding the U.S. Trade Deficit

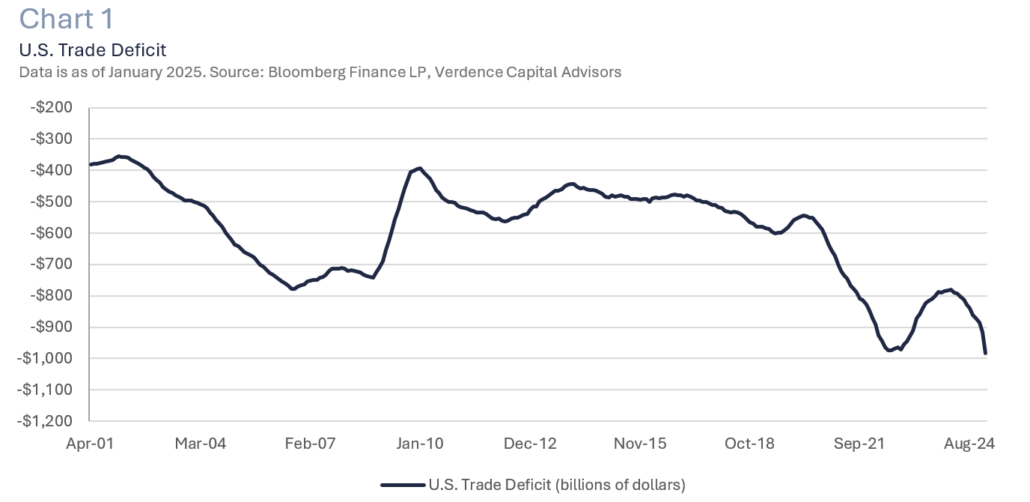

The U.S. runs a trade deficit where we import more than we export. Economists have studied the reasons and risks of the U.S. trade deficit for decades and there are several documented factors that have contributed to the deficit ballooning to ~$1 trillion. The deficit has been up more than 100% since 2000 and makes up ~3% of GDP. (Chart 1). Some reasons include:

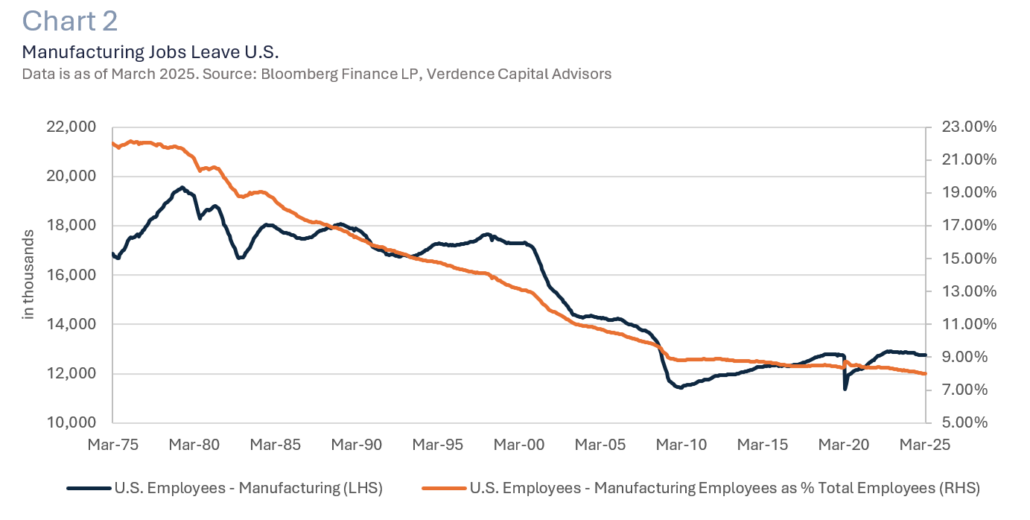

- The rise of globalization, specifically at the turn of the century with China joining the World Trade Organization. Foreign countries make goods cheaper than we can in the U.S. Unfortunately, U.S. manufacturing has been a victim of globalization. The U.S. has lost ~7 million manufacturing jobs over the past 25 years and manufacturing jobs have gone from making up over 20% of our non-farm payrolls to under 10%. (Chart 2). In addition, the Economic Policy Institute reports that between 1998-2019 the U.S. saw the closure of nearly 70,000 factories. This also devastated certain U.S. geographic locations (e.g., The Rust Belt).1

