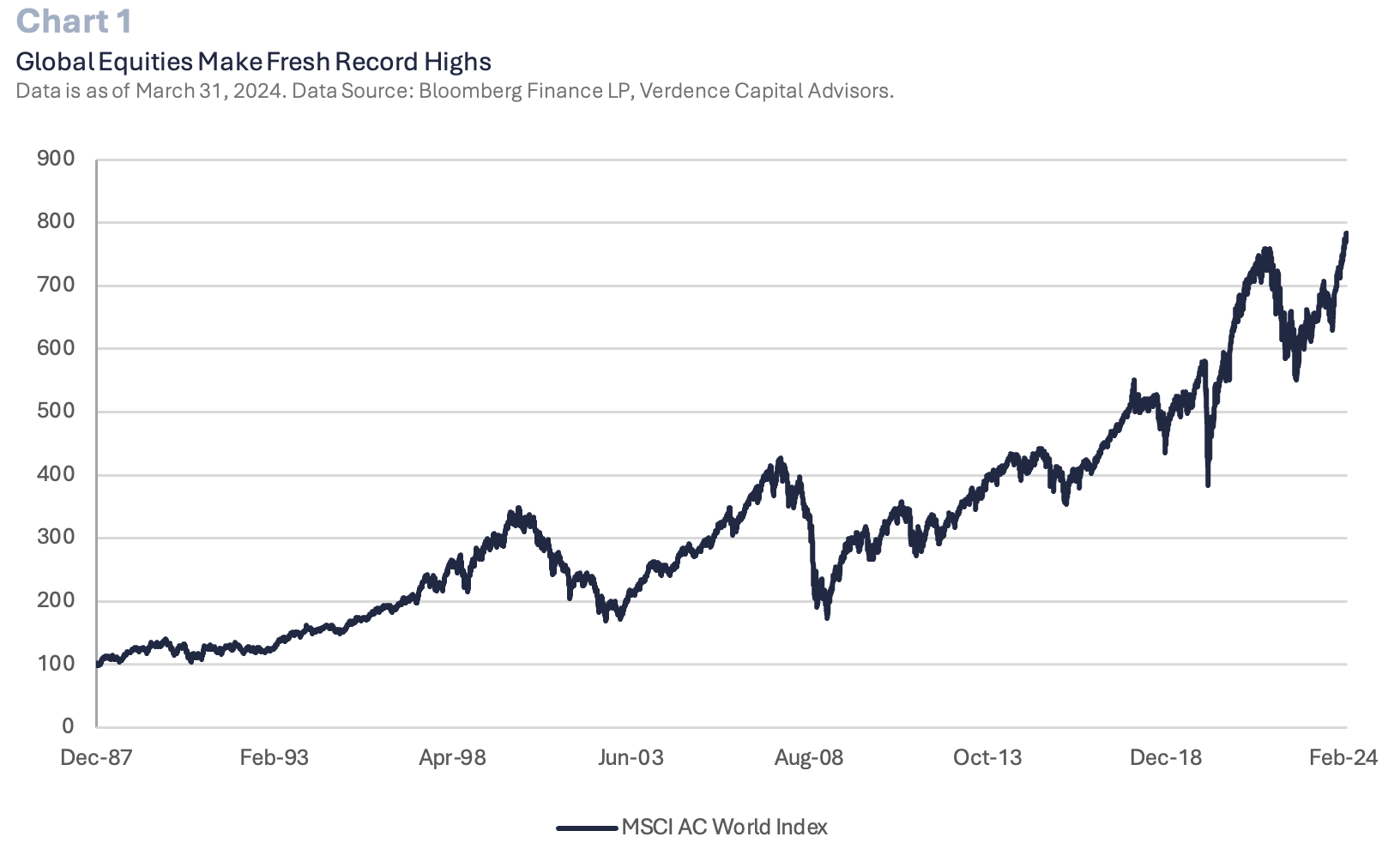

The U.S. economy has been resilient since the start of 2024 despite many headwinds (e.g., high interest rates, elevated debt levels, rising delinquencies, and geopolitical tensions). In fact, in 1Q24, the U.S. economy is believed to have grown more than 2.0% after a strong finish to 2023 (4Q23 GDP +3.2% QoQ). The strength in the economy and dovish comments from central banks that rate cuts are on the way fueled risk sentiment to kick off the year. Global equities as measured by the MSCI AC World Index made a fresh record high in 1Q24 along with many other regional equity markets (e.g., S&P 500, the Eurostoxx 50, the FTSE 100 and the Nikkei 225). (Chart 1). In addition, bonds carrying higher credit risk (e.g., high yield and emerging market bonds) rallied while commodities were supported by supply concerns.

