This article is a guide to learn how to avoid identity theft, identity theft prevention services, how to protect your credit, as well as tips for identifying scammers. It’s a holistic take on identity theft protection.

In today’s digital age, protecting oneself from identity theft has become increasingly crucial as scammers continuously evolve tactics to exploit unsuspecting victims. The importance of robust identity theft protection cannot be overstated, particularly in light of high-profile data breaches. To avoid falling prey to these malicious actors, consumers must be vigilant and proactive in securing their personal information. This includes utilizing credit freezes, monitoring and identity theft prevention services, and secure password practices to outsmart scammers and safeguard their identities against potential threats. It’s a holistic approach to identity theft protection.

Remember the Equifax hack? What a mess. In September of 2017, 148 million Americans’ personal data was compromised.1 One month later, Equifax disclosed this breach. Ironically, Andrew Smith, an attorney representing Equifax, explained that Equifax had no fiduciary duty to safeguard customers’ data.2 What?? Later, the Consumer Protection Agency appointed Andrew Smith as Chief of their organization.

With that said, consumers must take the lead role in protecting their own credit. This hack affected roughly 73% of all adults with a credit history.3 And ironically, Equifax is a credit reporting agency and is the agency the Social Security Administration used to safeguard its data. Since the Equifax hack, there have been many other breaches. Just in the last half of 2023 alone, these notable companies reported security breaches.

- Norton Healthcare

- Vanderbilt University Medical Center

- Toronto Public Library

- Infosys

- Boeing

- Duolingo

- io

- Indian Council of Medical Research

- IBM MOVEit

- Maximus

- Missouri Medicaid

- Okta

- Police Service of Northern Ireland

- Air Europa

- 23andMe

- SONY

- Topgolf Callaway

- Freecycle

- Forever 21

- Norwegian Government

So, let’s look at identity theft protection solutions.

Identity theft prevention and learning how to avoid it in the first place is crucial in the modern tech era, where scammers are constantly finding new ways to exploit personal information: including credit. Personally, I have experienced three separate occasions when scammers have attempted to open credit for themselves under my identity! Therefore, I quickly learned that freezing my credit stopped their attempts cold!

The research I completed and my own personal experience show the best path is to contact the four credit agencies and place a credit freeze. As of September 2018, freezing and unfreezing your credit is free for all consumers. A credit freeze prevents anyone, including yourself, from opening credit in your name.

If you are currently in the process of buying a house, car, or securing a loan otherwise, this will obviously complicate that legitimate process. Also, if you are in the midst of having a legitimate credit report pulled, you may have to wait until the credit report is pulled. And also, if you have frozen your credit, you may be required to unfreeze it at some point. Freezing and unfreezing credit is simple. You can temporarily unfreeze credit for one or several days to allow a legitimate credit report to be pulled.

And remember, the FTC requires credit bureaus to unfreeze your account upon your request within one hour if you request online or by phone. Or even within three business days if you make your request by mail. Most lenders seem more than willing to share the time frame and require only one day.4 This should be the new normal. It would be best if you did this for your elderly parents and for your children as well.

One way this process can be made more efficient and offer more identify theft prevention is by using a password manager (like Dashlane, LastPass, or NordPass) to log passwords to each site. To enhance security, create complex passwords that do not include your name or personal information. Do not re-use passwords—make each unique.

Weblinks to freeze your credit online — tested and verified January 8, 2024:

Equifax

Experian

Transunion

Innovis*

*Innovis is smaller, but a legitimate credit agency

Freezing your credit will:

Prevent scammers

Be of no cost to you

Freezing your credit will not:

Affect your credit score

Stop pre-approval credit offers

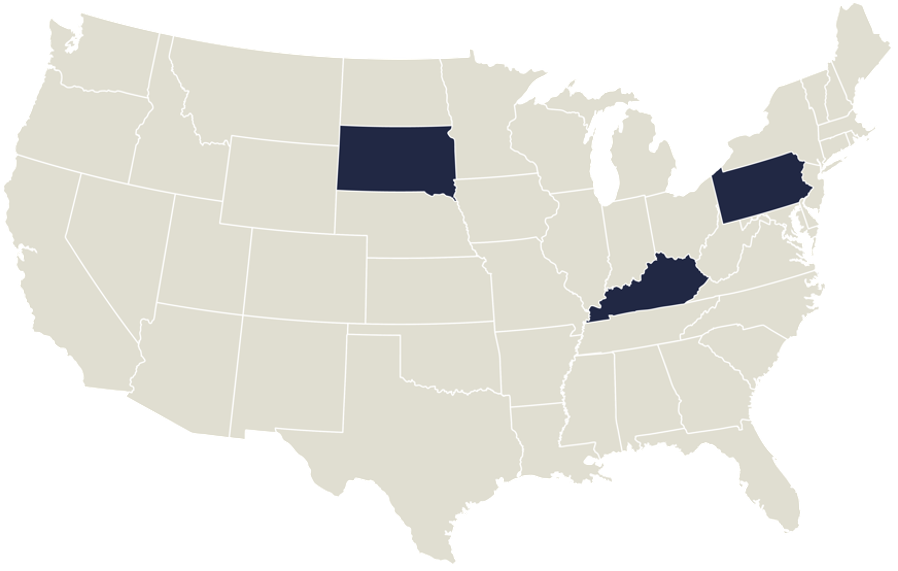

As of this writing, three states, Kentucky, Pennsylvania, and South Dakota remove your credit freeze automatically after seven years. The others are permanent.5 This is subject to revision.

