The first half of 2024 was much better from an economic and asset class return perspective than most had anticipated. While inflation gave investors a scare earlier this year, prices eventually resumed their deceleration in 2Q24 and the probability of the first Fed rate cut in over four years has accelerated. As a result, equities (as measured by the MSCI AC World Index) posted the second consecutive start to a year (through 2Q) with double digit gains. This is the first time this has occurred since the Index was created (in 1998). Bonds were modestly lower as investors focused more on the stronger than expected economy than the deceleration of inflation.

As we move into the second half of the year with an unprecedented election season, a still uncertain Fed path, economic growth that is struggling and elevated equity valuations we expect volatility to continue. In this quarterly, we will address the ongoing concerns with the economy. We will outline how to look at portfolios with the anticipation that cash rates may fall. In addition, we will continue to reiterate patience and highlight where we see value in the global equity market.

U.S. Economy – Not a Technical Recession Yet, but it Feels Like One

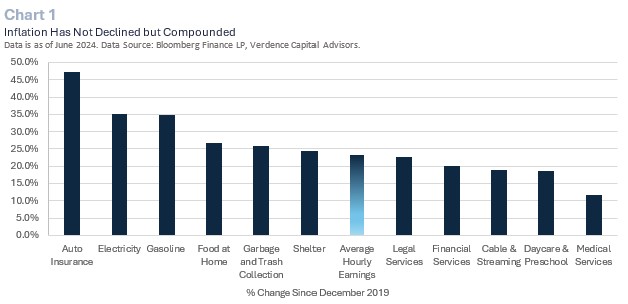

The U.S. economy has been extraordinarily resilient and has avoided the technical definition of a recession this year (i.e., two consecutive quarters of negative growth). However, that does not mean that most Americans don’t feel like we are in a recession. In fact, in a recent survey, three in every five Americans believe the U.S. is already in a recession.1 While inflation has been decelerating, it is not declining. The compounded effect of continual above average price increases, especially on necessity items, is squeezing the American consumer. For example, auto insurance is nearly 50% higher than it was before the pandemic. Household electricity is 35% higher and food is over 25% higher, all of these are outpacing the gains in earnings. (Chart 1). The result has been an ongoing dependency on credit cards and a weakening in consumer confidence. American’s credit card debt is exceeding $1.3 trillion, and delinquencies are rising.

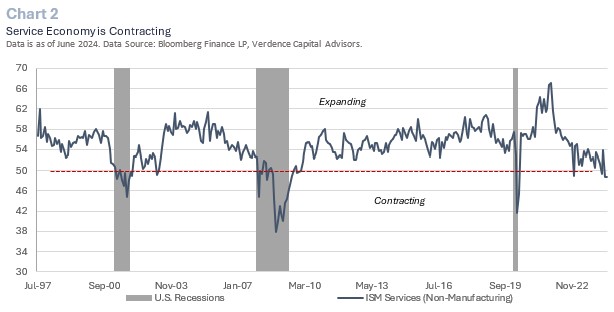

While the consumer makes up the majority of GDP, there are other areas of the economy that are flashing recession signals. Manufacturing has been in contraction territory for 20 out of the past 21 months. This has never occurred in American history without a recession. In fact, there was only one other time where manufacturing had contracted for more time and that was the recession of 1990-1991. While we are more of a service-oriented economy than a manufacturing economy, it is important to note that even the service index has dipped into contraction territory. (Chart 2).

Aside from the Leading Indicator Index flashing warning signs, bank lending conditions being tight, housing in a deep recession, business confidence tepid and consumer discretionary spending deteriorating, we are now starting to see cracks in the labor market. The consumer and the labor market have been the two pillars keeping the economy from dipping into a recession. However, we have often highlighted the fact that employment is a lagging indicator. Companies typically do not lay off workers until the economy is already contracting. We have seen continuing unemployment claims jump to the highest level since 2021, employment in the ISM Manufacturing Index has been contracting (level below 50) for most of the last two years and even employment in the service sector is contracting rapidly (Chart 3). Lastly, the unemployment rate has jumped to the highest level since October 2021.

