At the start of the year, many economists forecasted that the aggressive tightening cycle by the Fed would result in a recession. Not only did the recession not materialize but GDP is on pace to have grown nearly 3% in 2024. The resiliency of the U.S. consumer helped the economy avoid a downturn. With inflation peaking and slowly moving towards the Fed’s target rate, the Fed was able to cut interest rates by 100 bps in 2H24, which also supported risk appetite. The MSCI AC World Index posted a double-digit return for the second consecutive year led by a strong rally in U.S. equities.

However, the U.S. equity rally was concentrated in the “Magnificent 7” stocks as the euphoria around artificial intelligence sent stocks higher. Bonds produced a modest gain, but it was concentrated on credit as investors reached for yield, disregarding the risk associated with corporate bonds. Lastly, the broad Bloomberg Commodity Index was higher due to gold prices making more than 40 record highs along with rising prices of cocoa and coffee.

As we move into 2025, we expect the economy to grow but at a more modest pace. While the Fed cutting interest rates boosted economic growth at the end of 2024, it is unlikely the Fed can offer the same support in 2025. Inflation has been stubborn and will likely limit the Fed’s flexibility this year. As a result, we are struggling to find a catalyst that can support valuations moving much higher from here. In fact, we are seeing select areas of the U.S. equity market exhibiting “bubble like” characteristics that have us cautious in the near term.

Instead, we think volatility will remain heightened and returns across many asset classes will be more muted in 2025. We continue to focus on valuations and earnings over the misguided emotional mistake of investing with a “fear of missing out.” In addition, we will balance the associated risks and adjust asset allocation when the price factors in the downside risks. On the following pages, you will find our key themes for 2025.

Theme #1: Expansion to continue but at a Slower Rate

The continuation of the U.S. economic expansion has become a very consensus view. However, at the start of last year we also saw a consensus view that the economy would contract.

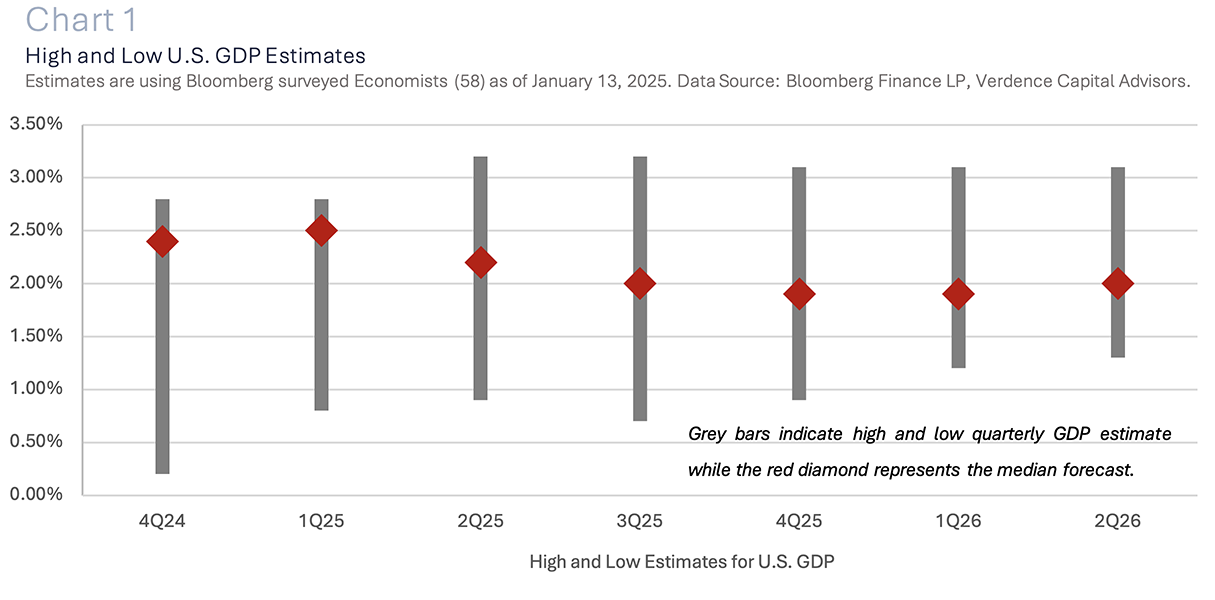

In fact, of all the economists that Bloomberg surveys (58), is not one that expects any quarter in 2025 to post negative economic growth. The median consensus is for steady ~2.0% growth in each quarter this year. (Chart 1).

We think the first half of 2025 will be the most vulnerable to a slowdown in economic activity. With economic growth moving towards a more historically normal pace, it leaves the economy open to fiscal and monetary policy shocks as well as geopolitical shocks. In addition, the consumer spending that we have seen since the pandemic has surpassed expectations and personal finances are worsening.