With the S&P 500 posting its third best start to a new year over the past 25 years, we warn the road ahead may get more volatile. The economy has received a boost thanks to dovish central bank rhetoric, but underlying challenges remain a threat to the ongoing expansion, and we are concerned that a soft landing for the economy may not come to fruition. In this quarterly recap and outlook, we reiterate our base case of a slowing economy and our view on what the Federal Reserve may do with the path of interest rates. We explain why equity prices near record highs are likely reflecting a positive economic and/or earnings environment with little to no room for error and what that means for asset allocation.

A Fed-Induced Economic Boost – Can it Last?

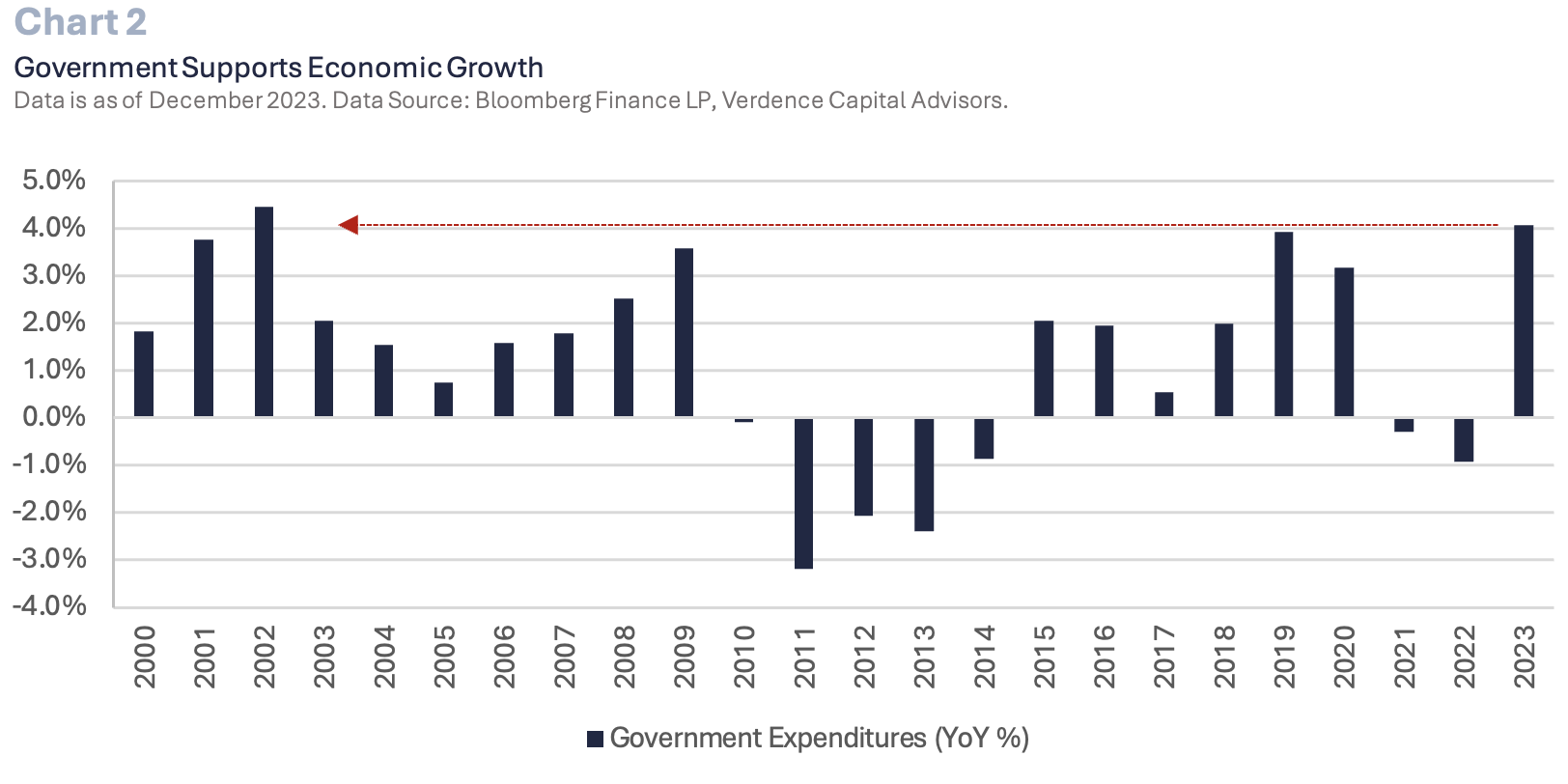

The U.S. economy has been supported by government and consumer spending. The U.S. government increased spending in 2023 by 4% (vs. 2022), the largest annual growth in government spending since 2002. (Chart 2). Consumers continue to spend as the labor market remains strong. However, both are fueling their spending by relying on debt. The federal government deficit is approaching $2 trillion and is ~6% of GDP, well above the historical average (~3%). In fact, the Treasury debt that is issued to fund the deficit is expected to exceed 115% of GDP in the next 10 years. This is not sustainable, especially when factoring in the increased cost to fund the deficit due to a higher interest rate environment. Net interest costs are expected to make up 4% of GDP in the next 10 years—a record high—and are expected to account for more than defense spending this year!

Consumers have been spending because the labor market is strong, but they are stretched. Persistent inflation has Americans turning to credit cards. There is ~$1.4 trillion worth of credit card debt outstanding, a record high. In addition, credit card rates are at or near a record high. As a result, delinquencies are rising and are near the highest level since the pandemic. As long as the labor market remains strong, consumers may continue to fund spending through debt. However, if the labor market softens, as we expect, spending at these levels is unlikely to last, and we should see delinquencies continue to rise.