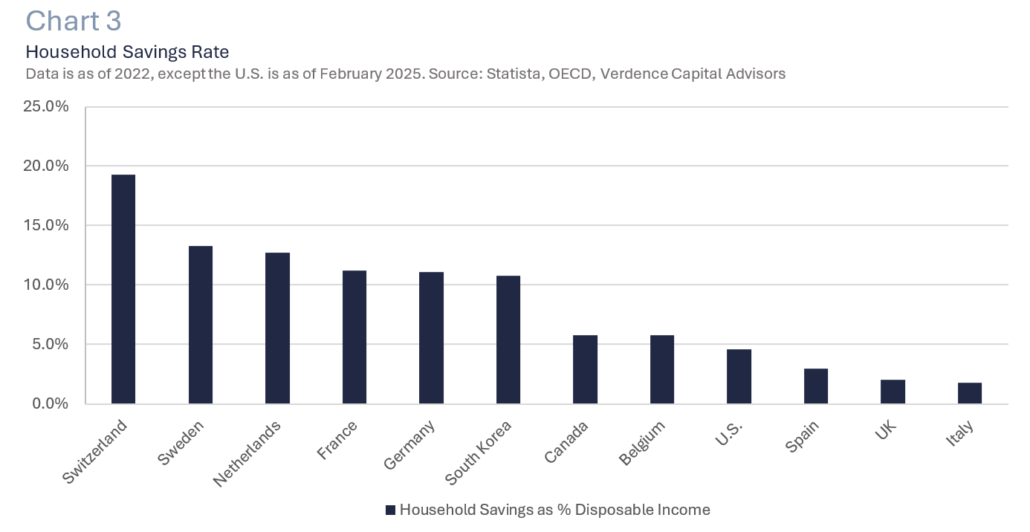

- Americans are not savers. The American consumer makes up 25-30% of global consumption but only makes up 4% of the global population.2 Americans do not save like other developed economies. Instead we spend, and a lot of that spending is in the form of goods (Chart 3), especially cheap goods. While the U.S. is a service-oriented economy, services are not as easy to export as goods. Therefore our exports are lower than our imports.

- Strong dollar hurts U.S. companies. The U.S. dollar has fluctuated against many different currencies throughout different economic cycles. However, the U.S. Dollar Index is ~20% higher today than in 1980. A strong dollar makes imports cheaper for Americans and American exports more expensive for other countries. This exacerbates the imbalance of imports and exports.

Why is Trump Using Tariffs?

The initial tariffs that Trump implemented on Mexico and Canada were in retaliation for the immigration and fentanyl crisis. But the intention of the newest wave of tariffs is to renegotiate existing trade agreements and make trade fair for American companies. It is important to understand that the use of tariffs is not an uncommon part of global trade. In fact, according to the World Trade Organization over 170 countries around the globe currently impose tariffs.3 Bermuda, the Solomon Islands and Cayman Islands are the countries with the top weighted average tariff rates (29.5%, 20.7% and 20.4% respectively).4

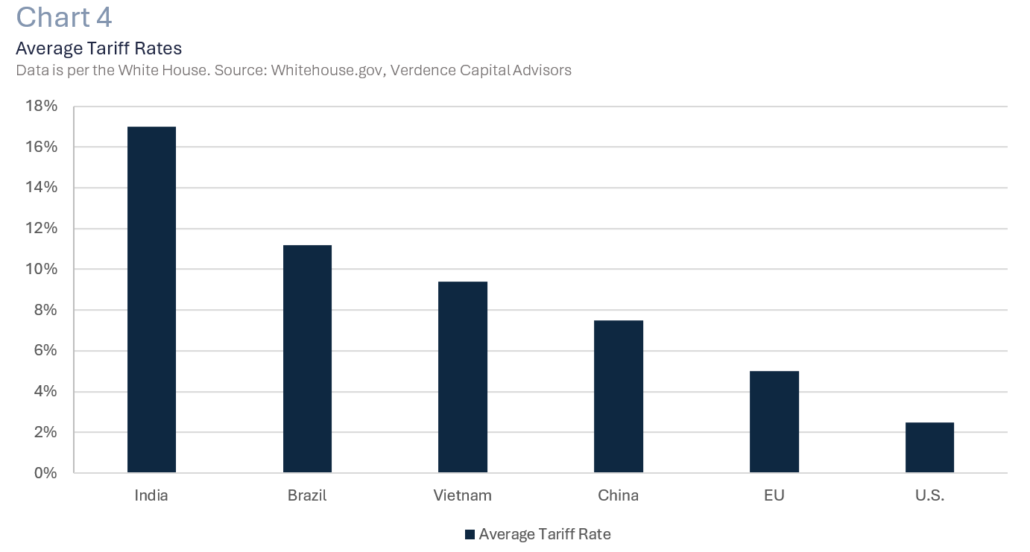

Prior to “Liberation Day,” the U.S. charged a relatively low average tariff rate compared to many other major export countries (Chart 4). This is because we have always been an advocate for free global trade. However, over the years many countries have taken advantage of that. And it is making it difficult for American companies to compete in global trade and raising several risks to our country. Some of the risks and unfair trade practices include:

- Uneven tariff rates: The foundation of global trade was built on reciprocity. However, there are many examples of U.S. products that are sold to other countries. Those companies pay a much higher tariff than the U.S. charges them. For example, U.S. dairy companies face tariffs of 200-300% to sell their products to Canada (after certain quotas are met).5 Harley Davidson motorcycles face over 30% tariffs when sold in the European Union.6 The EU imposes a 10% tariff on U.S. cars sold in their markets, compared to a 2.5% rate imposed by the U.S. on European cars.7

- Financial security at risk: By purchasing goods from foreign countries, the U.S. is sending dollars overseas. Those countries typically buy U.S. Treasuries with that money. This has allowed the U.S. to fund a massive budget deficit by issuing more Treasuries. For example, China and Japan are the two largest foreign holders of U.S. Treasuries. Combined, they hold 5% of the outstanding Treasury securities. If foreign owners decide to slow or sell U.S. Treasuries that would have a direct impact on interest rates in the U.S.

- Intellectual property theft/technology transfer: There are several instances where U.S. companies (especially in technology, aerospace, semiconductors, healthcare) that do business in a foreign country (mainly China). They are required to share technology which has led to the stealing of American intellectual property and puts U.S. innovation at risk.

- Dumping: Dumping is an example of an unfair trade policy. It’s where a foreign country sells goods abroad at a price that is below what it costs them to produce it and lower than what they sell it for in their own country. This puts U.S. companies at a competitive disadvantage.

- Subsidies/Tax Breaks: Foreign countries offer subsidies and tax breaks to their domestic producers. This is so they can sell their products internationally more cheaply. While this is allowed under the World Trade Organization rules, it has damaged U.S. corporations’ global competitiveness.

- Domestic security: We are relying on foreign countries to produce critical necessities. For example, the U.S. imported $246 billion worth of medicinal, dental and pharmaceutical products in 2024. We also imported $649 billion worth of non-agricultural industrial supplies and materials including nuclear fuel, metals and chemicals. We witnessed what the lack of domestic production means in times of crisis. We scrambled for medicine and supplies during the COVID pandemic.

It is important to understand that the use of tariffs is not an uncommon part of global trade.

Verdence View

We understand that even the mention of tariffs is a highly contentious topic. In this white paper, we wanted to educate why the world is talking about tariffs, trade deficits and why we are igniting a trade war with some of our greatest allies. The U.S. is the world’s largest consumer and countries have been using that to their advantage for decades. There has been widespread abuse and even cheating to circumvent the World Trade Organization’s rules and regulations on global trade. Many politicians regardless of their political affiliation can agree on the disadvantages U.S. companies face in global trade, few politicians have the will to tackle the problem.

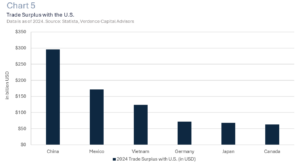

We do not know what the result will be as negotiations are actively taking place, but we believe that tariffs in some form or fashion are here to stay. We do know that President Trump is a negotiator. He has campaigned on that in the past and even showed us his negotiating style in his first term. He comes out hard and fast with the intention to meet somewhere in the middle. We also know that because we are the world’s largest consumer other countries need us to support their own economies. China has a massive trade surplus with the U.S. which shows how important it is for trade to continue (Chart 5).

We think discussions will proceed country by country and concessions will be made on both sides of the table. We also think this will be resolved in the coming months as President Trump has a much bigger campaign promise to satisfy with the extension of the Tax Cuts and Jobs Act that expires at the end of this year. That does not mean it will not come with short term pain.

We have seen that in the financial markets and could see temporary disruptions from a supply chain perspective and a slowdown in growth if not a short and shallow recession. It may also temporarily impact inflation and keep the Federal Reserve in a difficult position on flexibility with interest rates. However, we are looking at dislocations in the market due to the volatility around the constant headlines as buying opportunities. We do not see this as a long-drawn-out disruption. Countries around the world are too intertwined and dependent upon each other to not see some agreements made sooner than later.

Lastly, it is important to remember that our economy is resilient, and U.S. companies are highly innovative and resourceful; we will get through this, and we may even see added benefits when we get to the other side. We have already seen major companies, U.S. and international, commit to considerable investments in the U.S. which can have long term benefits for the U.S. economy. We will continue to monitor the situation and focus on our long-term investment philosophy and take advantage of dislocations when the price is reflecting near-term risks.

If you have any questions or comments, please reach out to your financial advisor.

Megan Horneman | Chief Investment Officer Past performance is not indicative of future returns

1 https://www.epi.org/publication/botched-policy-responses-to-globalization/

2 Consumption data is according to World bank data, 2023. Global population is per worldometer as of 2025.

4 World bank data, most recent as of 2022.

7 https://www.capitalgroup.com/individual/insights/articles/understanding-tariffs-5-charts.html