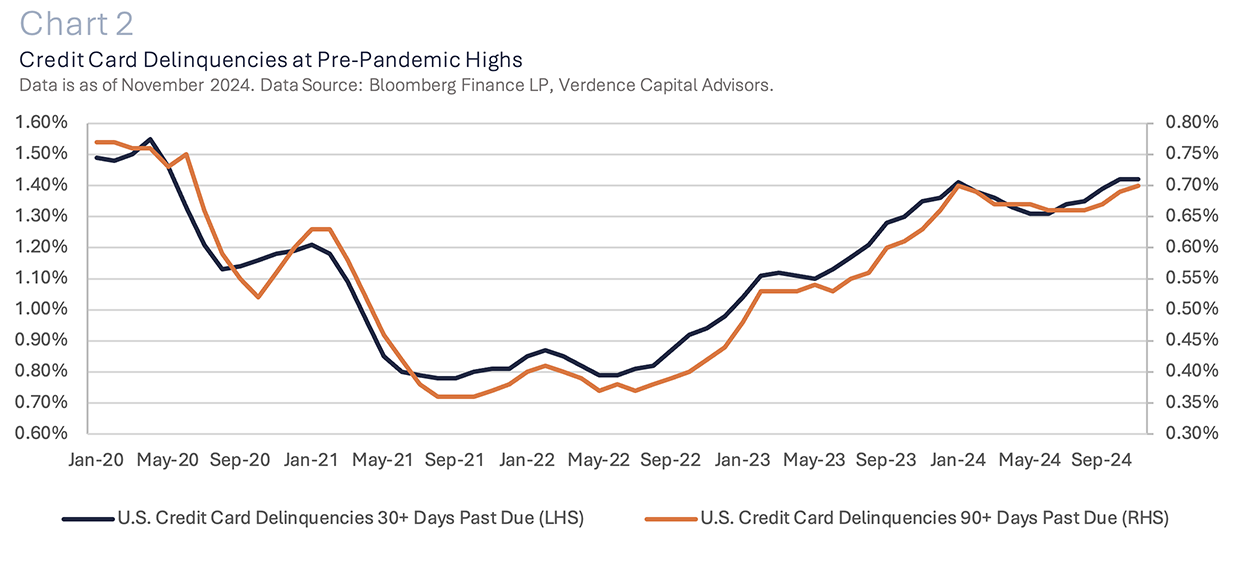

Credit card balances are at record highs. Credit card delinquencies are at the highest level since the pandemic and almost 40% of credit card holders have maxed out at least one credit card.1 (Chart 2).

Additionally, inflation on necessity items like services, housing and food remains burdensome to consumers. Combine that with the Federal Reserve, who has less flexibility with cutting rates, and a labor market that has likely seen its cyclical low in unemployment. This presents headwinds to the consumer spending spree.

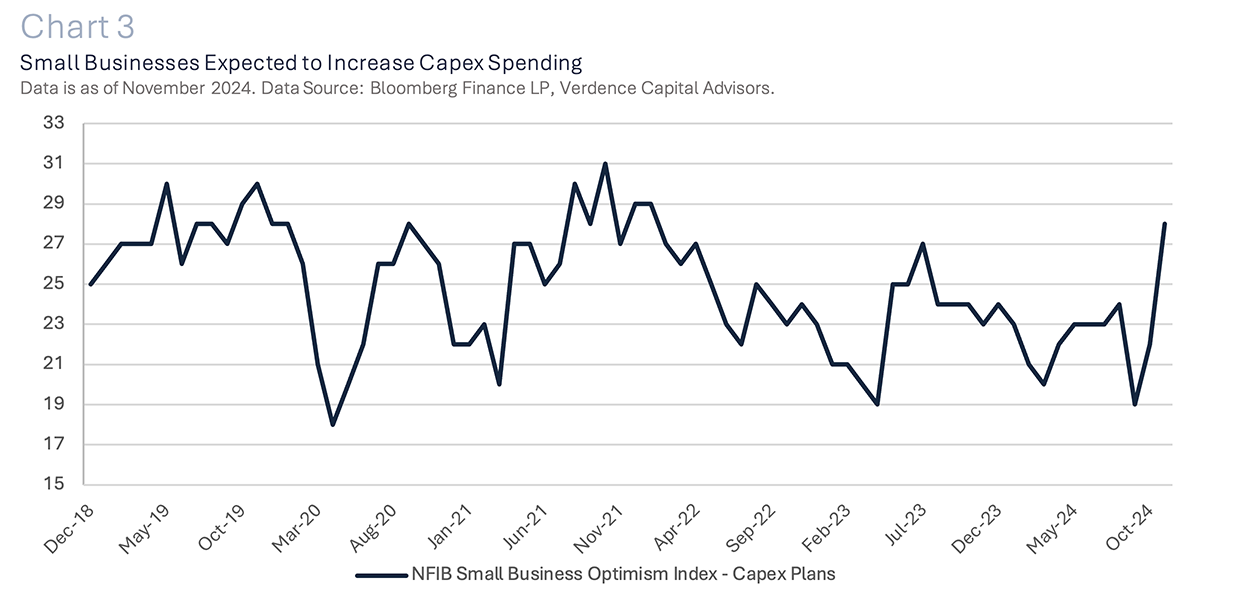

While we may be cautious about growth in the near term, we remain positive long term on the U.S. economy. Technological advancements from the investment in artificial intelligence and its infrastructure and an increase in capital expenditures due to the new Administration’s favorable view on corporate tax rates should support economic activity in future years. (Chart 3).