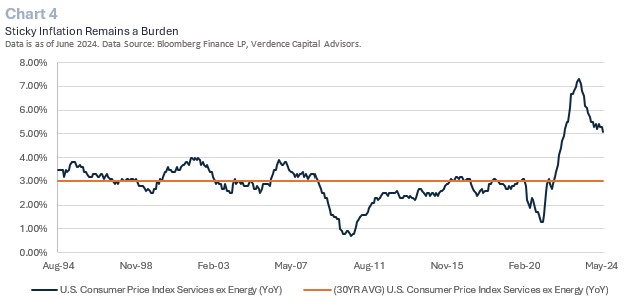

In aggregate, these indicators lead us to remain very cautious about the prospect for economic growth. While it is rare for an economy to enter a recession in an election year, it is not unheard of. We have seen the economic dominoes falling since the Fed started their most aggressive rate tightening cycle since the 1970s/1980s. We believe the Fed will cut rates in 2H24, likely in September, but additional rate cuts will be dependent on inflation and how much faster the labor market unravels. While headline inflation is consistently moving lower “sticky” inflation, which is inflation on items like housing and services, is still growing well above the level of earnings and the Fed’s target rate. (Chart 4). If this does not improve more quickly, it will put a lid on the Fed’s flexibility with rate cuts. In addition, while the money supply has contracted since its peak (from $21.7 trillion to $21.0 trillion) it is still ~75% of nominal GDP and it has been steadily increasing for the past four months. These factors make aggressive rate cuts highly unlikely.

While the consumer makes up the majority of GDP, other areas of the economy are flashing recession signals.

Global Equities – Pricing in Perfection is Not Rational

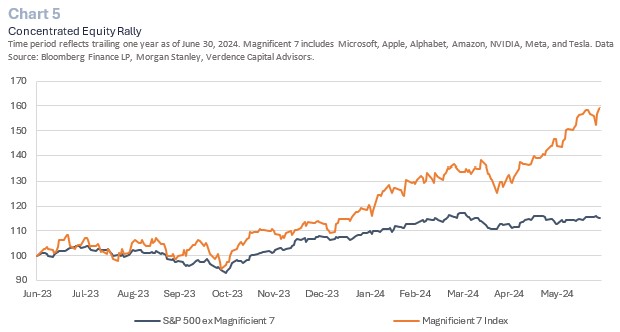

The MSCI AC World Index posted its third consecutive quarter of gains in 2Q24 and the sixth best start to a new year in the past 25 years. The returns were primarily led by the U.S. and its technology heavy large cap indices (i.e., S&P 500, Russell 1000 Growth, and Nasdaq). The AI boom that has dominated the market in recent years continued through 2H24. In fact, the Magnificent 7 (i.e., Microsoft, Apple, Alphabet, Amazon, NVIDIA, Meta and Tesla) have outperformed the rest of the S&P 500 by more than 40% over the past one-year time frame. (Chart 5).

We favor equities over bonds for the long run, but we believe equity valuations are not pricing in the downside risk that is growing for the economy and earnings. Instead, valuations are pricing in a perfect soft landing for the economy and a Fed that will start an aggressive easing cycle. As we explained in our economy section, neither of these are realistic at this point.

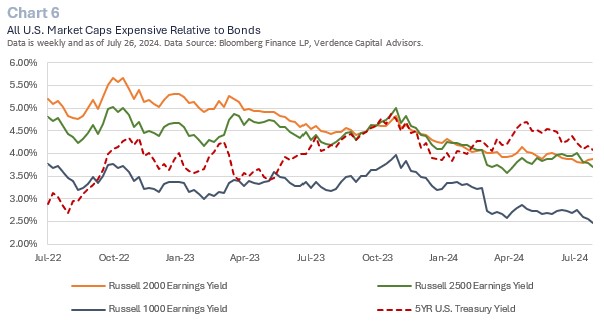

At the end of 2Q24, when we compare U.S. equities across all market cap levels, they are trading below bond yields. (Chart 6). This is rare and proves to us that equities are expensive compared to bonds at current levels. From an earnings perspective, estimates for 2025 have barely moved to reflect the slowing economic backdrop. Instead, earnings growth of 10-15% for 2025 is highly unlikely given the ongoing economic challenges. In addition, companies do not have the same pricing power they once had and in an economic downturn pricing power becomes limited. This is a risk to margins which have been resilient in this inflationary environment.

We have just recently started to see some rotation out of the expensive large cap growth stocks into small and midcap stocks. If equities are falling only due to a valuation correction, small and midcap stocks that have more realistic valuations may outperform. However, an equity correction that is driven by an economic slowdown and/or recession (as we expect) can hit all market cap levels. Especially those more cyclical like small and midcap stocks. While the small and midcap space should see the best rebound coming out of an economic downturn, we would prefer to see them pullback more before adding to the exposure.

International equities (both developed and emerging market) also look attractive versus the U.S. Although European economic growth is registering a mild recovery, the powerhouse of Germany just posted a quarter of negative growth. While this gives the ECB flexibility to continue to cut rates, which should be good for equities, the EuroStoxx 50 is only 6% off its record high. Not a compelling entry point. In addition, Japan is raising rates as it struggles to stabilize its currency. This can have cause ripple effects across other developed countries.