Of course, it is important to note that freezing your credit will not have a negative impact on your credit score.

Opting Out

To prevent scammers or someone from intercepting your mail and using the offer to open an account, you

can stop the pre-approved credit offers by calling 888-5OPTOUT (888-567-8688). In addition, you can do this online at www.optoutprescreen.com.

Scroll down to the bottom of the page to the “Click Here” button. This will stop the offers that go through the consumer reporting agencies, which is most of them. It’s good for five years electronically or you can make it permanent for mailed offers.

This is a free service and just another way to protect yourself from scammers, and secure yourself with identity theft protection.

Paid Monitoring and Identity Theft Prevention Services

Of course, it may make sense to consider paid identity theft prevention services such as LifeLock*, EZ Shield,* Privacy Guard*, Identity Guard*, IdentityForce*, or ID Watchdog*. These identity theft prevention services or monitoring services are certainly helpful and have merit and are more helpful if one becomes a victim of identity theft. Of all these, ID Watchdog is the only one of the identity theft protection services that will help if you have already been an ID theft victim.

If you are inclined to let a service work for you in this regard, all are valid choices. Credit Sesame and CreditKarma and many credit cards offer free monitoring services. I suggest you check your credit score at least once per month through one of these free services to check for anomalies.

Consumers Advocate ranked Identity Guard and IdentityForce the two best identity theft prevention services, however other sites have many different rankings. Consumers Reports, however, suggests a more direct approach by checking your own credit through annualcreditreport.com, signing up for credit and banking alerts, and using credit freezes.

*Monitoring services are not endorsed by Verdence Capital Advisors

File Taxes Early

File Taxes Early

According to a CNBC report, the IRS flagged more than one million tax returns for identity fraud in 2023. Filing income tax returns as early as possible, makes it more difficult for scammers to file a bogus return and get an artificial refund. Never leave your paper tax returns in your mailbox to be sent to the IRS.6

The Bottom Line:

- Do not reuse passwords, use a well-researched password manager and autogenerate passwords

- Choose a reasonably complex password for your password manager

- Have a secure data backup – newer Solid-State Drives (SSDs) often fail without warning

- Shred credit card offers or anything that could be used to usurp your credit

- Don’t let someone (potential scammers) with bad grammar, a bad accent, or someone with a website with fuzzy graphics who just phoned you bully you into wiring money right away

- Don’t trust anyone/scammers who demands cash, Western Union, Venmo, or gift cards as payment

- Check your accounts regularly, question unfamiliar charges

- Sign up for text alerts for your credit cards and bank accounts so you get an alert for any purchase on the cards you use

- If your credit card company provides the ability to create a virtual credit card, create one and use that virtual account number to make online purchases

- The IRS will never call or email to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer

- Generally, the IRS will first mail you a bill if you owe any taxes

- The IRS doesn’t initiate contact with taxpayers by email, text message, or social-media channels to request information

- The IRS will not threaten to immediately bring in local police or other law-enforcement groups to have you arrested for not paying, nor will they demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe

- The IRS will never ask for credit or debit card numbers over the phone

Author:

Kelly Wright | Director of Financial Planning

Sources:

https://tech.co/news/data-breaches-updated-list

https://www.creditkarma.com/id-theft/i/lift-credit-freeze

https://consumer.ftc.gov/articles/prescreened-credit-insurance-offers

Footnotes

- https://www.ftc.gov/enforcement/refunds/equifax-data-breach-settlement

- https://www.nytimes.com/2018/05/11/technology/ftc-consumer-protection-chief.html

- https://www.census.gov/quickfacts/fact/table/US/PST045223

- https://www.creditkarma.com/id-theft/i/lift-credit-freeze

- https://tradelinesupply.com/what-is-a-credit-freeze/#:~:text=In%20Kentucky%2C%20Nebraska%2C%20and%20Pennsylvania,to%20lift%20a%20credit%20freeze

- https://www.cnbc.com/2023/05/17/irs-flagged-more-than-1-million-tax-returns-for-identity-fraud-in-2023.html

Disclosure:

The information presented herein is for educational purposes only, is the opinion of the author and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. It is not intended to be and should not be treated as legal, tax, investment, accounting, or other professional advice.