In fact, according to Gartner (a global company that provides insights and solutions across areas of information technology), worldwide spending on technology will increase by over 9% in 2025 to $5.75 trillion and will be driven by technological advancements and replacements outside of AI spending.2 To put that in perspective that is ~5% of global GDP. 3

Globally, we have witnessed economic stagnation in Europe due to the aggressive interest rate hikes imposed to cool inflation. In addition, slower economic activity in important trading partners (e.g., China) and ongoing energy challenges have hampered economic growth. In 2025, we expect growth to remain positive but muted in Europe as it has become heavily reliant on exports to the U.S., and we expect U.S. growth to cool.

China has tried many different stimulus measures to boost growth in 2024 and none have yielded meaningful change. We expect to see more stimulus out of China in 2025 but must weigh the economic benefit with the threat of ongoing trade tensions with the U.S., the structural challenges in its property sector and a weak Chinese consumer. Therefore, we expect 2025 to be another challenging year for China.

Bottom Line: The U.S. economy has been resilient in its fight to get inflation to the Fed’s target. In addition, the U.S. has held up much better than its global counterparts due to a strong labor market and robust consumer spending. We expect growth to slow in 2025 led by a slowdown in consumer spending, ongoing structural challenges in the housing market, less supportive monetary policy and uncertainty around tariffs.

While we may be cautious about growth in the near term, we remain positive long term on the U.S. economy.

Theme #2: Inflation Battle is not Over

Combating an inflation cycle has never been an easy feat for central banks. In fact, most of the time, inflation moves in waves as opposed to spiking and retreating and staying at the Fed’s target. We think history is repeating itself and 2025 will be a whipsaw between good and bad inflation data.

We know the easy work is behind the Fed and that getting from that 3.0% year over year level to the Fed’s target rate of 2.0% would take an economic slowdown or extraordinarily tight monetary conditions. While the Fed did embark on its most aggressive tightening cycle since the 1970s/1980s, it is hard to say that policy has been significantly restrictive. In fact, the real Fed funds rate (the Fed funds rate minus PCE core year over year) sits under 2.0%. The median average real Fed funds rate before the pandemic was relatively close to where it sits now (from 1972-2019 it was 1.8% vs. 1.9% now). In addition, in prior Fed tightening cycles, the median average peak in the real Fed funds rate has been 5.0%.4

In the most recent tightening cycle that spanned from 2022-2023, the real Fed funds rate peaked at 2.9%. This data suggests the Fed is not necessarily restrictive and is walking a fine line with continuing to ease policy at the same time as the economy is still expanding at a solid pace, inflation remains stubborn, and the unemployment rate has risen but remains relatively low. Therefore, we do not believe that the Fed will cut interest rates two to three times in 2025 like the futures market was suggesting at year end 2023. Instead, we see a higher likelihood they may need to remain on hold in 2025. In addition, if inflation continues to remain persistent, investors should be aware of the odds of a rate hike increasing.

Bottom Line: The progress on inflation has stalled as aggressive Fed rate cuts in 2H24 have refueled economic growth and sticky inflation continues to be problematic (e.g., services, housing). While slower economic growth can help, sticky inflation is hard for the Fed to control without massive Fed rate hikes and/or a contraction in economic growth. Therefore, we think the Fed will be tied to keeping rates on hold in 2025 with a chance of a rate hike if inflation continues to remain problematic.