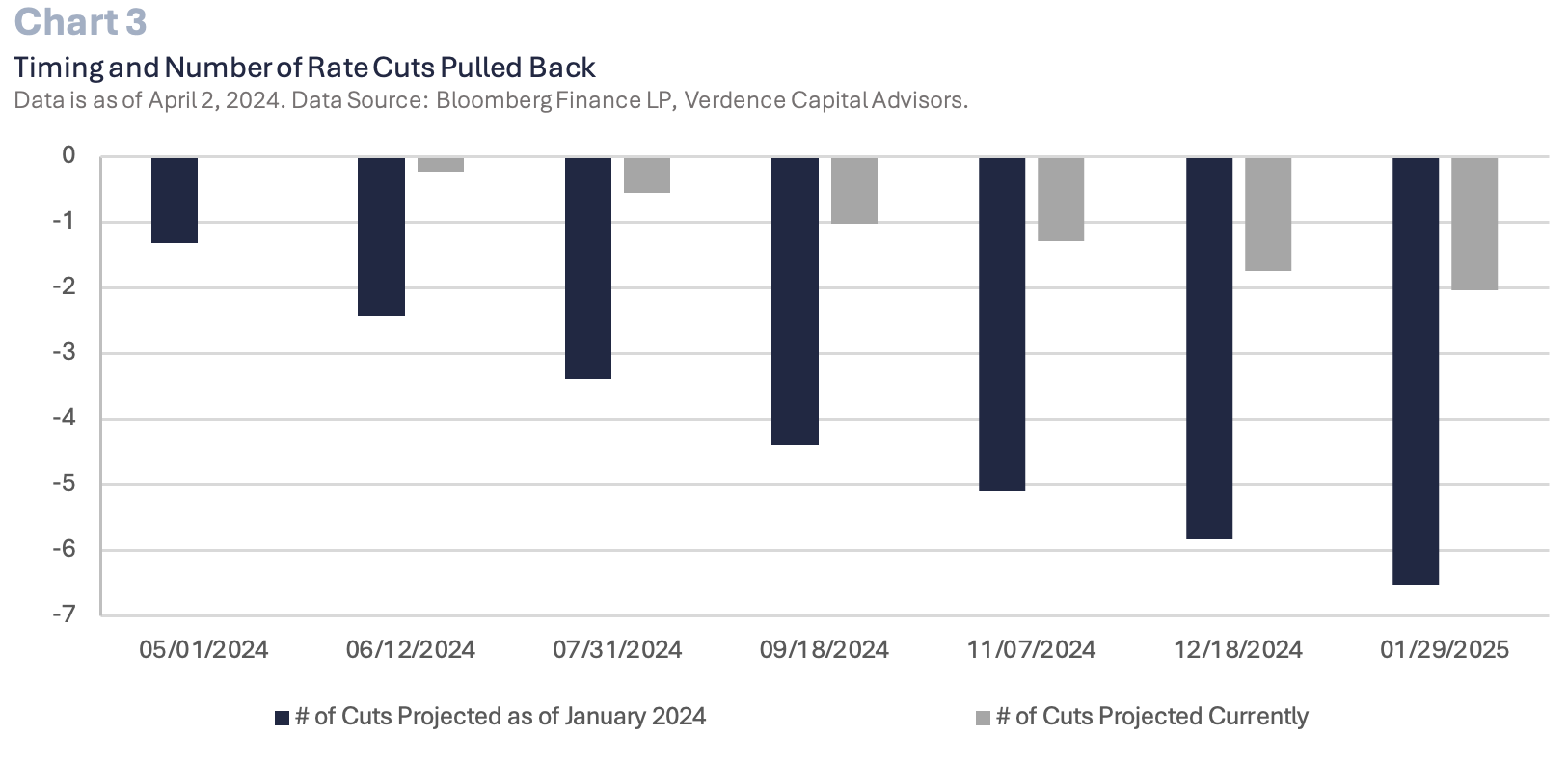

The risks to this expansion are countless. Elevated debt levels, high interest rates, persistent inflation, stress in commercial real estate, banks tightening lending conditions and geopolitical uncertainty are just a few. We think the biggest risk to the economy comes from the strained consumer and stubborn inflation. In addition, the unrealistic view of what the Fed will do with interest rates this year. At the beginning of 2024 the Fed funds futures market was pricing in up to six rate cuts this year starting as early as March. However, as we closed out the first quarter with no rate cuts delivered and sticky inflation proving harder to tackle, the timing of future Fed rate cuts is being pushed out and the magnitude of cuts is being reduced. (Chart 3).

One of our themes for 2024 was “Fed Walking a Fine Line: Reflation Risk is High.” We warned that the Fed turning dovish too soon could inadvertently refuel inflation. Therefore, it is not surprising that in recent months, we have seen progress on inflation stalling as investors have had multiple rate cuts priced for this year. However, the recent surge in commodity prices, sticky service inflation, and relentless wage and housing price pressures have some central bankers pushing back on rate cuts. We maintain our expectation that the economy will slow enough in 2H24 to warrant at least the start of a rate-cutting cycle. However, if the economy continues to accelerate at an above-average pace, the unemployment rate remains low, and inflation stagnates above the Fed target rate, there may not be a need or the flexibility for the Fed to cut rates in 2024.

We continue to maintain a neutral allocation to global equities and have an overweight cash position. At some point, cash can be a drag on portfolios, but with our view that the Fed cannot cut rates imminently, we believe there is no harm in holding cash and earning an attractive yield. We prefer to have liquidity/dry powder to put to work when markets correct. While we remain wary of the outlook for economic growth, we will look to add to areas of the equity market when they look to be reflecting the downside risk. At this point, we are being patient and believe having flexibility with cash in these highly uncertain and volatile times should prove beneficial for good entry points to achieve long-term returns.