At this point, we are comfortable with a neutral allocation to global equities compared to our long-term strategic allocation and having an overweight cash position to find better entry points for the long run. While we remain wary on the outlook for economic growth, we will look to add to areas of the equity market when they better reflect the downside risk. At this point we are being patient and believe having flexibility with cash in these highly uncertain and volatile times should prove beneficial for good entry points to seek long-term returns.

Fixed Income – Opportunity but Cautious about Debt Overhang

Fixed income returns were relatively flat in 2Q24 as decelerating inflation helped keep yields contained. Short term fixed income outperformed long term bonds as investors began pricing in Fed rate cuts. Typically, when an economy slows or heads towards recession, investors should push their fixed income maturity range further out to get more potential for price appreciation. However, we would still stick relatively close to the Bloomberg Aggregate benchmark due to the deteriorating situation with the budget deficit. According to the Congressional Budget Office, our Treasury debt outstanding is expected to rise by ~75% over the next 10 years. This massive supply will need to be absorbed. This is occurring while international investors have less need for U.S. Treasuries since they can earn yield in their domestic bond markets and the Fed has been reducing its balance sheet of bonds. Fixed income will always have a place in portfolios as an important part of diversification, but we remain defensive in our positioning in fixed income (from a maturity and credit perspective).

Despite our view that the economy is expected to slow, which should cause attractive returns in long term bonds, we remain cautious given the deteriorating fiscal health of the U.S. government. Ongoing volatility at auctions, stubborn inflationary pressures, and lack of clarity from the Federal Reserve will likely keep yields on long term bonds volatile and the interest rate risk high. Therefore, we would focus on intermediate term bonds for the long run. We are also patiently awaiting the chance to add to credit (high yield and/or investment grade) but we believe the extra yield investors earn over Treasuries is still too small to justify the risk. We will watch them closely for opportunities as the economy weakens.

Alternatives and Commodities –

Diversification and Risk

For qualified investors, we continue to favor a well-diversified allocation to alternative investments. Alternatives have historically performed well in periods of economic uncertainty and in periods of tighter lending conditions. On the private side, managers have more flexibility and time to find and make good long-term investments. For clients qualified to invest in private investments, they are spared the daily volatility seen in public markets and historically have been offered an uncorrelated asset with robust risk-adjusted return opportunities. Not only are alternatives good for an added layer of asset class diversification but from a vintage year perspective, it is important to have some diversification. Historically, periods of economic weakness have offered private equity managers the opportunity to find attractive long-term investments. We like private credit but admit the space is getting crowded and due diligence is crucial. In addition, real assets may present additional opportunities, especially in the real estate space as mortgage rates peak. Lastly, we like low volatility hedge funds as a hedge for investors’ public market exposure.

From a commodity perspective, geopolitical tensions, and central bank uncertainty have supported select commodities, especially gold. Gold prices continue to make fresh record highs as investors remain concerned about the geopolitical risk and the massive level of global debt. We are watching the performance of cyclical commodities (e.g., oil) as potential opportunities. However, these commodities typically do not see the worst of their weakness until we are well within the economic downturn.

Alternatives are a broad asset class with the capability to invest in different vintage years and strategies for diversification (e.g., private equity, real assets, and hedge funds). For qualified investors, we continue to favor well-diversified exposure to the alternative space, seeking the opportunity for attractive long-term risk adjusted returns that have little to no correlation to public market asset classes.

Alternatives have historically performed well in periods of economic uncertainty and in periods of tighter lending conditions.

The Bottom Line

The economy has been much more resilient than most had anticipated in 1H24. However, many of the headwinds that we have warned about (e.g., housing, tight lending conditions, manufacturing, and business confidence) are all starting to collide, and we are seeing the two remaining pillars holding the economy up faltering (i.e., consumer and labor market). The recent volatility in global equities is highlighting the complacency that had been building for these risks. Equities are starting to weaken, and volatility is sky rocketing. We expect to see more volatility over the next couple months as investors get more realistic about the challenges facing the economy and a Fed that will likely cut rates in September but is limited in terms of how far they can cut due to select inflationary pressures (e.g. services). We believe we are well positioned to take advantage of periods of weakness with a healthy cash position in our model accounts. We are consistently monitoring the situation and will adjust when we believe the price reflects the downside risk for our investors for the long run.

If you have any questions or comments, please reach out to your financial advisor.

Author: Megan Horneman | Chief Investment Officer Past performance is not indicative of future returns