Theme #3: Global Equities – Expect More Muted Returns with Bar Set High

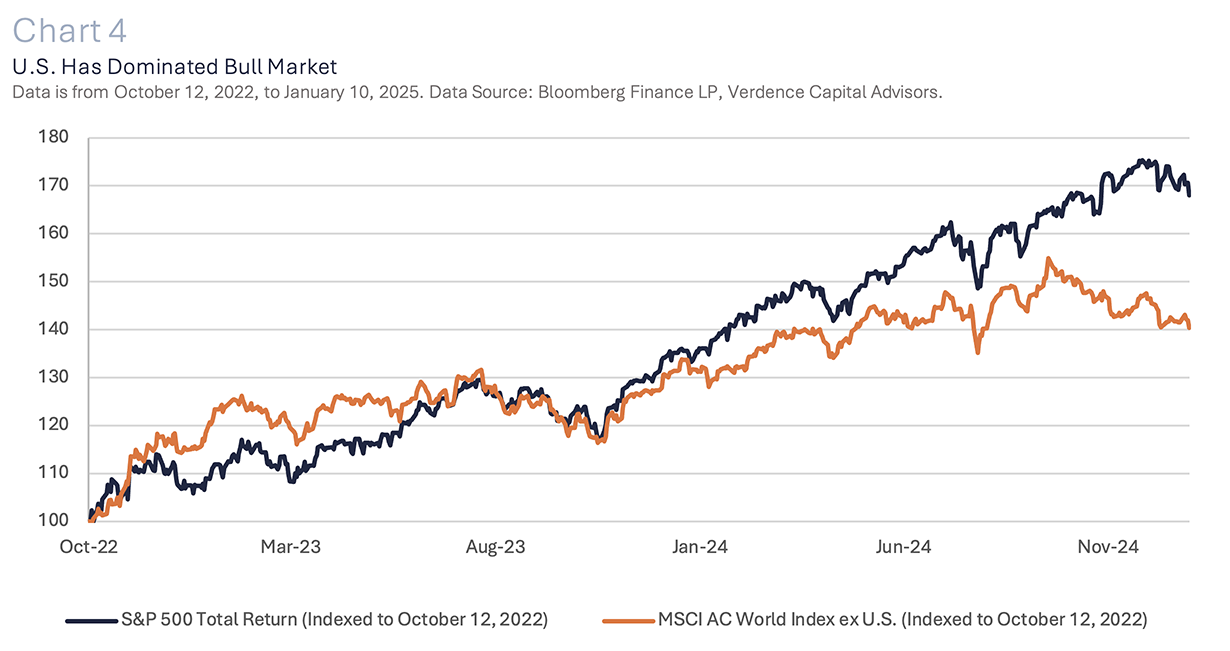

The U.S. has been the leader in the global rally that started in October 2022 (as measured by the S&P 500 vs. MSCI AC World Index excluding the U.S.). (Chart 4). The U.S. has benefitted from better economic and earnings growth, healthier margins and a heavy weighting in technology companies which have been boosted by the evolution of artificial intelligence. The S&P 500 notched 57 fresh record highs, while the NASDAQ posted 51 record highs during 2024.

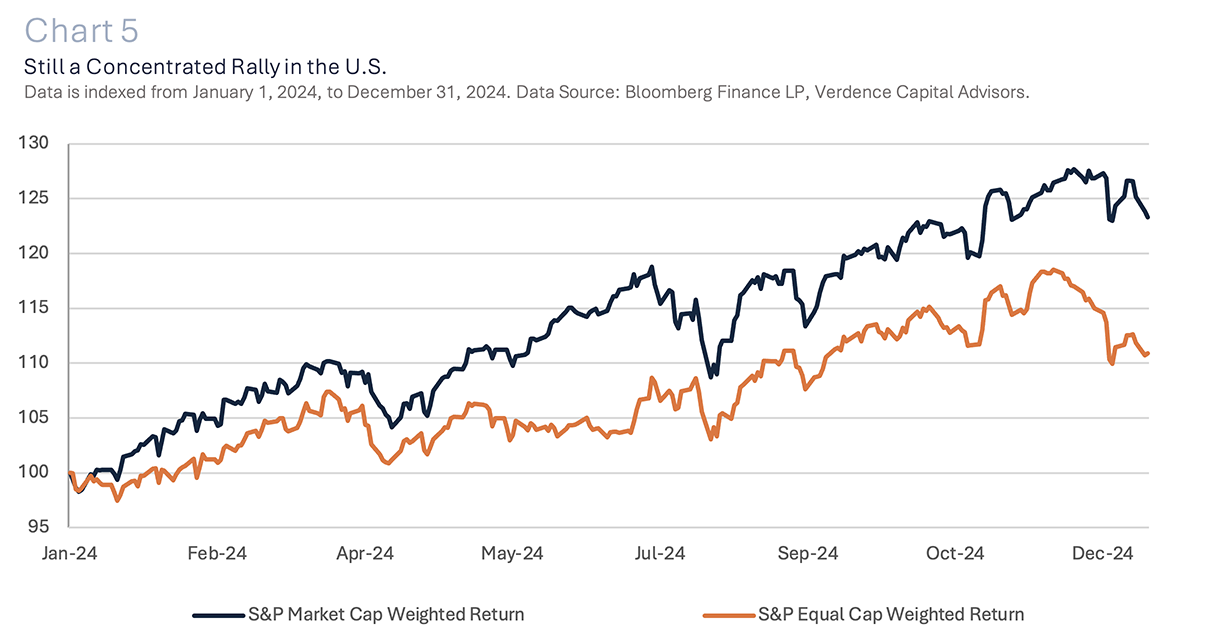

However, using the S&P 500 as a representation of the entire U.S. market is not a fair assessment. Especially since the top five companies by market cap make up 28% of the S&P 500 Market Cap Weighted Index. In addition, the top 10 companies in the Index made up 95% of the total return in 2024. This can also be seen by the performance difference between the S&P 500 Market Cap Weighted Index and the S&P 500 Equal Cap Weighted Index. (Chart 5). The market cap weighted index outperformed the equal cap weighted index by over 12%.