Global Equities – Rocky Road Ahead

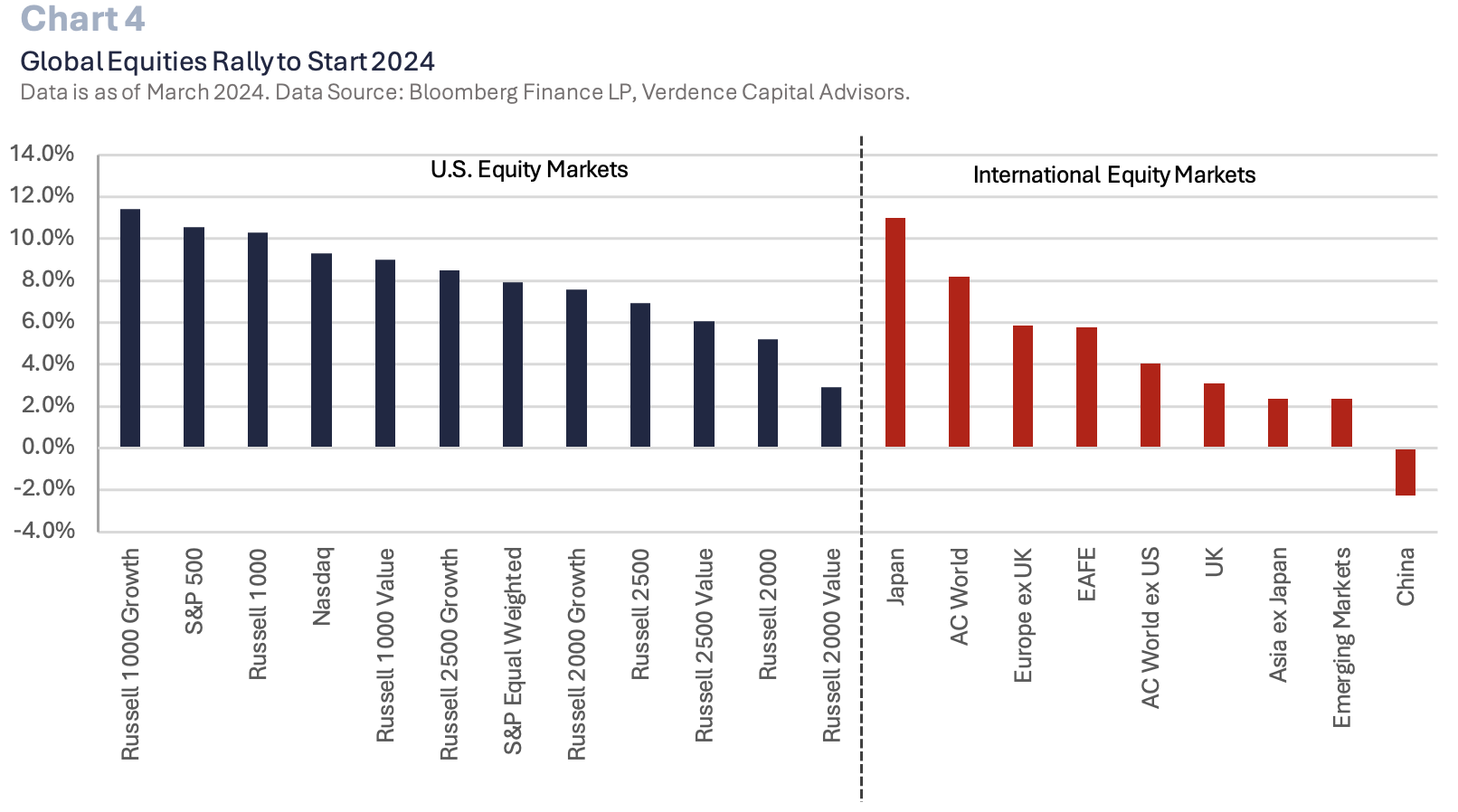

The MSCI AC World Index posted its best first quarter performance since 1Q19 as investors were overly confident about central banks’ ability to cut rates. While U.S. large cap growth sectors (e.g., communication services and technology) led the rally, nearly every major global equity region (except China) posted solid gains for the quarter (Chart 4).

We favor equities over bonds for the long run, but we are cautious about the near term as global equities hover near record highs. They may be pricing in an unrealistic perfect soft landing and central bank easing cycle. For example, valuations are too high given the current inflation climate. Historically, when inflation is between 2-4%, the trailing PE of the S&P 500 is between 17-18x earnings. Instead, the trailing 12-month PE ratio of the S&P 500 is trading over 24x. (Chart 5). Earnings may also be overly optimistic given our base case scenario of a slowdown to potential recession. In addition, we don’t believe that equity investors are being rewarded for the added risk to invest in equities. The equity risk premium for the S&P 500 (extra yield you earn in equities over bonds) is trading at the lowest level since 2002.

We admit that not all global equity markets are as expensive as the U.S. (specifically large cap growth). In fact, within the U.S., the small and midcap space looks historically attractive versus their large cap counterparts and typically rebound the most out of an economic slowdown/recession. However, we are being patient as the earnings environment is highly uncertain and the full extent of downside risk may not be priced in. In addition, developed international equities are attractive relative to U.S. equities and may present another opportunity. However, valuations, while not as expensive as the U.S., are elevated and developed equity market prices are still near a record high.

