Key Takeaways:

- Five years since COVID sent stocks into bear market.

- Global economy starting to pay the price.

- S. labor market nearing equilibrium.

- Deficits are out of control.

- Challenges unlikely gone for good.

- Inflation trends since COVID pandemic

Five Years Since COVID Bear Market

Five years ago this week, the S&P 500 started to stumble into a short but painful bear market as the COVID crisis worsened. Fast forward to 2025. The global economy is still dealing with some of the negative ramifications of the actions that governments took in response to COVID. While economists will study the long term effects for decades, we want to take a look at inflation trends since COVID pandemic, and the economic impact five years later.

- S. labor market finally near equilibrium: The pandemic damaged the U.S. labor market for years. Early retirements, health fears and government stimulus kept Americans out of the workforce. This occurred at a time when the world began to reopen. And the pent-up consumer demand was met with a tight labor force. At the peak, there were 12 million job openings for the six million unemployed Americans. As of January 2025, that imbalance was nearly normalized with 6.9 million unemployed and 7.6 million job openings. The labor force participation rate has improved from the lowest level since 1973 during the pandemic but remains below the historical average.

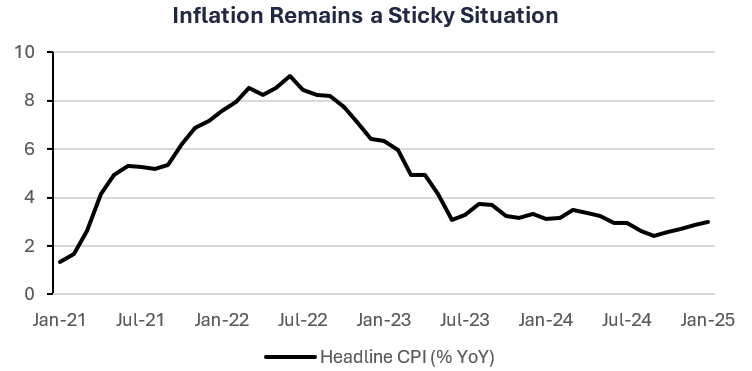

- Inflation has been a residual challenge: Central bank error and excessive spending pushed inflation to multi-decade highs. In the U.S., the Fed started (albeit late) an aggressive tightening cycle and brought inflation lower (CPI peaked at 9.1% and is currently 3.0%) but their progress has stalled in recent months. In addition, the Fed has little control over some of the sticky areas of inflation (e.g., housing). Not even the Fed expects the U.S. to see their target inflation rate (2.0%) until 2027.

- The bill continues to grow: Governments around the world paid a hefty price tag to keep their economies from collapsing during COVID. Global government debt has surged to $102 trillion from $60 trillion 10 years ago (~100% of global GDP).1 However, global GDP only grew $40 trillion over the past 10 years.2 In the U.S., a burgeoning deficit and higher interest rates have worsened the government’s balance sheet. Net interest costs have almost tripled since 2020, and the U.S. is paying more for interest on their debt than Medicare or defense.3

- Consumers still hurting: The net worth of American households has increased by $55 trillion since 1Q20. This has been primarily led by the surge in asset prices (e.g. stocks, housing). Americans have faced continued challenges since the pandemic (especially those that do not own a home or investments). Inflation on items like food, energy and insurance are surging more than wages. Homeowner affordability is hovering near a record low. Credit card debt is at a record high. Confidence has deteriorated. The COVID stimulus has been long gone and savings are depleted.

The Bottom Line:

It is hard to believe it has been five years since the COVID pandemic began. Economic growth has been resilient due to government support and a euphoric consumer. But the negative ramifications are unlikely to disappear anytime soon. There has been a structural change in interest rates and inflation that needs to be absorbed by companies and consumers. Unfortunately, this will likely come at the expense of growth.

Your Economic and Market Detailed Recaps

- Small business optimism falls for first time in five months.

- Headline CPI increases more than expected.

- Consumers slow their pace of spending.

- Tech leads global equity rally.

- Yields relatively unchanged; Municipal bonds underperform.

- Natural gas prices higher on frigid weather outlook.

Weekly Economic Recap — Inflation Picks Up

Small business optimism decreased for the first time in five months in January. Capital spending plans fell at the steepest monthly pace since 1995. The uncertainty indicator increased by the most since 1986 (14 pts.), matching the third-highest level on record.

Inflation as tracked by the Consumer Price Index increased more than expected in January (3.0% vs. 2.9% est. year over year). Shelter costs continued to be a problem as the gauge increased 0.4% for the month and accounted for ~30% of the headline increase. Egg prices increased by the most since June 2015 driven by the avian bird flu outbreak. Core inflation, which excludes volatile food and energy prices, increased more than expected driven by higher prices for car insurance and airfares. Prescription drug prices increased at the fastest pace on record.

Wholesale prices as tracked by the Producer Price Index increased slightly more than expected in January (0.4% vs. 0.3% est. month over month) driven by higher food and energy costs. Diesel fuel costs surged 10.4% in January and egg prices climbed 44% on a monthly basis, and more than 185% on an annualized basis.

Retail sales were sharply lower than expected in January (-0.9% vs. -0.2% est. month over month) and posted the largest monthly drop in two years. Nine of the thirteen categories indicated lower sales, with the largest decline coming from motor vehicles. The control group, which strips out volatile prices and filters into the government’s calculation of spending for GDP, decreased by the most since March 2023 (-0.8%).

The U.S. federal budget gap widened to a record $840 billion over the first third of the fiscal year. Interest costs on federal debt continued to be a key driver to the deficit, as costs hit $392 billion in the period.

Weekly Market Recap — Global Equities Rally on Hopes of Less Severe Trump Tariffs

Equities: The MSCI AC World Index was higher for the second straight week. Global equities rallied on hopes Trump’s reciprocal tariff plans may not be as severe as believed. China equities led global market performance last week as investors bought up AI names, leading the Hang Seng Index to post its best return (in USD) since October 2024. Tech also outperformed in the U.S. as the Nasdaq Composite Index posted its best return since December.

Fixed Income: The Bloomberg Aggregate Index was higher for the fifth straight week. Treasury yields were volatile during the week as hotter-than-expected CPI data spooked investors, but hopes of Trump’s reciprocal tariff plans caused yields to finish the week relatively unchanged. Municipal bonds were lower for the first time in five weeks as volatility in longer-data yields put downward pressure on the market.

Commodities/FX: The Bloomberg Commodity Index was higher for the second straight week. Copper prices were higher for the second straight week as optimism around China stimulus continued. Fears of Trump tariffs on copper also drove the price higher. Natural gas prices were higher as frigid weather continues to drive demand higher for heating oil.