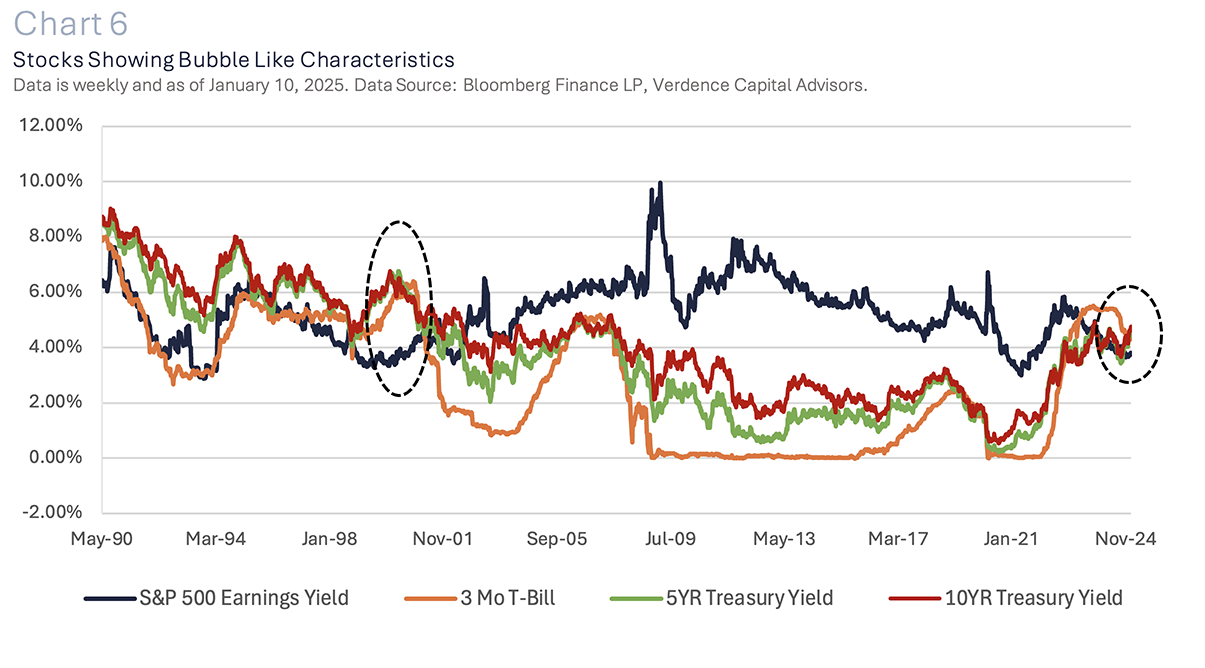

With double digit multiple expansion and earnings growth in the prior two years, the bar is set high for the U.S. equity rally to be as robust as seen in prior years. In fact, the S&P 500 Index has been showing bubble-like characteristics when comparing the yield on equities to a variety of safe bond maturities. The earnings yield on the S&P 500 Index is below the yield on Treasury bills, intermediate Treasury notes and long-term Treasury yields. (Chart 6). This phenomenon has not occurred since the lead up to the dotcom bubble.