We continue to maintain a neutral allocation to global equities and have an overweight cash position. At some point, cash can be a drag on portfolios but with our view that the Fed cannot cut rates imminently, we believe there is no harm in holding cash and earning an attractive yield. We prefer to have liquidity/dry powder to put to work when markets correct. While we remain wary of the outlook for economic growth, we will look to add to areas of the equity market when they look to be reflecting the downside risk. At this point, we are being patient and believe having flexibility with cash in these highly uncertain and volatile times should prove beneficial for geed entry points to achieve long-term returns.

Fixed Income – Defensive but Looking for Opportunities

Fixed income returns were relatively muted in 1Q24 as investors continued to be perplexed about the timing and magnitude of future Fed rate cuts. In addition, supply is becoming a challenge to Treasuries as demand at auctions has been disappointing. This presents a long-term risk to fixed income because of the burgeoning budget deficit which is resulting in a massive increase in bond issuance. This is occurring while international investors have less need for U.S. Treasuries since they can earn yield in their domestic bond markets and the Fed has been reducing its balance sheet of bonds. Fixed income will always have a place in portfolios as an important part of diversification, but we remain defensive in our positioning in fixed income (from a maturity and credit perspective).

Despite our view that the economy is expected to slow, which should cause attractive returns in long term bonds, we remain cautious given the deteriorating fiscal health of the U.S. government. Ongoing volatility at auctions, stubborn inflationary pressures, and lack of clarity from the Federal Reserve will likely keep yields on long term bonds volatile and the interest rate risk high.