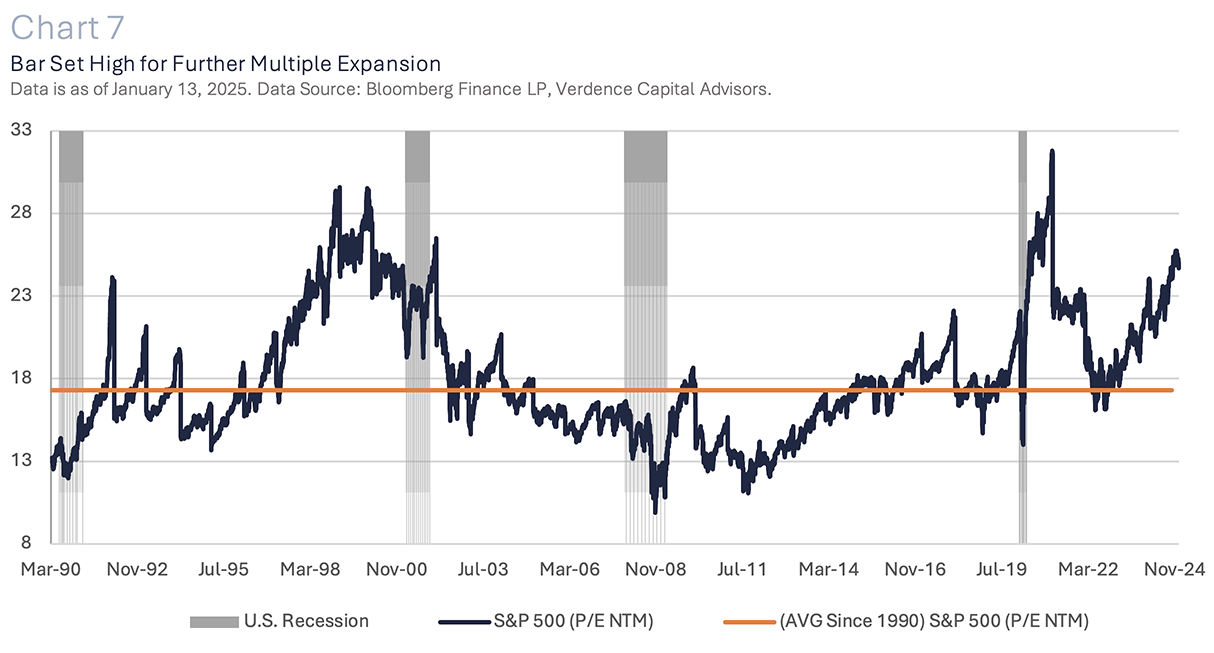

In addition, with the forward price to earnings multiple on the S&P 500 well above its historical average (Chart 7), we believe the bar is set high for multiple expansion in 2025. Especially since multiple expansion has been driven by the anticipation of lower interest rates. Instead, we expect interest rates will remain higher for longer. This is a headwind for valuations, especially those areas of the market that have been driven by price to earnings multiple expansion (e.g., large cap growth and technology). Instead, equity returns will be more dependent on earnings growth than multiple expansion and we expect more muted returns in 2025.

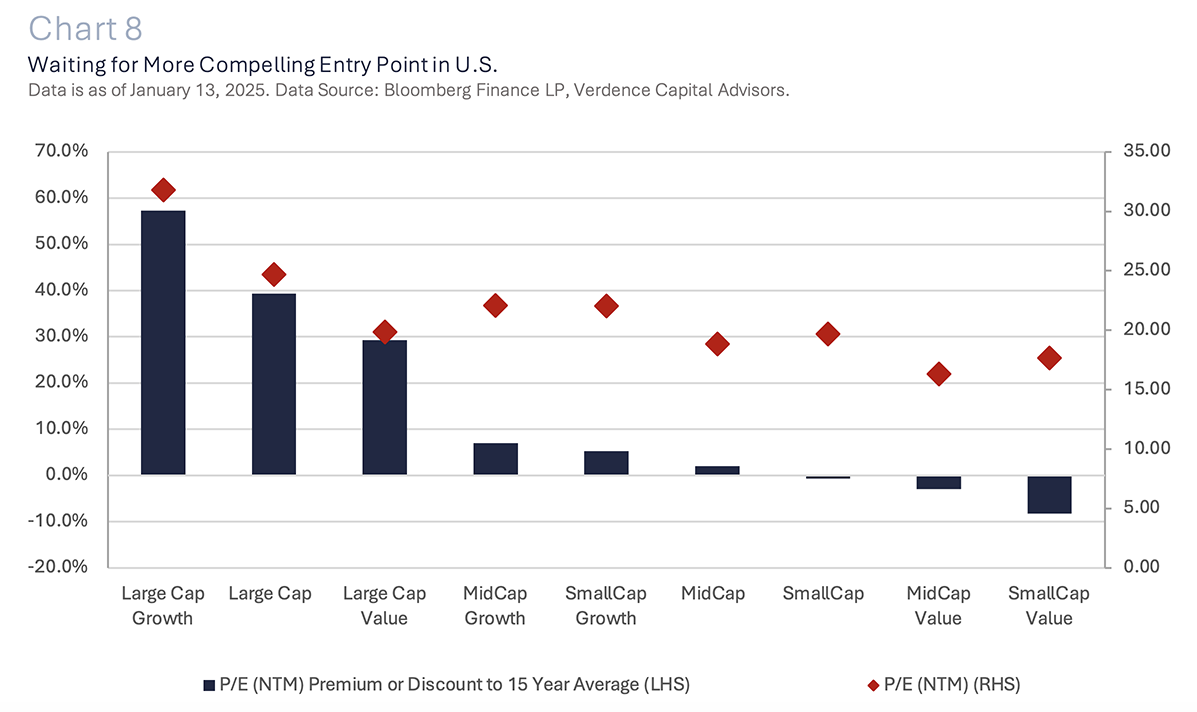

While we favor equities for the long run, it is important to be realistic about the price you are willing to pay for the added risk. With some broadening of the rally beyond U.S. large cap growth and technology in 2H24, valuations across all market cap and styles remain stretched. Therefore, we are patiently awaiting a better entry point to U.S. equities. Within our global equity allocation, we recommend the following:

- Do not overpay for technology: The forward P/E of the NASDAQ 100 is hovering near the highest level seen since the dotcom bubble. While we believe in the AI evolution, the multiples may be reflecting the long-term upside to earnings and not factoring the risk of higher interest rates for longer. We would wait for better entry points where we believe the risks are factored in prices.