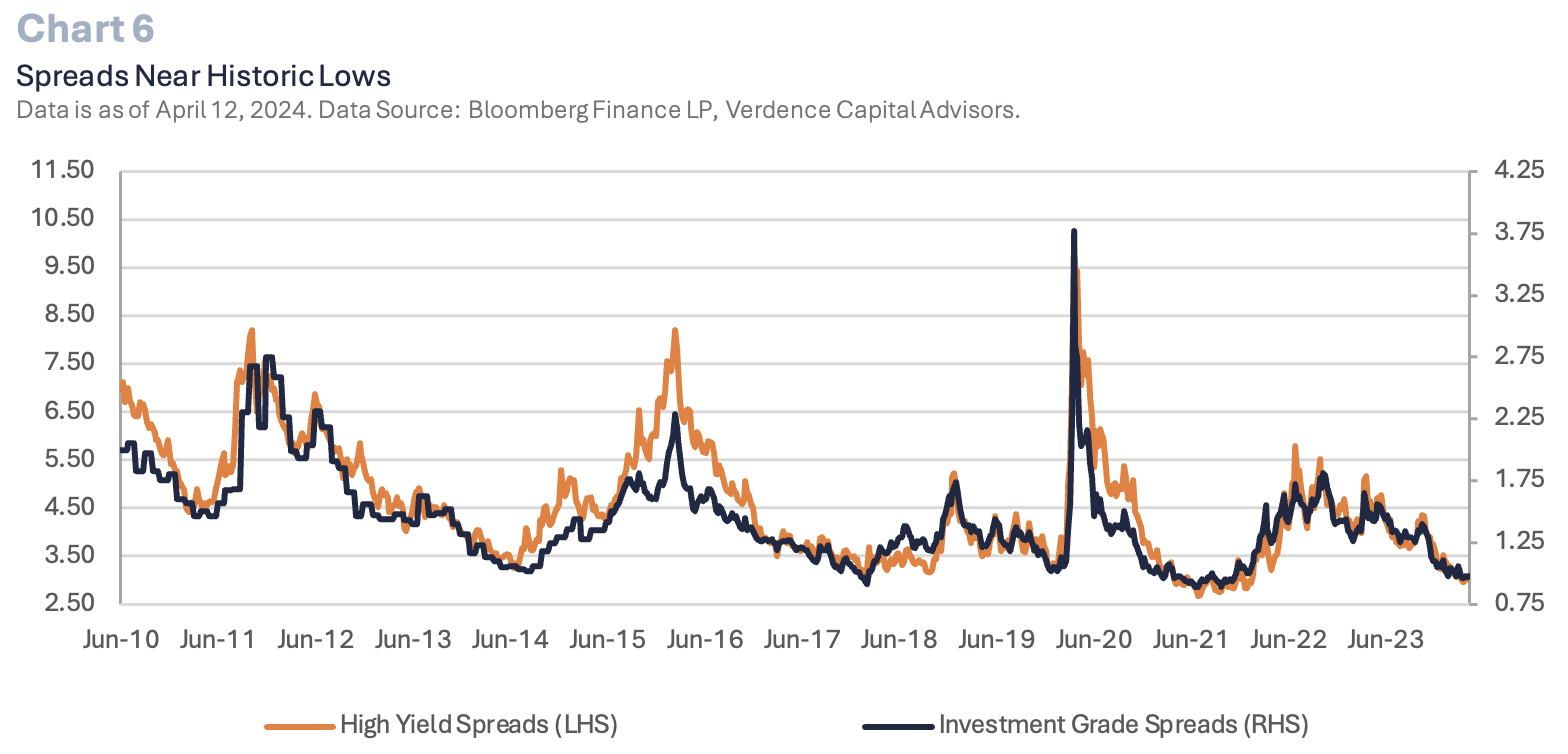

In addition, credit has been resilient despite the aggressive tightening cycle and rise in defaults. According to S&P Global Ratings, corporate debt defaults jumped 80% in 2023. However, investors are not being rewarded for the risk of investing in lower quality fixed income. Within the U.S., the spread (extra yield investors take on extra risk) on both investment grade and high yield debt remains near historic lows. (Chart 6). This is inconsistent with the expectation from major rating agencies that defaults should continue to rise in 2024 and refinancing risk in the next few years is high for companies. They will need to refinance debt at higher rates and with tighter lending conditions.

We expect opportunities to add exposure to bonds this year. As Treasury yields continue to creep higher, we will analyze the risk/return potential and possibly add to our core bond exposure. In addition, as defaults continue to be an issue in the corporate bond market, we expect that spreads will widen to reflect the added risk. We are watching spread levels and will look at corporate bonds when they widen enough to reflect the added risk for investors.

Alternatives and Commodities – Diversification and Risk

For qualified investors, we continue to favor a well-diversified allocation to alternative investments. Alternatives have historically performed well in periods of economic uncertainty and in periods of tighter lending conditions. On the private side, managers have more flexibility and time to find and make good long-term investments. For clients qualified to invest in private investments, they are spared the daily volatility seen in public markets and historically have been offered an uncorrelated asset with robust risk-adjusted return opportunities. Not only are alternatives good for an added layer of asset class diversification, but from a vintage year perspective, it is important to have some diversification. Historically, periods of economic weakness have offered private equity managers the opportunity to find attractive long-term investments. We like private credit but admit the space is getting crowded, and due diligence is crucial. In addition, real assets may present additional opportunities, especially in the real estate space as mortgage rates peak. Lastly, we like low-volatility hedge funds as a hedge for investors’ public market exposure.