- Small and midcap and value cheaper but not cheap: Small and midcap stocks are attractive compared to the large cap space but are not trading at significant discounts that would warrant adding exposure at this time. (Chart 8). In addition, small and mid-cap stocks are sensitive to domestic economic growth as well as interest rates. Both present a headwind. Value across all market caps is cheaper than growth but the discount for select market caps (small and midcap value) is not enough to warrant the risk. In addition, we think the benefit of less regulation, a steeper yield curve and slowing economy are already reflected in the premium paid for large cap value stocks.

- Diversify outside of the expensive U.S. markets: The international markets continue to lag the U.S. rally, but we believe this can change in the coming year. While economic fundamentals and earnings remain challenged in both developed and emerging markets, it is likely reflected in the depressed multiples, especially compared to the U.S. Currently, we prefer the developed international markets over the emerging markets, but active management is crucial in this highly uncertain economic and political environment. Select emerging market companies can benefit from the artificial intelligence boom. However, China’s ongoing structural issues and geopolitical tensions with the U.S. present ongoing headwinds. In addition, Japan is finally escaping the deflation environment that has plagued their economy for decades but risks to the stability of the Yen remain a concern.

Bottom Line: We favor equities over bonds for the long run but are disciplined about the price we are willing to pay for exposure to equities. U.S. market valuations look stretched and even bubble like in select areas (e.g., growth and technology) and we expect heightened volatility will present better entry points. International equities are a good way to diversify outside of the expensive U.S. markets, but due diligence and active management are crucial due to the varying dynamics across economic growth and political tensions.

While we favor equities over bonds in the long run, it is important to be realistic about the price you are willing to pay for the added risk.

Theme #4: Fixed Income – Higher for Longer

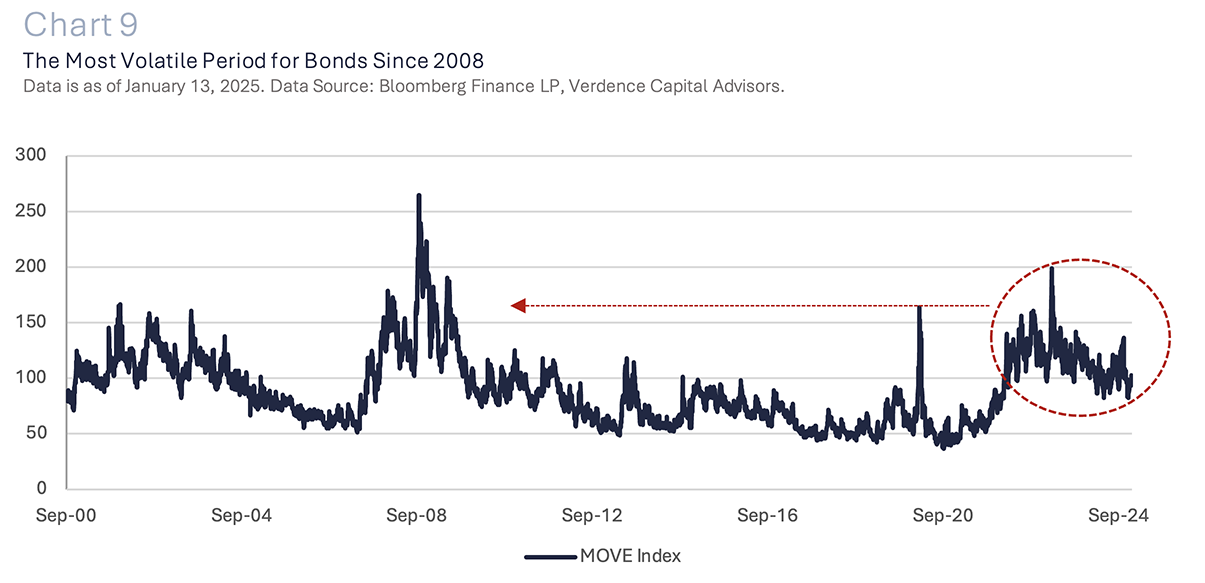

The broad fixed income market was able to post a modest gain in 2024, but it did not come without its waves of volatility. In fact, the MOVE Index which measures volatility across U.S. Treasuries has moved higher since 2021 and is in a period that is the most volatile since 2008-2009 (Chart 9). Investors have been fortunate to experience a multi-decade bull market in bonds, pre-pandemic, which kept volatility in control. However, we think investors need to understand that ongoing yield volatility is the new normal. Interest rates, specifically long-term interest rates, should remain volatile as investors get whipsawed by inflation and economic growth fundamentals. In addition, Treasuries will be challenged by the massive supply glut as the deficit is funded. While bonds should be used as a portfolio diversifier, we recommend the following allocation:

- Duration matters: When interest rates are rising due to better economic fundamentals, that can support risk assets from equities to corporate bonds. However, what we are seeing is that Treasury yields are moving because of higher inflation expectations. With the yield curve in positive territory after being inverted for years, it makes sense for investors to move away from ultra short duration bonds and cash and invest in an intermediate term maturity range (5-6 years). This range of maturities should benefit as growth slows and helps to mitigate interest sensitivity if inflation becomes a problem longer than anticipated. We would avoid bonds beyond that maturity range as structural issues remain with supply and the deficit.

- Credit expensive: Credit has been extraordinarily resilient in recent years despite bankruptcies accelerating as investors’ demand has been strong with the highest absolute yields that investors have seen in over a decade. However, like equities, valuations as measured by the extra yield investors demand to own corporate bonds, remain historically tight. We will be patient and look for opportunities when spreads (extra yield over Treasuries you earn for the added risk) offer an attractive risk/reward dynamic.

- Municipals attractive: Municipals had a difficult year in 2024 but yields, especially after-tax yields, may be reflecting the downside risk that has risen due to uncertain inflation and volatility in Treasuries. In addition, most state and local governments have healthy balance sheets, so credit risk is muted. Lastly, with the rise in municipal yields, investors in a variety of different tax brackets (not only the top tax bracket) can see yields superior to Treasuries and even select investment grade corporate bonds.

Bottom Line: Fixed income should be used as a portfolio diversifier, but investors should get accustomed to a more volatile environment for bonds and higher for longer yields. Inflation continues to be one of the major risks to fixed income. In addition, spreads (the extra yield investors earn over Treasuries to own corporate bonds) remain historically tight and leave little room for shocks (e.g. more bankruptcies, higher for longer rates). Extending from cash with a positive yield curve should prove to be beneficial but keep duration exposure in the intermediate part of the curve.

Fixed income should be used as a portfolio diversifier, but investors should get accustomed to a more volatile environment for bonds.

Theme #5: Alternatives – A Shelter from Expensive Public Market

For qualified investors, alternative investments can perform well in periods of stretched public market valuations, slowing economic growth and an uncertain interest rate path. On the private side, managers have more flexibility and time to find and make good long-term investments.

For clients that invest in private investments they are spared the daily volatility. This volatility is typically seen in public markets and historically has offered an uncorrelated asset with robust risk adjusted return opportunities. Not only are alternatives good for an added layer of asset class diversification but from a vintage year perspective, it is important to have some diversification.

Historically, periods of economic weakness have offered private equity managers the opportunity to find attractive long-term investments. We like private credit but admit the space is getting crowded and due diligence is crucial.

We believe that one of the most attractive areas of alternatives is in the real asset space. Real assets can not only perform well in periods of heightened inflation but also in periods of infrastructure investment.

The infrastructure investment that is occurring due to artificial intelligence (e.g. electricity), aging infrastructure being highlighted with natural disasters and the potential for price appreciation and income should benefit investments in the real asset space. Commodities also fall within the real asset space, but diversification and active management is crucial in a period of slowing economic growth and ongoing geopolitical tensions.

We realize that many investors are questioning investments in cryptocurrencies due to the regulatory environment changing and the new administration favoring the investment. However, we have not changed our view that cryptocurrencies do not belong in a long-term diversified portfolio.

There is still no cash flow or earnings to create a valuation for cryptocurrencies, they are not regulated to protect investors and are still used by thieves and criminals. The volatility and lack of a pricing mechanism make it difficult for cryptocurrencies to warrant a spot as a separate asset class or real asset within alternatives. Instead, we view these as highly speculative investments and warn investors of the high volatility and risk of loss.

We continue to recommend alternatives for qualified investors as a portfolio diversifier.

Bottom Line: We continue to recommend alternatives for qualified investors as a portfolio diversifier, an uncorrelated asset and the potential for income and price appreciation. Real assets and low volatility hedge funds offer a good opportunity.

The Bottom Line

If we combine all our themes into one theme for 2025, it is, what is the appropriate price to pay for an investment? We have witnessed bubble like characteristics in select areas of the U.S. equity market as investors cling to the newest technological advancement in AI.

While we agree that AI is a technological game changer, we think the momentum driven rally is inflating multiples and not pricing in any downside risk.

We warn investors that making investment decisions based on a fear of missing out is not a recipe for long term investment success. Instead, we remain disciplined with our approach to asset allocation. We will evaluate investments whose price reflects the risks that we see from an economic and interest rate perspective in 2025.

Given the highly uncertain economic, political and geopolitical environment we expect volatility in both equities and bonds will remain heightened and present opportunities to take on more risk.

Currently, we are entering 2025 with a defensive and cautious approach across our asset allocation buckets with extra cash to put to work as opportunities present themselves.

As always, if you have any questions about our perspective, please do not hesitate to reach out to your advisor.

Author: Megan Horneman | Chief Investment Officer Past performance is not indicative of future returns

2: https://www.cio.com/article/3587053/gartner-projects-major-it-spending-increases-for-2025.html

3: Using World Bank estimate for Global GDP in 2025.

4: We looked at all tightening cycles from 1972-2019. Our definition of a tightening cycle is three consecutive rate hikes without a cut in between. We do not count the period on hold in the median average real Fed funds rate. We stop in the month of the last rate increase.