From a commodity perspective, geopolitical tensions, relentless inflationary pressures, and central bank uncertainty have supported commodities, especially oil and gold. In 1Q24, gold prices made fresh record highs, and oil jumped by over 10% due to supply concerns. However, we are waiting for better entry points for commodities for several reasons. First, commodities typically do not see the worst of their weakness until the economic downturn has begun. Second, gold prices are being driven by fear and momentum. This can easily shift by a tone change by central banks or easing inflation pressure. This leaves investors with the risk of substantial losses when buying at these record-high levels.

Alternatives are a broad asset class with the capability to invest in different vintage years and strategies for diversification (e.g., private equity, real assets, and hedge funds). For qualified investors, we continue to favor well-diversified exposure to the alternative space, seeking the opportunity for attractive long-term risk-adjusted returns that have little to no correlation to public market asset classes. Commodities are a traditional form of alternative investments and tend to be well supported in times of geopolitical tensions. However, we think there is risk to the energy market as global growth weakens. In addition, precious metals, specifically gold, may have limited upside at current levels.

The Bottom Line

We realize the U.S. economy has been more resilient than most had anticipated. However, it is important to realize that growth is being supported by government spending and a consumer that is running on fumes. Ongoing government spending is not guaranteed to continue, especially after an election year and when our deficit is overwhelming. It will be challenging for the consumer to continue their spending habits, especially if the rest of the economy weakens and the job market softens. In addition, the rising geopolitical tensions are a risk to growth and risk sentiment. We are not geopolitical analysts or politicians, so it is difficult to quantify the full impact on assets or economic growth. However, we are monitoring geopolitical tensions and assessing the risk to portfolios, on the lookout for potential opportunities if sentiment gets so weak that prices reflect the downside risks.

If you have any questions or comments, please reach out to your financial advisor.

Author: Megan Horneman | Chief Investment Officer Past performance is not indicative of future returns